Fraud Management as a Service

Know your enemy…in real time

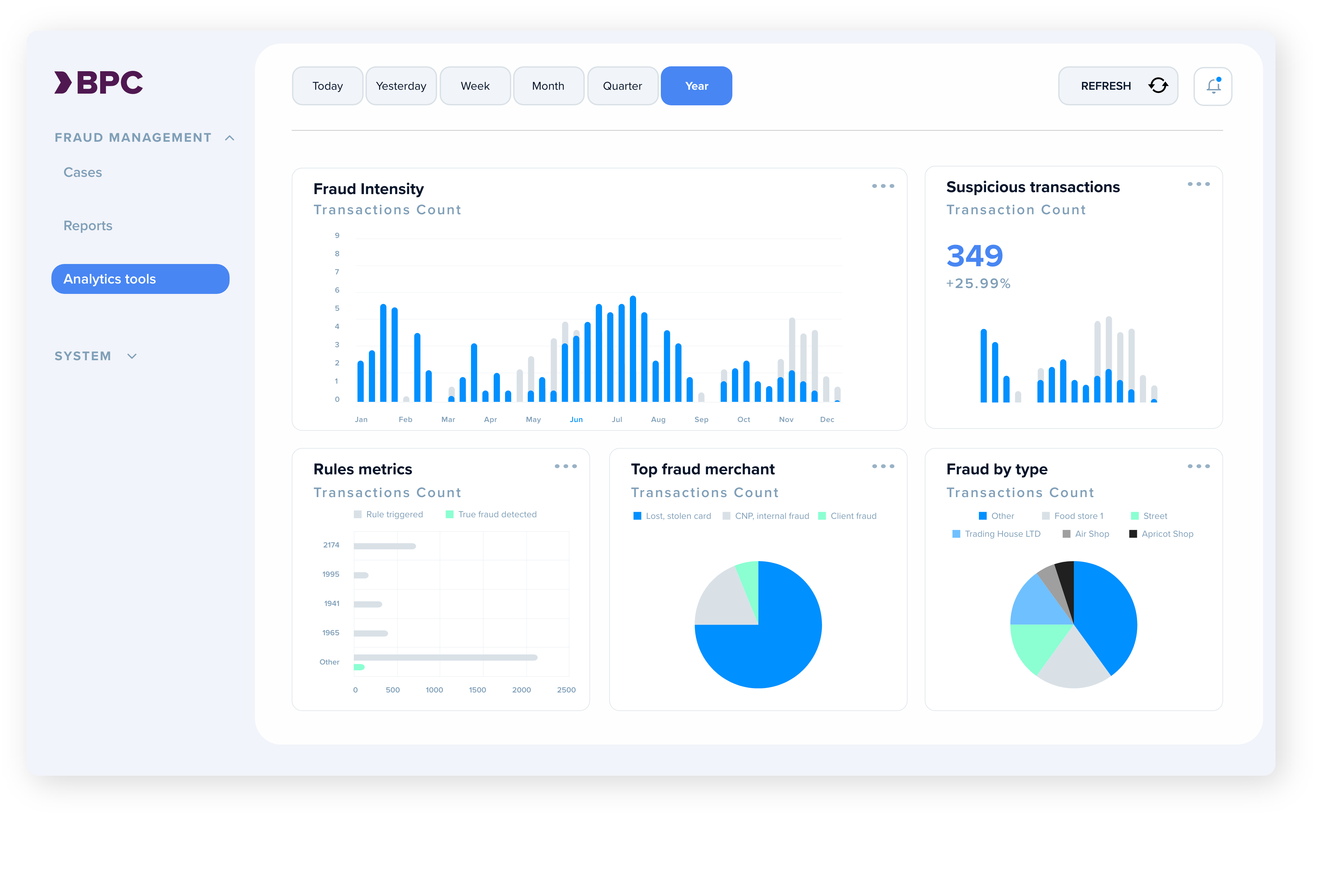

Fraud is omnipresent and unfortunately part of life. BPC takes fraud prevention to be a vital component of a services offer.

We therefore combine all of the key methods of handling fraud across all entities in the chain, all channels and in real-time. While protecting all of the channels, receive all of the data in the dashboard in real time. Know your enemy.

Best “face control”

BPC offers a comprehensive fraud detection that provides robust capabilities to secure all transactions and operations for your business, through performing on-line, near real-time, and batch fraud scoring, enabling to quickly identify and block fraudulent activities as they happen.

We harness the power of advanced machine learning algorithms and behavioural analytics. Our sophisticated system delves into enormous volumes of data, identifying suspicious patterns and irregularities in real-time.

With BPC's Fraud Management as a Service, you get the best of both worlds - the peace of mind that comes with top-tier protection and the competitive edge from staying one step ahead of fraudsters.

RBA and TBA support

BPC offers cutting-edge Risk-Based Authentication (RBA) and Transaction-Based Authentication (TBA) methods that ensure the highest level of security for all your online transactions and operations.

Analyse account transaction history to determine the risk level of each transaction and apply additional security measures when necessary or provide your customers with authentication code with every transaction, ensuring maximum security.

Be Alert

Be Alert

Stay one step ahead of fraudsters with BPC's advanced Alert feature for fraud prevention. Receive real-time notifications whenever suspicious activity is detected, and take immediate action to prevent fraudulent transactions.

Expand it

Expand it

Expand the safety of many institutions simultaneously. Manage fraud prevention across multiple institutions and gain a holistic view of your entire business. Share data and insights between institutions, improving your ability to detect and prevent fraud at every level.

Enjoy end-to-end service

Enjoy end-to-end service

Going SaaS possesses lots of benefits such as quick onboarding, cost-effectiveness, and end-to-end service. You can start using the software right away, save money by paying only for what you need, while BPC supports you on your journey.

Fraud Management as a Service

Making a difference

Making a difference

-

Multi-institutional approach

-

Omni-channel solution

-

Real-time monitoring

-

Interfaces ISO-8583, SOAP, HTTP/JSON, XML

-

E2E service

Working for you

Working for you

- Business-driver rules

- Secure PA-DSS validated

- Alert generation

- Comprehensive analysis

- Custom configured fraud lists

Working for your customers

Working for your customers

- Multiple validation rules

- RBA and TBA support

- Quick onboarding

Related services

ATM Acquiring

Experience seamless, efficient and customizable ATM management with BPC's ATM Acquiring as a Service - a 24/7 real-time network operations solution offering modern transactional support, tailored hierarchical configurations, remote control and zero-maintenance for a diverse range of ATMs and self-service kiosks.

Card Management

BPC's Card Issuing and Management as a Service provides end-to-end, secure, and integrative payment solutions - offering efficient card issuance, seamless payment operations management, advanced tokenisation security, and personalised customer connectivity for diverse card types.

E-commerce

Embrace the future of retail with BPC's E-commerce as a Service, offering a secure, customisable, and user-friendly platform with white-label solutions, flexible payment methods, rapid merchant onboarding, and end-to-end service for seamless online transactions and business growth.

POS Acquiring

Transform your payment experience with BPC's POS Acquiring as a Service - an efficient, cost-effective solution enabling seamless transactions, diverse payment method acceptance, effortless merchant management, and superior settlement experiences.

Switch

BPC's Switch as a Service: Offering a comprehensive solution for seamless, secure, and efficient transaction processing across multiple networks, reducing costs, and empowering businesses with quick onboarding and end-to-end services for a holistic, hassle-free payment experience.