Gestion des Risques et de la Fraude

Surveiller Tous les Niveaux sur Tous les Canaux

La Conformité au Service de la Confiance

La fraude est la première chose que vous souhaitez prévenir. Non seulement à cause des pertes financières qu’elle engendre, mais aussi parce qu’elle peut nuire à votre réputation.

Vos clients doivent se sentir en sécurité pour pouvoir vous accorder leur confiance. Nous prenons votre conformité au sérieux à chaque étape : au-delà des stratégies KYC et des paiements.

Partout, Dans Toute Juridiction

Vous pouvez vous concentrer sur la relation avec vos clients, pendant que la fraude prend en charge la gestion de vos risques et de votre lutte contre la fraude.

Pour toute juridiction, sur tous les canaux et à tous les niveaux de votre organisation.

Au-Delà d’un Moteur de Règles Traditionnel

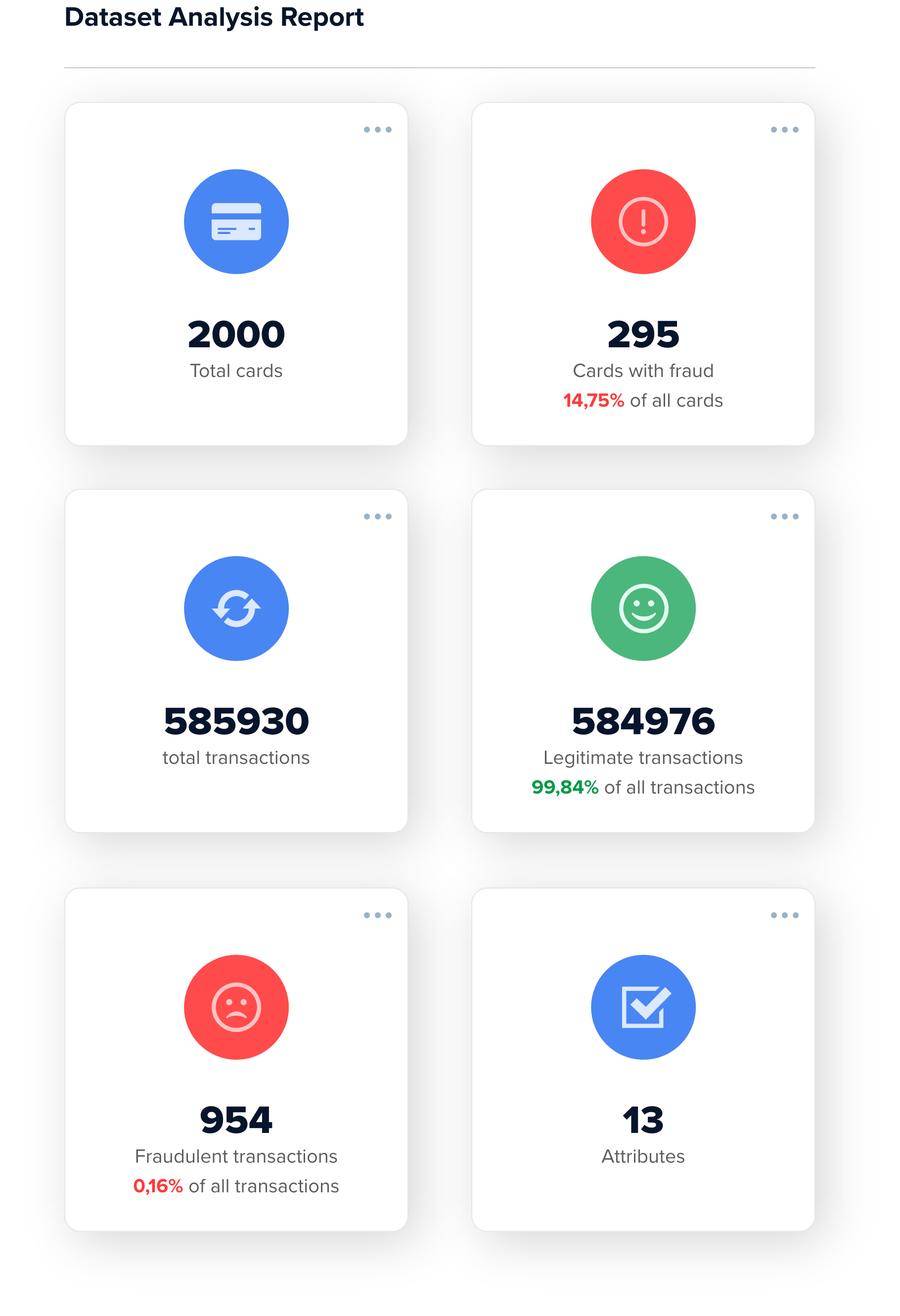

Le machine learning est essentiel pour les solutions modernes de prévention de la fraude comme la fraude. Il apporte rapidité, efficacité et scalabilité pour lutter contre la fraude dans un monde en ligne et hyper-connecté.

Ainsi, un plus grand nombre de transactions frauduleuses sont détectées, tout en réduisant le nombre de faux positifs.

Contrôler Tous les Canaux

Contrôler Tous les Canaux

Luttez contre la menace croissante en surveillant 100 % des transactions et en construisant une vue à 360° du client sur tous les canaux : de l’utilisation de sa carte en ligne, en magasin, sur application, jusqu’aux transactions bancaires cœur de système.

Tout cela en temps réel, sur tous les canaux et dans toutes les juridictions nécessaires.

Toutes les informations sont surveillées, exploitées et réutilisées, permettant ainsi de créer un profil client précis basé sur des schémas de comportement récurrents.

Toujours à Jour

Toujours à Jour

Le moteur de règles puissant et flexible, enrichi par le profilage comportemental et les modèles de scoring basés sur le machine learning, vous permet de déployer rapidement des politiques de surveillance.

Vérifiez Avant de Bloquer

Vérifiez Avant de Bloquer

Échangez avec vos clients lorsqu’un paiement inhabituel est détecté.

Il n’est pas nécessaire d’arrêter, de reporter le paiement ou de bloquer un instrument de paiement pendant l’enquête, ce qui vous évite, ainsi qu’à vos clients, bien des complications.

