Agent Banking

Bring Your Bank to the People

Reaching out

Agent and microfinance banking services are developed to support unbanked and underserved communities in the most effective and relevant way.

Financial services are offered through a wide network of agents who use their mobile devices. This allows to reach each and every customer without capital investments into hardware, branches, etc.

Full range of transactions and services

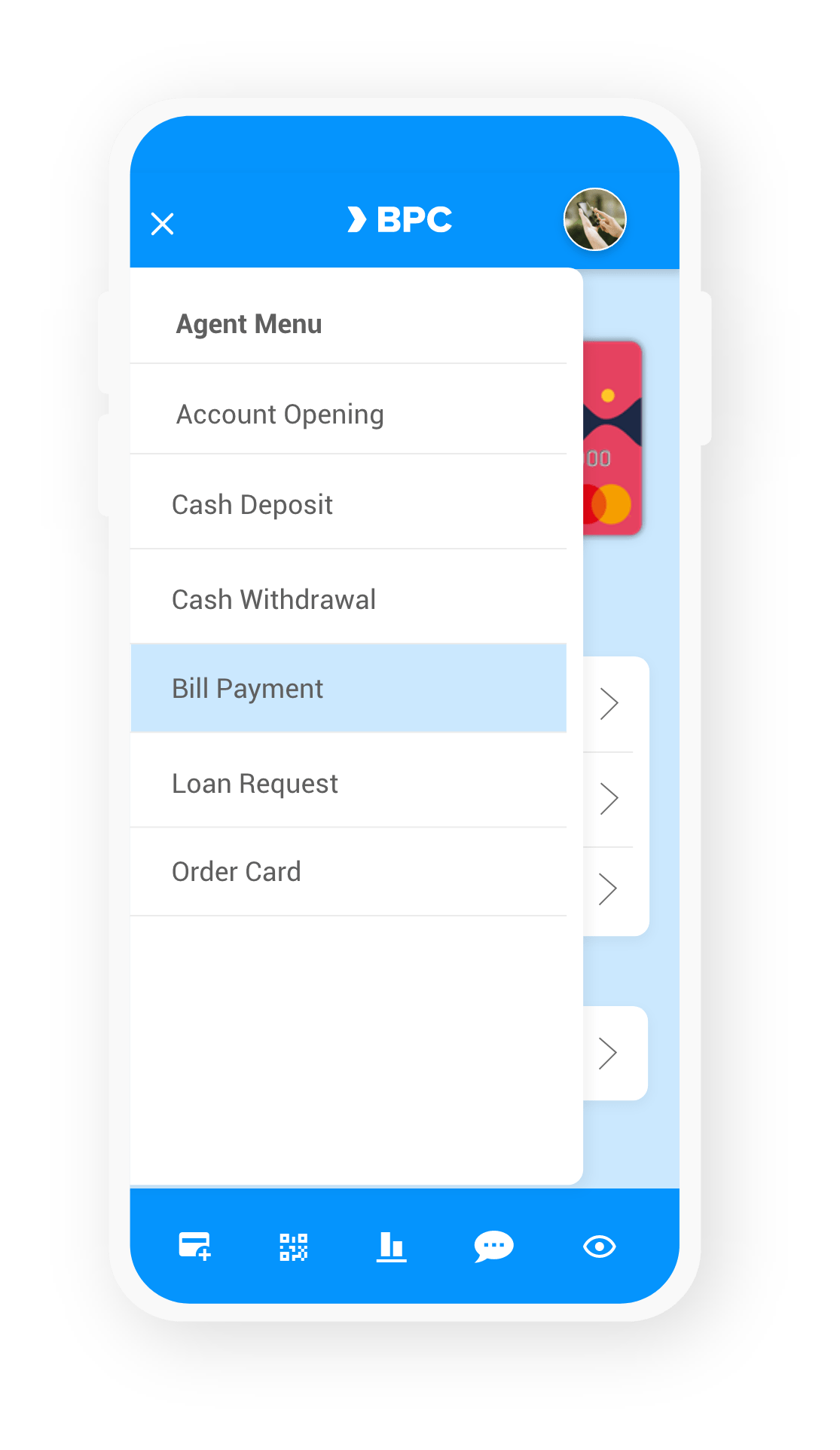

SmartVista’s Agent Banking solution allows agents to offer a full range of transactions and services.

