Gestión de cajeros automáticos y quioscos

Conectando los puntos para una experiencia omnicanal pero única

Mucho más que "simplemente retirar efectivo"

Los cajeros automáticos y los quioscos brindan capacidades de autoservicio para los clientes del banco y reducen la dependencia de las sucursales. Los clientes pueden hacer mucho más con un cajero automático que retirar efectivo, como comprar una tarjeta prepaga, recargar una cuenta móvil o comprar un ticket de viaje, o incluso comprar boletos de cine utilizando tecnología biométrica, sin contacto NFC o de reconocimiento facial.

Descargamos bancos y procesadores de terceros

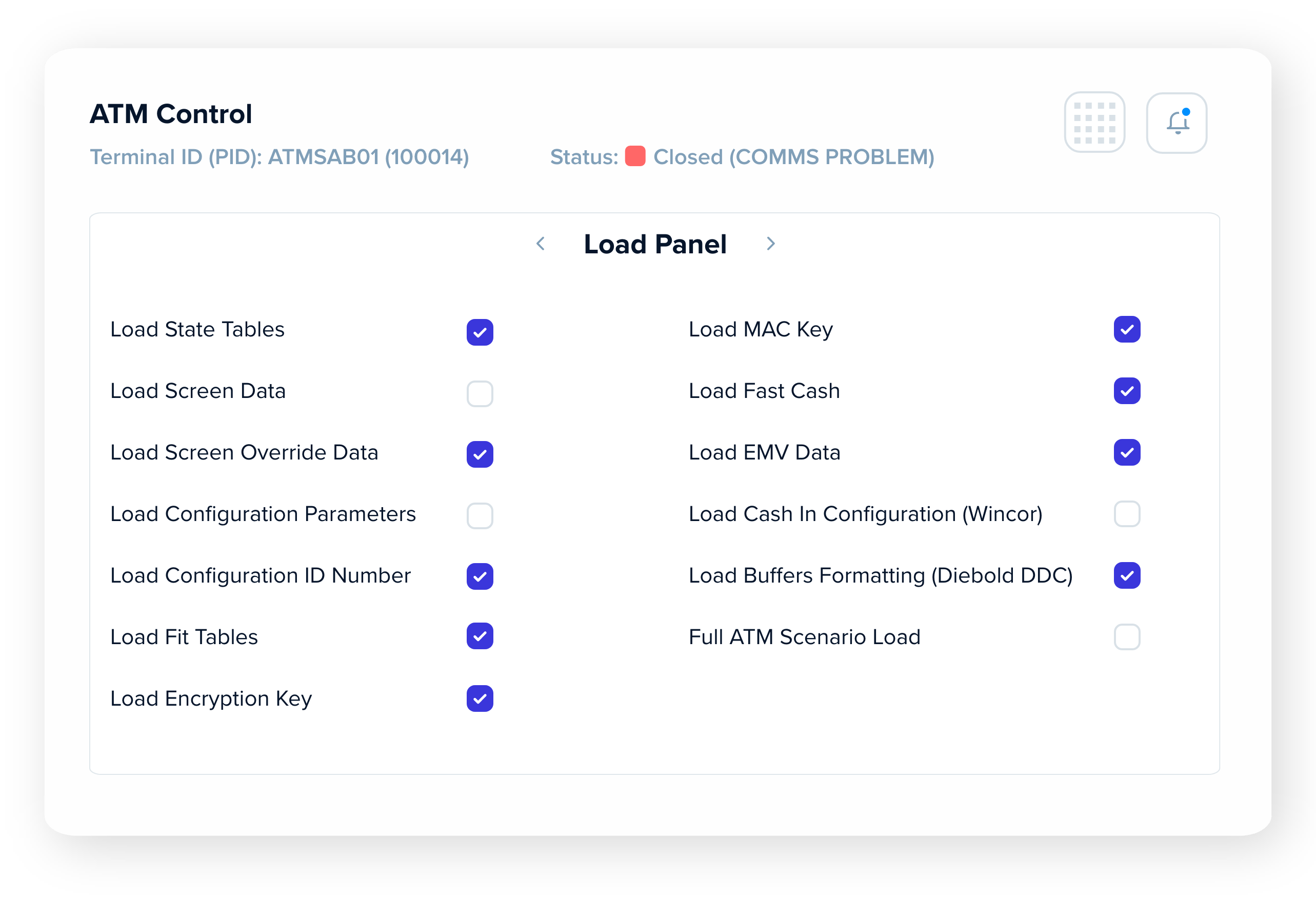

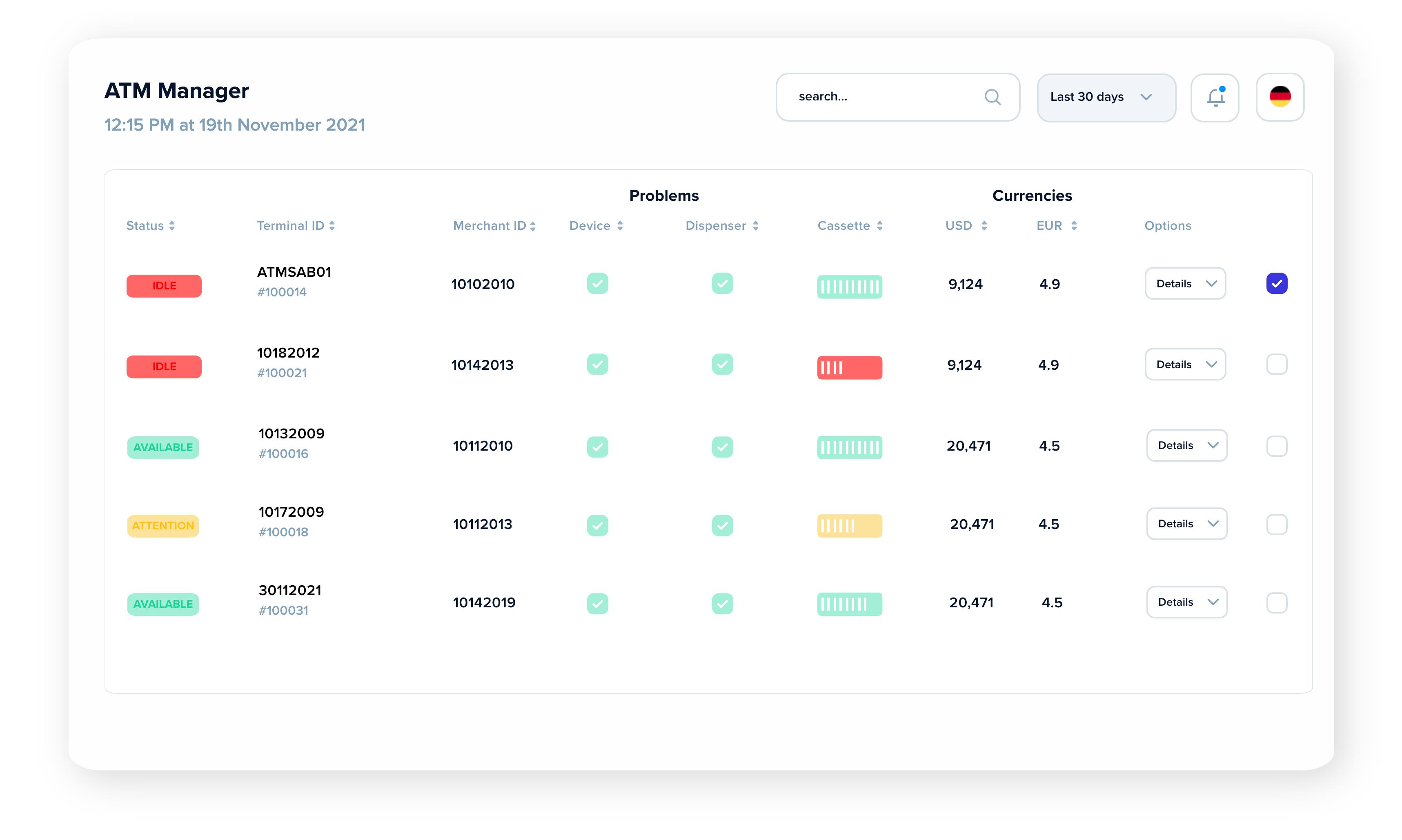

Conectar y administrar pagos en el mundo digital y físico puede llevar mucho tiempo. Aquí, BPC puede aliviar la carga de los bancos y los procesadores de terceros tanto como sea posible con SmartVista ATM Management para un servicio y monitoreo eficientes de una amplia gama de cajeros automáticos y quioscos de autoservicio.

Nueva fuente de ingresos

Los cajeros automáticos son una opción viable para reducir la dependencia de las sucursales y ofrecer a los consumidores un canal conveniente de servicios bancarios. Pero los bancos pueden ampliar fácilmente este servicio con servicios de valor agregado que pueden monetizarse utilizando el cajero automático como un canal de venta adicional.

Suba a bordo, actúe y pregunte

Suba a bordo, actúe y pregunte

Con video interactivo, compatibilidad con dispositivos sin contacto y autenticación biométrica, los cajeros automáticos y los quioscos inteligentes pueden brindar todos los servicios necesarios, abrir una cuenta, depositar efectivo o cheques y ahorrar, retirar algo de dinero o reservar un servicio 'sin cola' para cualquier consulta.

