Analyst Reports

Recognized by analysts

Chartis

Enterprise Fraud Solutions

Chartis Research, the leading provider of research and analysis on the global market for risk technology published a report that evaluates the current landscape of Enterprise Fraud Solutions. It examines how in a solutions market still driven mainly by the large, complex frauds occurring in investment banking, financial institutions and vendors are developing their technological capabilities to address an ever-evolving fraud landscape.

“BPC is a true leader in this space with strength across diverse sectors, including traditional financial institutions, neobanks and challenger firms, and wide coverage of payment types and use cases,” said Ahmad Kataf, Senior Research Specialist at Chartis.

“Among its key differentiators are the flexibility of its risk engine and its implementation of machine learning analytics in various applications.”

Celent

Retail digital banking platforms: International edition

Celent, a top international financial research and consulting firm, has named BPC as one of the world’s leading digital banking providers in the report ‘Retail digital banking platforms: international edition’.

This report sheds light on trends in digital banking, including the race to cloud adoption, a single platform approach, end-to-end customer lifecycles, open ecosystems, and marketplaces, embedded AI, and customer engagement.

After a comprehensive review and analysis involving 35 vendors, BPC’s SmartVista Digital Banking was ranked within the Luminary Category by Celent which means that it excels in both advanced technology and breadth of functionality.

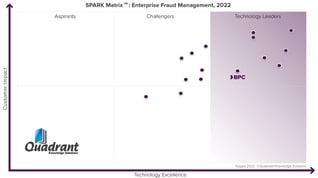

Spark Matrix

Enterprise Fraud Management (EFM), 2022.

Quadrant Knowledge Solutions named BPC as the 2022 technology leader in the Spark Matrix: Enterprise Fraud Management (EFM), 2022.

The Quadrant Knowledge Solutions’ SPARK Matrix™ includes a detailed analysis of global market dynamics, major trends, vendor landscape, and competitive positioning. The study provides competitive analysis and ranking of the leading technology vendors in the form of its SPARK Matrix™. The study offers strategic information for users to evaluate different provider capabilities, competitive differentiation, and market position.

Spark Matrix

Merchant Payment Platform,

2022

Quadrant Knowledge Solutions named BPC as the 2022 technology leader in the Spark Matrix: Merchant Payment Platform, 2022.

The Quadrant Knowledge Solutions’ SPARK Matrix™ includes a detailed analysis of global market dynamics, major trends, vendor landscape, and competitive positioning. The study provides competitive analysis and ranking of the leading technology vendors in the form of its SPARK Matrix™. The study offers strategic information for users to evaluate different provider capabilities, competitive differentiation, and market position.

