Tippay

Real life Appreciation in a Digital World

Giving back in a ‘cashless’ world

Contactless payments were boosted by the pandemic, but are here to stay. This shift in payment behaviour is a positive development reducing cash handling costs.

This also goes for giving and receiving tips which can be handled by BPC’s Tippay service.

Growing your micropayment business

Tippay is a standalone service for tipping and gratuity that can be deployed by financial institutions that wish to increase their presence in the growing micropayment business.

For more tipping convenience financial institutions can deploy Tippay as a standalone app available in their (hospitality) business client outlets and to their eCommerce partners.

Essential services for many

Tipping is essential for many service employees around the world and an integral part of their income.

The Tippay service enables businesses to reach new potential customers while generating additional revenues by taking a minimal fee on every tip registered.

FI deploy

FI deploy

Financial Institutions can deploy Tippay as a standalone app or integrate it with existing systems.

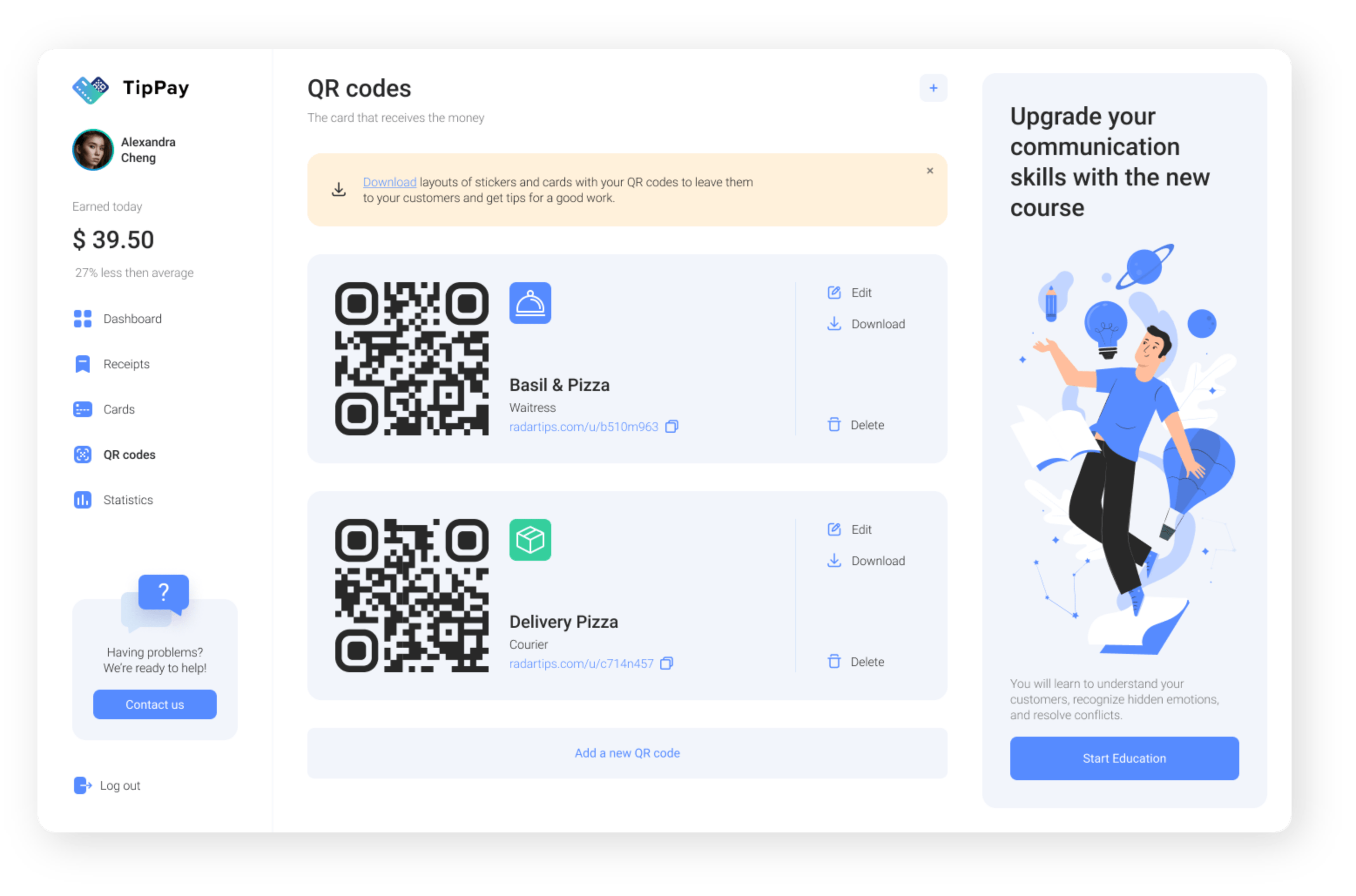

Easy registry

Easy registry

Access by using a phone number while setting up the password or adding card details if workers are not a customer of the bank.

