Acquiring

'Be Your Customer'

‘Over-deliver’

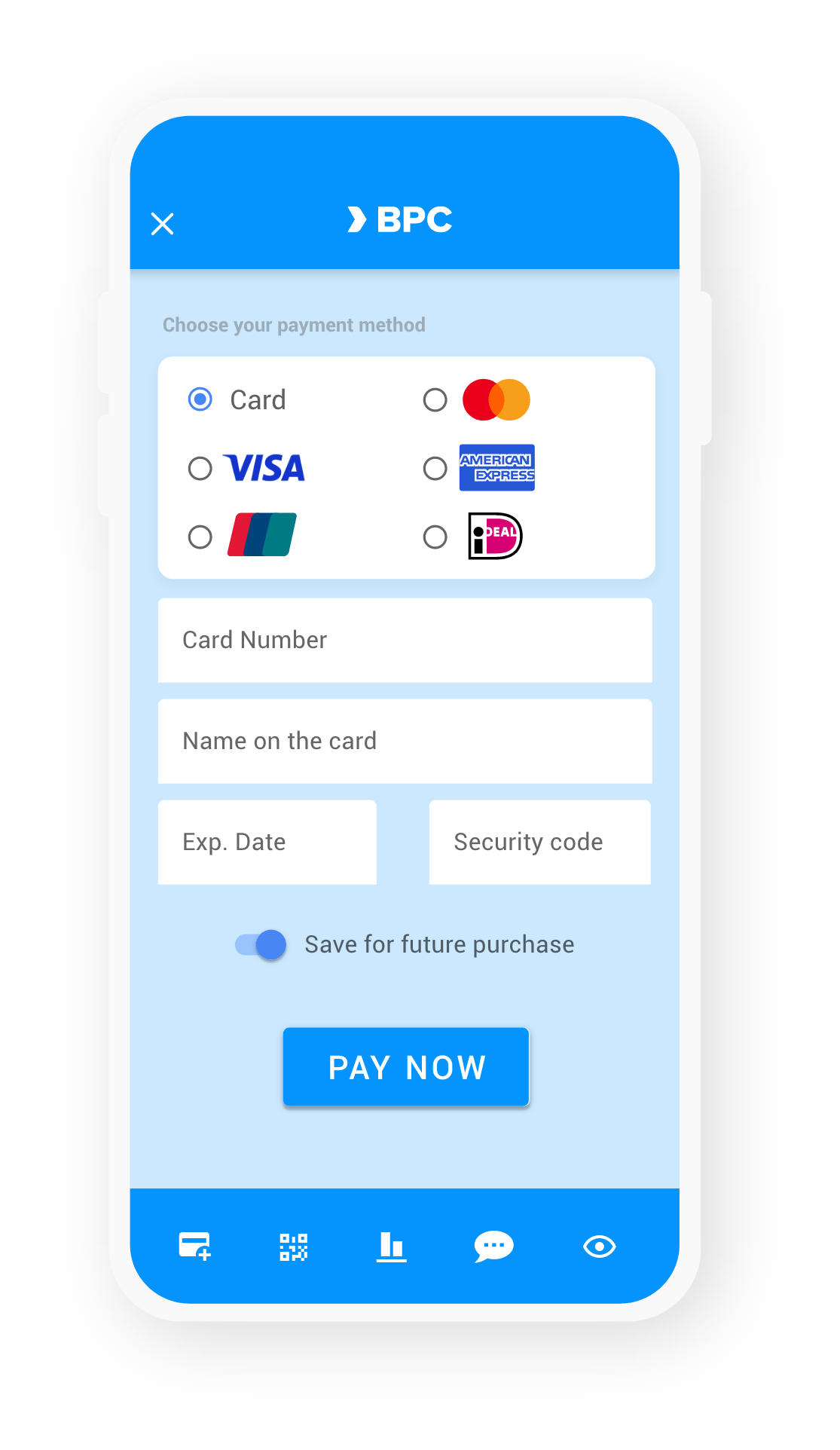

Never mind ‘under promise’, simply over deliver. Let your clients in any region use the payment method they prefer. Decimate the number of clicks between buy, pay, completion.

A flawless customer experience is the best guarantee for returning and growing trade.

BPC ensures that you are always up to date with any payments execution your customers might wish for.

Connecting payments to commerce

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for merchant acquirers (POS, SoftPOS, eCommerce) and the banking services world with (customised) ATM offerings, including ATM cash management.

Sharing our experience

Because of BPC’s long-standing track record in the field, we can offer services in literally any corner of the world. We understand the challenges you and your clients face.

From dense digital environments up to solutions for rural ecosystems: we offer state of the art solutions.

Secure

Secure

All our acquiring solutions are built to offer security and compliance standards needed in a highly competitive era in any corner of the world, based on PA-DSS and PCI-DSS frameworks.

Scalable

Scalable

As your business grows, your acquiring services need to grow and evolve with it. Mix and pick your services, resilient and scalable infrastructure. Whilst you focus on your business volume, we ramp up your payments stack.

Supported everywhere

Supported everywhere

Because of BPC’s long standing track record in this field, we can offer acquiring services in literally any corner of the world, integrated to international payment schemes and a variety of national networks. Any to any, to the last mile.

SmartVista Acquiring

Making a difference

Making a difference

- Voted the top cards acquiring platform by industry analysts

- Across any card scheme, stand alone or cash/ATM integration

Making it work for you

Making it work for you

- Security and compliance at the core, always-on

- Scaling up and down with your volume and reach

Working for your customers

Working for your customers

- Extending merchants’ reach in any region and jurisdiction

Related Products

Merchant Management

Meeting expectations seems more and more complicated. In the digital world as well as in real life, the bar is set high when it comes to payments. The BPC’s Merchant Management module offers a wide range of payment instruments, and it is vital to propose the right solutions and service levels to merchants.

eCommerce

The BPC e-commerce modules are easy to integrate with almost any CMS, in order to optimise the transaction flow. No need to worry about currencies either, you select the ones you need, and the system will cover any. Connection is key, so you can offer your ecommerce solutions on any device needed without limitations.

Risk & Fraud Management

Tap to Phone

Paying was never as convenient as now, where your devices can turn into a full-service payment channel. Through tap to phone, acquirers empower their merchants to accept all contactless payment methods: contactless EMV® cards, NFC devices such as smartphones, smartwatches, tablets and QR codes.

Buy Now Pay Later

The Buy Now Pay Later service to consumers opens revenue streams for merchants by reaching new customer segments and extending existing ones.. The global Buy Now Pay Later industry was estimated at $90.69 billion in 2020, and is anticipated to hit $3.98 trillion by 2030.

Billing & Invoicing

Not payments but receivables are crucial to any business. Billing and invoicing are where it all starts. Speed, but also accuracy is key to stay away from time-consuming conflicts and needless corrections. With the merchant administration and portal tools, invoices can be automatically generated and payment statuses are always accessible and up-to-date.