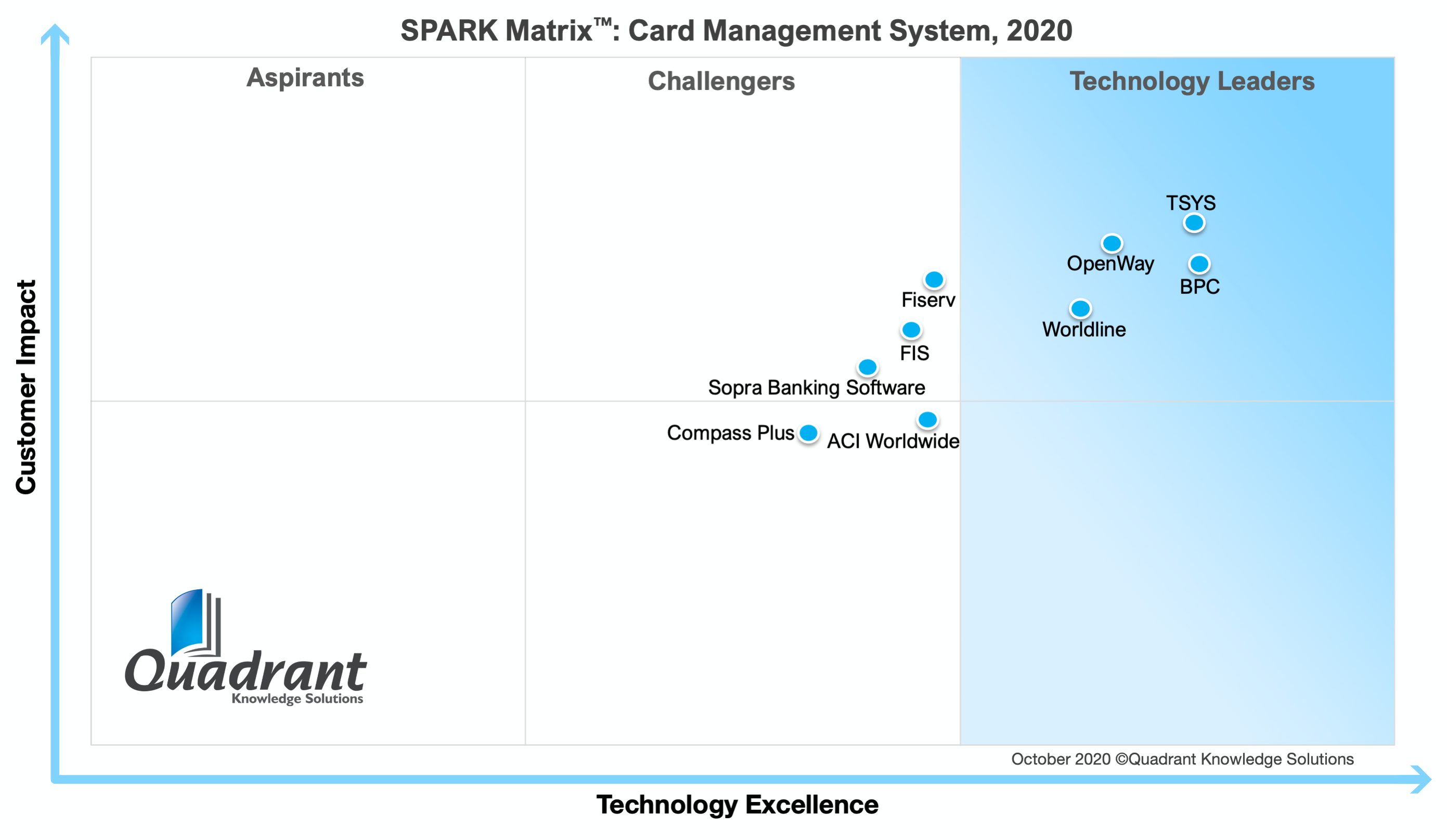

Spark Matrix

Card Management System

(CMS), 2022

Quadrant Knowledge Solutions named BPC as the 2022 technology leader in the Spark Matrix: Card Management System (CMS), 2022.

The Quadrant Knowledge Solutions’ SPARK Matrix™ includes a detailed analysis of global market dynamics, major trends, vendor landscape, and competitive positioning. The study provides competitive analysis and ranking of the leading technology vendors in the form of its SPARK Matrix™. The study offers strategic information for users to evaluate different provider capabilities, competitive differentiation, and market position.