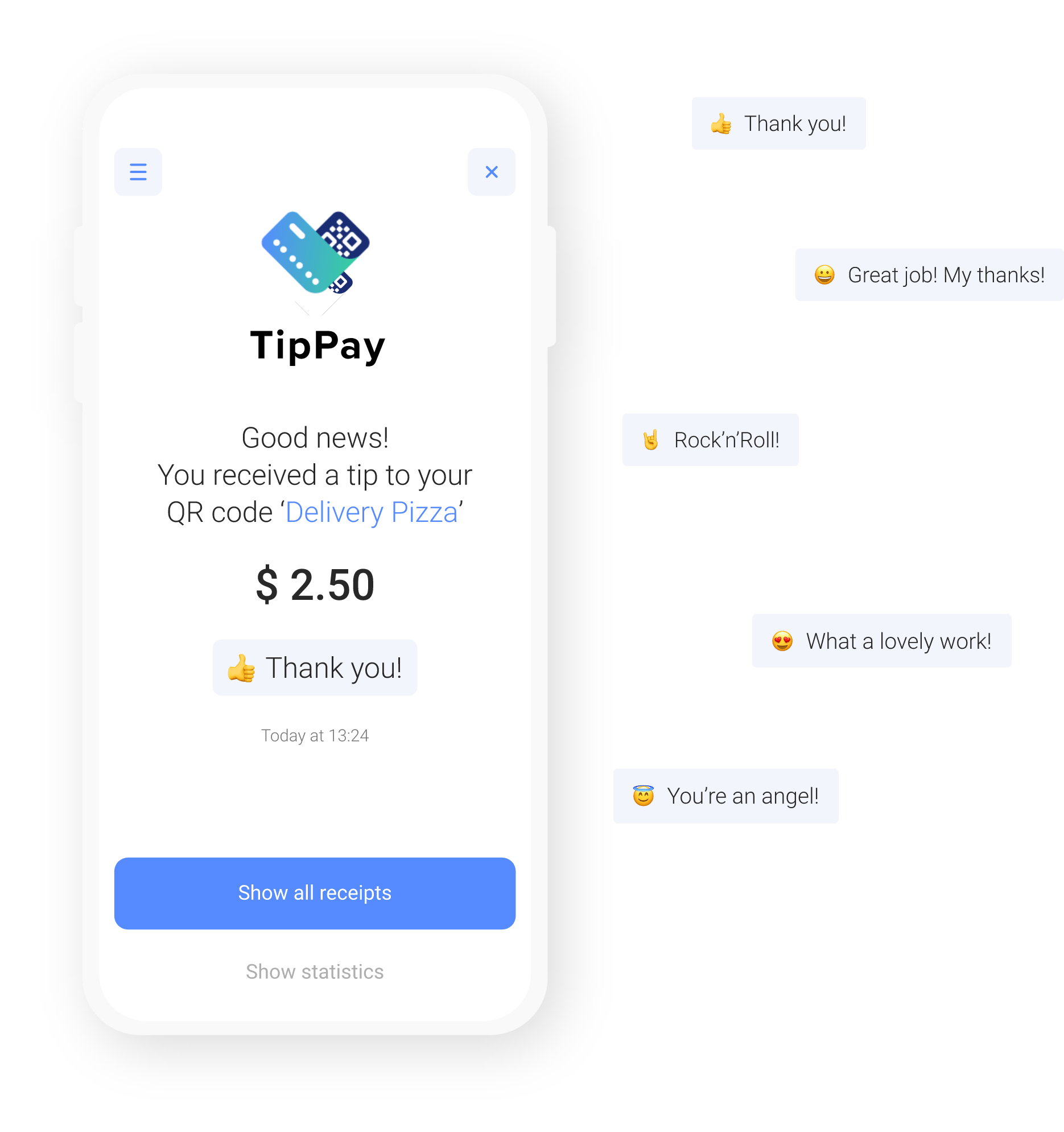

Customers scan & pay

Customers scan & pay

People can tip fast and easy by scanning a QR code, choosing the amount to tip and selecting their payment method.