Gestión de la complejidad

Gestión de la complejidad

SmartVista ATM lo ayuda a brindar un servicio ininterrumpido las 24 horas del día, los 7 días de la semana, mientras que el efectivo en cada cajero automático es óptimo. La solución es rápida de instalar y rentable.

Experiencia inteligente

Experiencia inteligente

SmartVista puede ayudarlo a personalizar las pantallas en ciertos cajeros automáticos y quioscos. Los mensajes de marketing dirigidos se transmitirán a sus clientes en el momento pertinente.

SmartVista ATM & Kiosk Management

Hacer una diferencia

Hacer una diferencia

- Kioscos y cajeros automáticos para cualquier servicio digital

- Monitoreo en tiempo real, tiempo de actividad 24/7

- Incorporación digital - en el sitio

- Presencia total de la marca en 'cada esquina'

Trabajando para ti

Trabajando para ti

- Digitalización de extremo a extremo desde la incorporación de KYC hasta la compra de productos

- Multi marca, multi host, multi moneda

Fácil configuración de flujo de pantalla

Trabajando para tu cliente

Trabajando para tu cliente

- Fácil pago de facturas

- Servicio de pre-pedido sin colas

- Acceso seguro, biométrico, sin contacto, sin tarjeta

Servicios relacionados

Card Management

Décadas de experiencia enfocan a los equipos globales de BPC en construir lo mejor en sistemas de administración de tarjetas para todos los jugadores en este mundo en expansión: bancos, fintechs, corporaciones, gobiernos, operadores de transporte y facilitadores del mercado.

Switch

Conecte dispositivos externos como terminales POS o cajeros automáticos e integre pagos electrónicos y móviles. Con SmartVista Switch de BPC, cualquier emisor, adquirente y procesador puede administrar el panorama de pagos de rápido movimiento y brindar los mejores niveles de servicio a sus clientes.