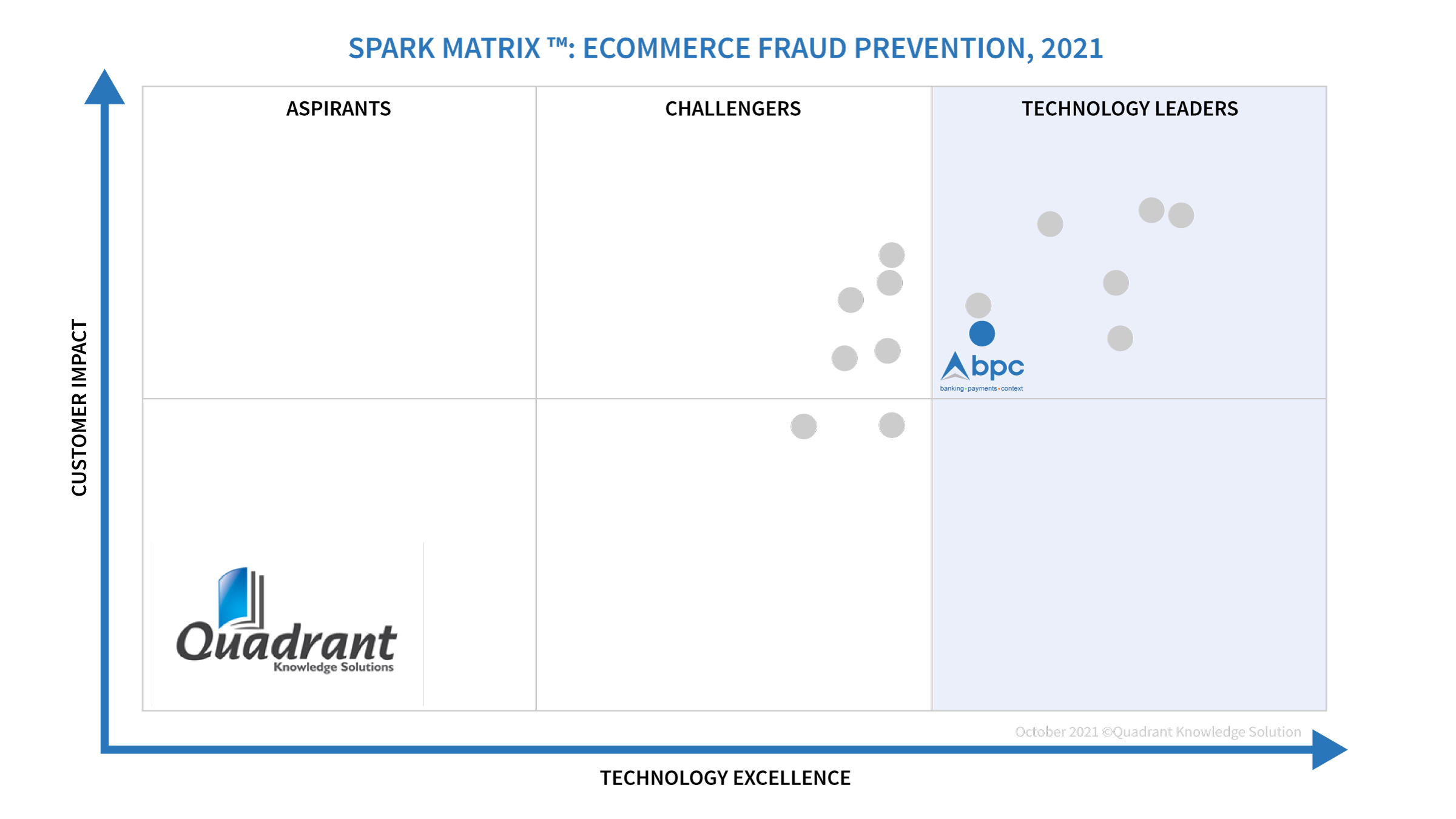

Spark Matrix

eCommerce Fraud Prevention, 2022

Quadrant Knowledge Solutions named BPC as 2022 technology leader in the Spark Matrix: e-Commerce Fraud Management, 2022.

The Quadrant Knowledge Solutions’ SPARK Matrix™ includes a detailed analysis of global market dynamics, major trends, vendor landscape, and competitive positioning. The study provides competitive analysis and ranking of the leading technology vendors in the form of its SPARK Matrix™. The study offers strategic information for users to evaluate different provider capabilities, competitive differentiation, and market position.