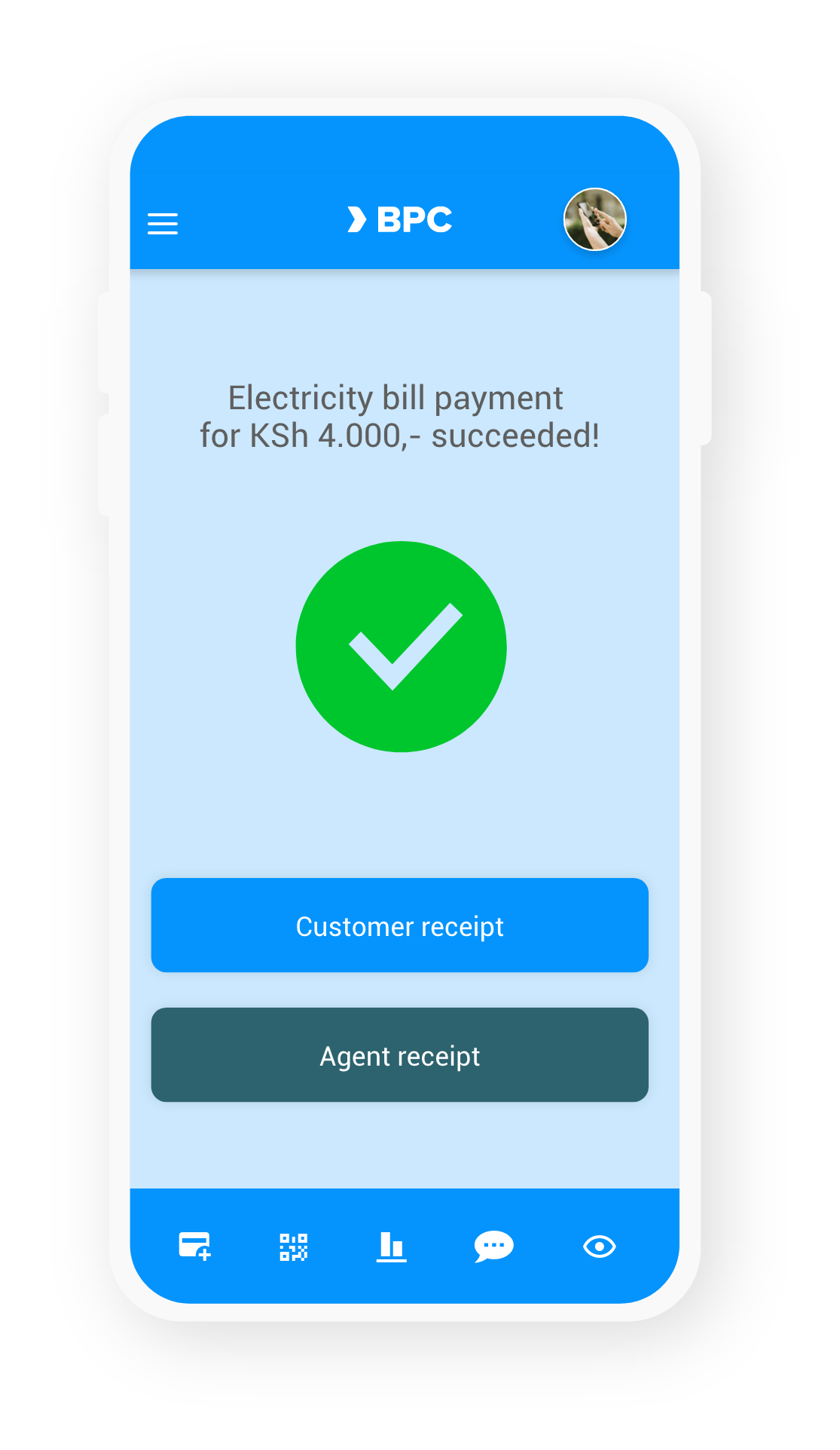

These include cash deposits and withdrawals, money transfers, account to account payments, loan repayments, bill payments or mobile top-up.

Agents, when authorised, are able to onboard new customers and perform KYC instantly.

Enabling agents matters

The agents that represent financial institutions are instrumental to the success of the agency network model. SmartVista’s Agent Banking equips agents with the right tools they require to provide their services efficiently and securely.

New revenue streams

New revenue streams

Reduce the cost of your branch network and expand the products offered to customers remotely. Reach new clients by turning regular retail or other community points of contact into full-service representatives of your brand and bank.

Easy fit with your infrastructure

Easy fit with your infrastructure

SmartVista has been designed to seamlessly and quickly integrate into virtually any (rural) infrastructure, saving you time and costs.

Keep control

Keep control

Instant KYC and full circle security are key, particularly in remote situations. Streamline your agent and terminal boarding, agent management, pricing and settlement with the SmartVista Agent Banking solution, anytime and anywhere.

SmartVista Agent Banking

Making a difference

Making a difference

- Extend the reach of your bank’s network to the very last mile

- Securely onboard remote clients

Working for you

Working for you

- Localise services based on your customer segments

- Agent on-boarding and rights configuration

- Agent accounts and liquidity management

- Agent Portal and Agent App

- Dispute management

- Multi-Institution capabilities

Working for your customers

Working for your customers

- Full banking services in your local area

- Personal service combined with digital access

Related Products

Microfinance

With SmartVista Microfinance, you provide financial services to underserved or excluded communities. With this solution, MFI agents can make real-life connections and connect the unbanked to a digital microfinance infrastructure. Services are delivered where the clients are, even in the most rural areas.

QR Payments

QR-enabled payments have grown rapidly worldwide, but particularly in Asia and especially in China and India. They allow merchants, street vendors and taxi drivers to accept payments with a QR code that can be simply printed on paper, eliminating the need for an expensive POS terminal.

eWallet

eWallets offers everything a classical wallet would offer and more. Digital wallets all start from the same core value proposition: offering mobile payments at large without the need for a bank account. This takes us to the next level of cash freedom anywhere: convenience and safety of a cashless future.