SmartVista Tippay

Making a difference

Making a difference

- Save the sum of the tips

- For auto or manual payout

- A new virtual wallet for every waiter

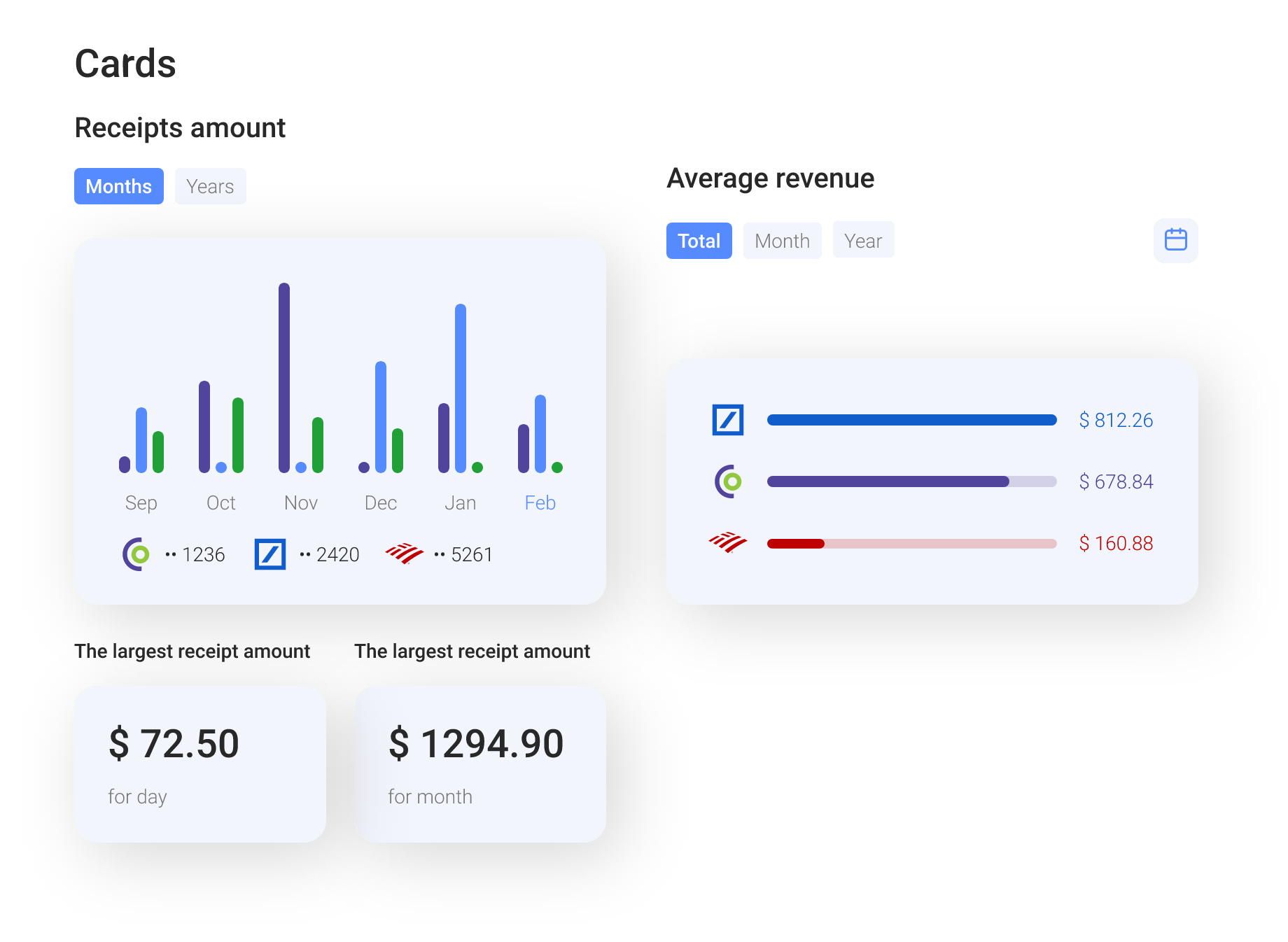

Working for you

Working for you

- Dashboard and review

of tipping activities - High security with 3DS, two-way

authentication and validation - Multi-language and multi-currency

- Multiple QR codes for multiple jobs

Working for your customers

Working for your customers

- Easy registration using mobile numbers

- Set a preferred tips amount

- Multiple payment methods: debit or

credit card, Google Pay, Apple Pay, Samsung Pay, etc

Related products

QR Payments

QR-enabled payments have grown rapidly worldwide, but particularly in Asia and especially in China and India. They allow merchants, street vendors and taxi drivers to accept payments with a QR code that can be simply printed on paper, eliminating the need for an expensive POS terminal.

Acquiring

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for both the merchant (POS) and the banking services world with (customised) ATM offerings, including ATM cash management, (Soft)POS.

Risk & Fraud Management

eWallet

eWallets offers everything a classical wallet would offer and more. Digital wallets all start from the same core value proposition: offering mobile payments at large without the need for a bank account. This takes us to the next level of cash freedom anywhere: convenience and safety of a cashless future.