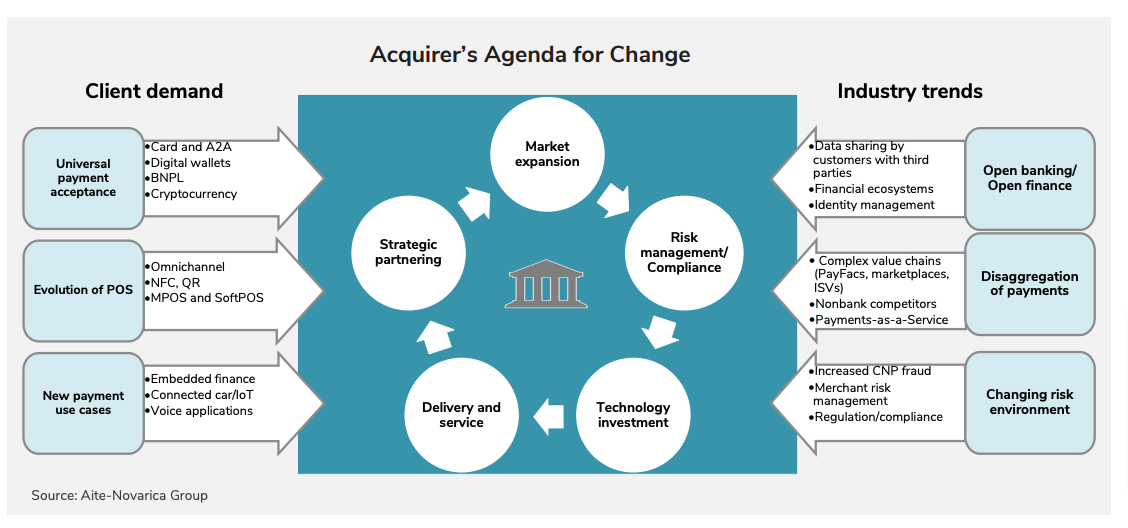

Aite-Novarica Group

Drivers of Change in Payments: Modernising Payments to Create new Value”

BPC, in collaboration with research and advisory firm Aite-Novarica Group launched a new report “Drivers of Change in Payments: Modernising Payments to Create new Value” to give payment providers a forward-looking view of the evolution of payments and investment drivers for modernisation.