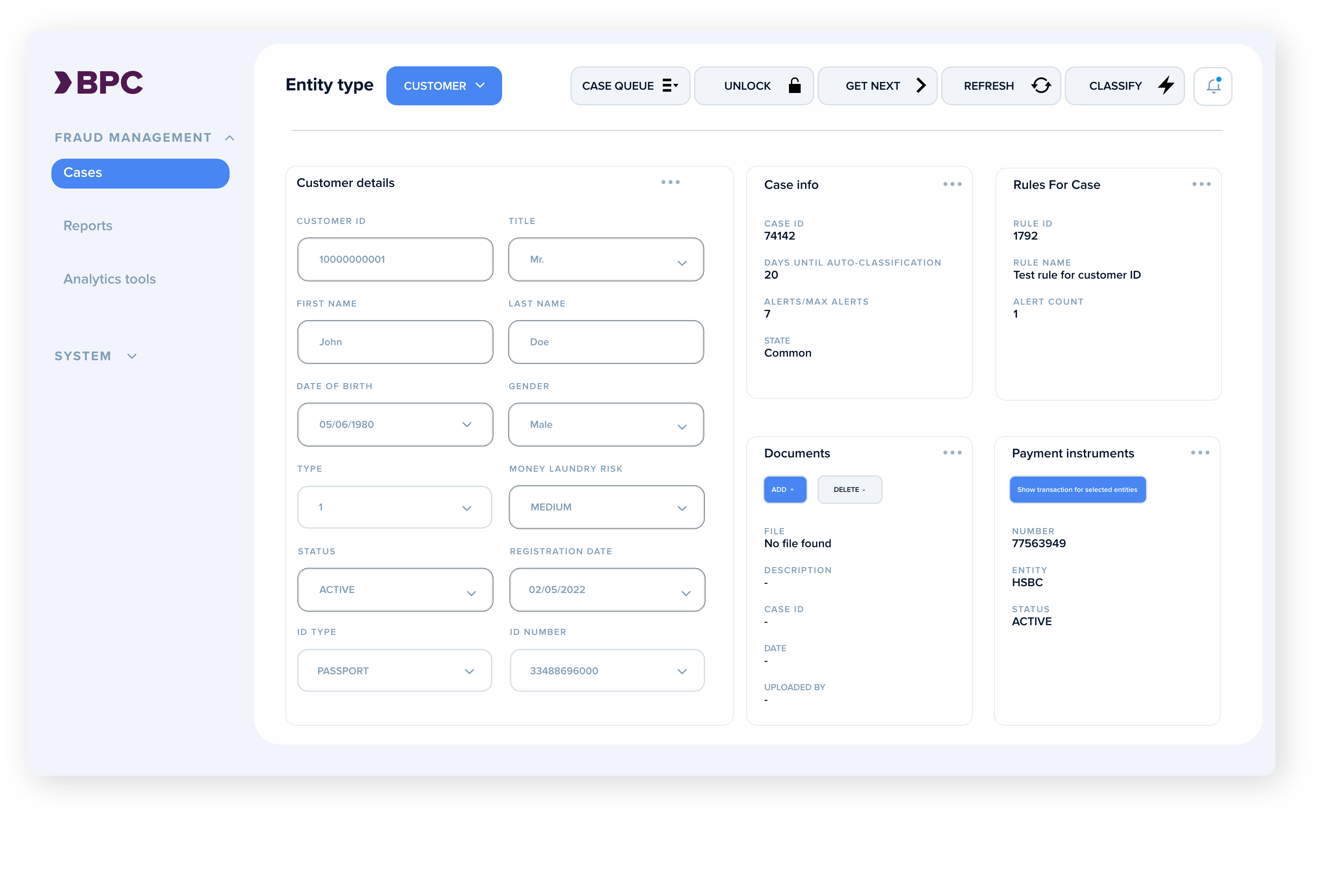

SmartVista Solution de Gestion de la Fraude

Faire la Différence

Faire la Différence

- Modèle de données flexible et configurable, cartographie des interfaces et interface utilisateur adaptables

-

Modèles de machine learning gérés par l’utilisateur final

-

Ouverture pour une intégration configurable et une personnalisation sur mesure

À Votre Service

À Votre Service

- Prévention multi-institutions et à l’échelle de l’entreprise : interne et sur les canaux

- Profilage client et gestion des cas

- Gestion des listes blanches, noires et de fraude

Au Service de Vos Clients

Au Service de Vos Clients

- Protection du commerce électronique

- Tableaux de bord et rapports

- Surveillance en temps réel des transactions et des comportements

Produits associés

ACS 3D secure

Participez aux programmes 3-D Secure des réseaux internationaux de paiement avec le SmartVista Access Control Server (SV ACS). La solution prend en charge la maintenance de l'enregistrement des cartes, l'authentification des demandes de cartes et de paiement, et la notification aux titulaires de carte, le tout entièrement conforme aux exigences PA-DSS et donc prête pour les audits PCI DSS.

eCommerce

Les modules e-commerce de BPC sont faciles à intégrer avec presque n'importe quel CMS, afin d'optimiser le flux de transactions. Pas besoin de se soucier des devises non plus, vous sélectionnez celles dont vous avez besoin, et le système en couvrira n'importe laquelle. La connexion est essentielle, vous pouvez donc proposer vos solutions e-commerce sur n'importe quel appareil nécessaire sans limitations.