Enabling a frictionless check-out experience. A single platform for all payment methods.

The global payment system is highly regulated and fragmented to protect consumers. As the complexity grows, so will customer demands: faster delivery, better customer service on any device, more insightful product selections and a range of payment options from at once to over time with loyalty credits attached. eCommerce will be linked to the physical sales cycle as customers demand a seamless, multi-channel experience.

In this context, it is vital for acquirers, payment service providers (PSPs), banks and merchants to keep pace with the fast changes in payments. They can do this by allowing shoppers to pay the way they want to and ensuring the highest levels of security to build and retain customer trust.

SmartVista does just that. It offers a white label platform for the widest acceptance of payment methods and schemes. It is powered by a best in class fraud prevention solution and co-created with partners to enhance the check-out experience and encourage digital currency payments.

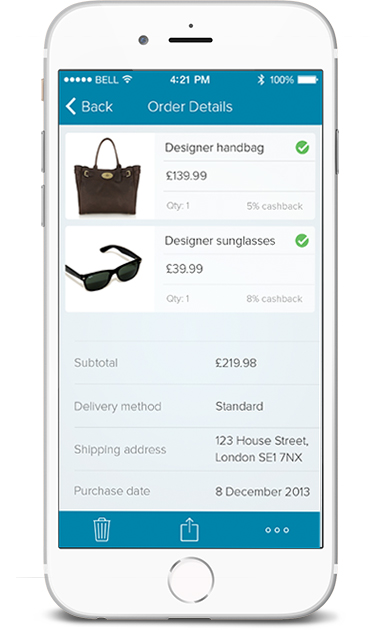

When you trade over the internet, your success depends on trust. SmartVista’s eCommerce engine provides a secure, state-of-the-art gateway for internet payment processing. It enables multi-currency, compliant, data-driven and highly secure transactions from a single platform while keeping your brand at the forefront through its white label component. The platform is evolving as consumer behaviors evolve to offer contextual, personalized and relevant check out experiences.

Radar Payments is BPC’s newest paytech concept. While payment complexity and compliance requirements are increasing, acquirers are faced with a rise in IT operations, risk and compliance costs. BPC has responded to this growing need from its clients for fully managed payment processing services with the creation of Radar Payments, leveraging Cloud technologies.

Radar Payments is a one-stop platform that connects all payment ecosystem players, from card schemes, alternative payment providers, issuing banks and acquiring banks to online payment gateways. It offers end-to-end omnichannnel processing, enabling the acceptance of most of the innovative and widely adopted payment methods. The users of the platform can build on it, consume it or migrate to it choosing the right path for their growth

In many parts of the world, customers expect their card providers to offer a wide range of loyalty and reward programs. However, loyalty is no longer about how consumers are spending; it is a mix of behaviors, context and personalization.

SmartLoyalty from BPC Banking Technologies is a loyalty and reward program management solution that enables users to rapidly create and manage innovative loyalty programs, the way customers want them.

Small businesses are the lifeblood of any economy. BPC’s SME Marketplace is all about financial inclusion for small enterprises.

SME Marketplace is designed to enable financial inclusion for SMEs and let entrepreneurs start trading even without capital. Starting from this core value proposition, SME Marketplace is the foundation for a true trading platform, where all participants in the value chain are brought onto a single platform to create an entire ecosystem to service the SME economy. It essentially creates a closed loop trading environment for B2B2C.

As the world becomes increasingly digital, eCommerce and mCommerce continue to grow. However, the online shopping experience differs from one country to another, one region to another. In China, Alibaba has gained customers’ trust as a payment method to complete business and retail transactions. In Mexico, providing options for accepting cash through agents to complete an online transaction is common as many customers do not own a card. In the Netherlands, direct account debit through the iDeal network has gained a 60% market share.

AI will not only deliver unprecedented insight into payment and shopping habits, it will also help to prevent fraud. Content around the product and service offerings will build unprecedented customer engagement and loyalty. Tracking of offline sales will provide insight into online sales, drones will deliver the goods and eCommerce will continue to offer different payment and purchase insurance models.

SmartVista has been designed with evolving shoppers in mind, ensuring acquirers can provide future-ready, end-to-end digital payment solutions. Offering the widest reach, security, flexibility and value from a single platform is no longer an exception thanks to BPC’s SmartVista. Deployed on premise, as a service or as a modular payment managed service, banks, PSPs and merchants can focus on building customer relations while digital payment completion, compliance and security are taken care of.

Commerce is all about logistics and execution. Insights are key to success: better, targeted traffic; fewer returns; faster payments; and additional revenues through ancillary services such as guarantees, insurance, repairs and returns. A seamless, end-to end-experience that creates repeat purchasers is achievable if, and if, the right processes are in place.

SmartVista is used by acquirers, PSPs and merchants such as airlines and large retailers to ensure successful check-out rates. The platform processed more than USD 2 trillion worth of transactions in 2019 for the smallest and largest organisations.

BPC understands both the STP of eCommerce and more importantly, the complexities of delivery and payment in a broad ecosystem of producers, suppliers and online retailers.

BPC creates relevant industry ecosystems addressing supply chain challenges by removing the middleman. BPC Marketplace is an ecosystem of value where SMEs can fulfill all their needs from supplies to finance.

As Warehouse’s business grew in size and complexity, the group needed a practical solution to deliver a wide range of card services.

Today they are able to offer its consumers sophisticated loyalty programmes while at the same time, enhancing the company’s ability to roll out new payment and loyalty services to their clients.

The Safal Fasal Marketplace connects buyers and sellers and improves the income of the farmer by enabling access to multiple buyers, multiple input companies at reduced prices, credit at affordable rates, financial services lifting them into the real economy and access to advisory services for a more efficient and sustainable crop productivity. Buyers in turn benefit from access to a large and varied segment of credible and vetted farmers and their produce, ease of procurement and planning in a fragmented market, better logistics and tracing and therefore a better and more balanced price with reduced risk.