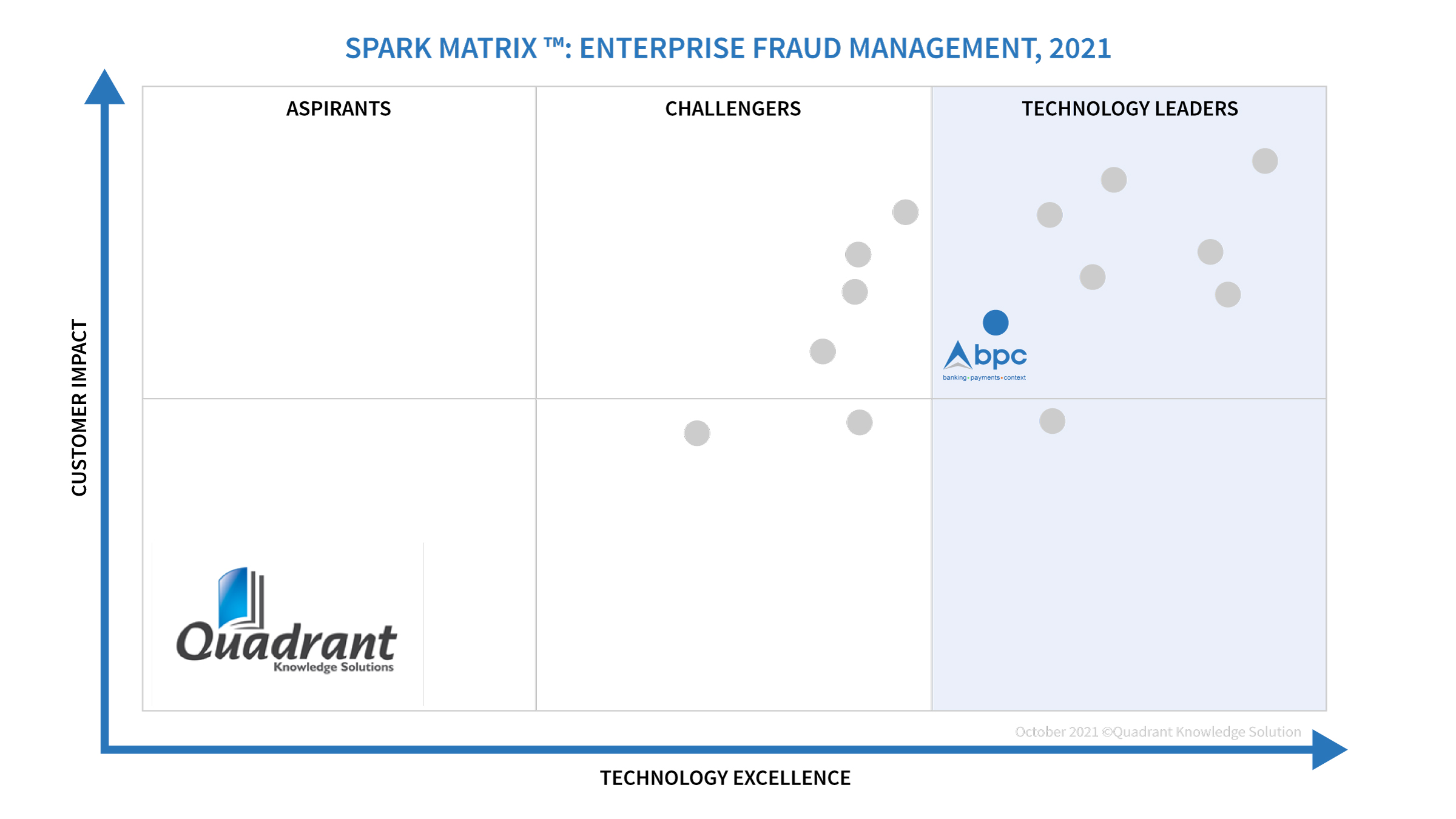

Spark Matrix

Enterprise Fraud Management

Driven by its comprehensive ML driven EFM capabilities, strong customer value proposition and continued focus on strengthening its SmartVista platform to make it a single platform solution for fraud management, risk scoring, KYC, AML, and other use cases, BPC is positioned as a technology leader in the 2021 SPARK Matrix of EFM market.

Spark Matrix

Card Management System

With BPC's strategic approach to strengthening its partner ecosystems to penetrate geographies, sophisticated CMS capabilities, and strong customer value proposition, BPC has received strong ratings across the parameters of technology excellence and customer impact and has been positioned amongst the technology leaders in SPARK Matrix: Card Management System (CMS), 2021.

With BPC's strategic approach to strengthening its partner ecosystems to penetrate geographies, sophisticated CMS capabilities, and strong customer value proposition, BPC has received strong ratings across the parameters of technology excellence and customer impact and has been positioned amongst the technology leaders in SPARK Matrix: Card Management System (CMS), 2021.

Spark Matrix

eCommerce Fraud Prevention

The key differentiating points for BPC’s SmartVista Fraud Management solution includes omnichannel fraud prevention across all touchpoints and self-serviceable machine learning models. BPC’s SmartVista solution enables risk, fraud, and low-code professionals to define different scenarios without the help of technical support. The solution is offered as SaaS for both on-premises and cloud deployments.

Celent

The role of QR codes in payments

QR codes have now started to look resilient as they have made a comeback due to their speedy and seamless process. In many developing markets they dominate mobile payments. Even in the developed markets, there seems to be a growing number of options to pay and interact with merchants and service providers via QR codes. As consumers seek truly contact-free payment and shopping experiences in the post-pandemic world, can QR codes provide the answer?

QR codes have now started to look resilient as they have made a comeback due to their speedy and seamless process. In many developing markets they dominate mobile payments. Even in the developed markets, there seems to be a growing number of options to pay and interact with merchants and service providers via QR codes. As consumers seek truly contact-free payment and shopping experiences in the post-pandemic world, can QR codes provide the answer?

_V2.jpg?width=318&height=179&name=BPC_SPARK-Matrix_MPP-2022-(2)_V2.jpg)