BPC Banking Technologies’ SmartVista eWallet supports the entire spectrum of electronic payments, including sending and receiving funds, purchasing goods and services, bill payments, utility payments and mobile top up.

At their origin, digital wallets all start from the same core value proposition: offering mobile payments and digitizing payment instruments. Their implementation however varies greatly, ranging from wallet applications that are essentially offering a digital version of a plastic card, to others that offering closed loop payments based on carrier billing or even based on cash in/cash out mechanisms via agents that represent the wallet operator.

In developed markets, there are a wide variety of mobile wallets in use and their origins again are as diverse as they come.

In emerging markets, mobile wallets empower people by making financial services available to them. Mobile network operators play a key role in this and are also often the ones operating the wallet.

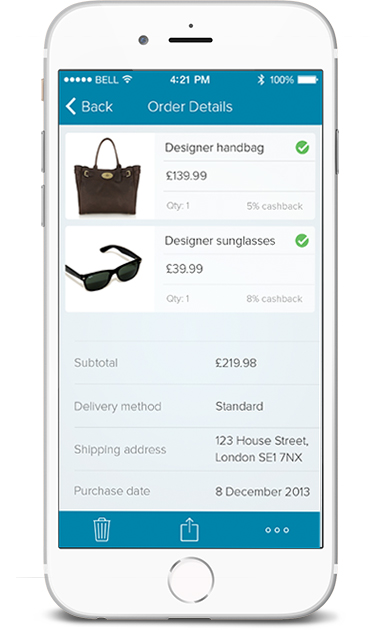

Mobile wallets can be used for so much more than paying friends or family through P2P payments or buying goods at a merchant, they are a secure, convenient platform for all payment needs, whether those are utility bill payments or mobile top up. Integration with loyalty and coupons creates an additional incentive to use mobile wallets as the preferred payment option.

Consumers can store all digital value in their mobile wallet, whether it is digital money or other elements of value such as loyalty points, vouchers or gift cards. Users can link their wallet accounts to any other payment instrument that is available, including cards (hosted on the SmartVista platform or elsewhere), bank accounts or external e-wallets.

BPC ‘s SmartVista payment hub centralizes the processing of all payments at a bank, whether they be Card, Real-time, ACH or any other form of payment.

BPC’s solution for internet and mobile banking ensures that you can deliver the same high levels of customer service across your internet and mobile channels.

SmartVista Fraud Prevention from BPC Banking Technologies provides a complete solution to help issuers, acquirers and processors detect and prevent fraud across all payment channels.