Payment Service Provider

Stack to Service - White Label PSP Excellence

Manage and scale

In today’s climate of exploding payments in types and volumes, running a payments platform is a complex mix of balancing top-notch technology with flexible operations. Of stringent security and the ability to innovate and add payment types constantly.

With pure transaction fees ‘racing to zero’, the business case is in the end customer: volume and more importantly innovation by means of data driven value-added services.

Moving your infrastructure from stack to service not only frees up capital in terms of money, it also frees up entrepreneurial energy.

De-risk and comply

Twenty-five years of running payments in over hundred countries have taught us quite a few things: regulations change and differ per region, fraudsters constantly ‘innovate’, and brand trust goes on horseback when systems and processes fail.

Bank-grade security and a 24x7 watch on fraud prevention and detection are of vital importance, as well as compliance with a wide range of regulators around data, identity and more.

Move from a focus on compliance, security, and support towards business-driven discussions with your customers around their roadmap for success and growth.

Innovate and extend

As a PSP or a fintech your eyes must be on fast-tracking a launch, extending your choice of payments, growing internationally with your customers, and moving into full commerce services without having to invest in new technologies or trying out new business models.

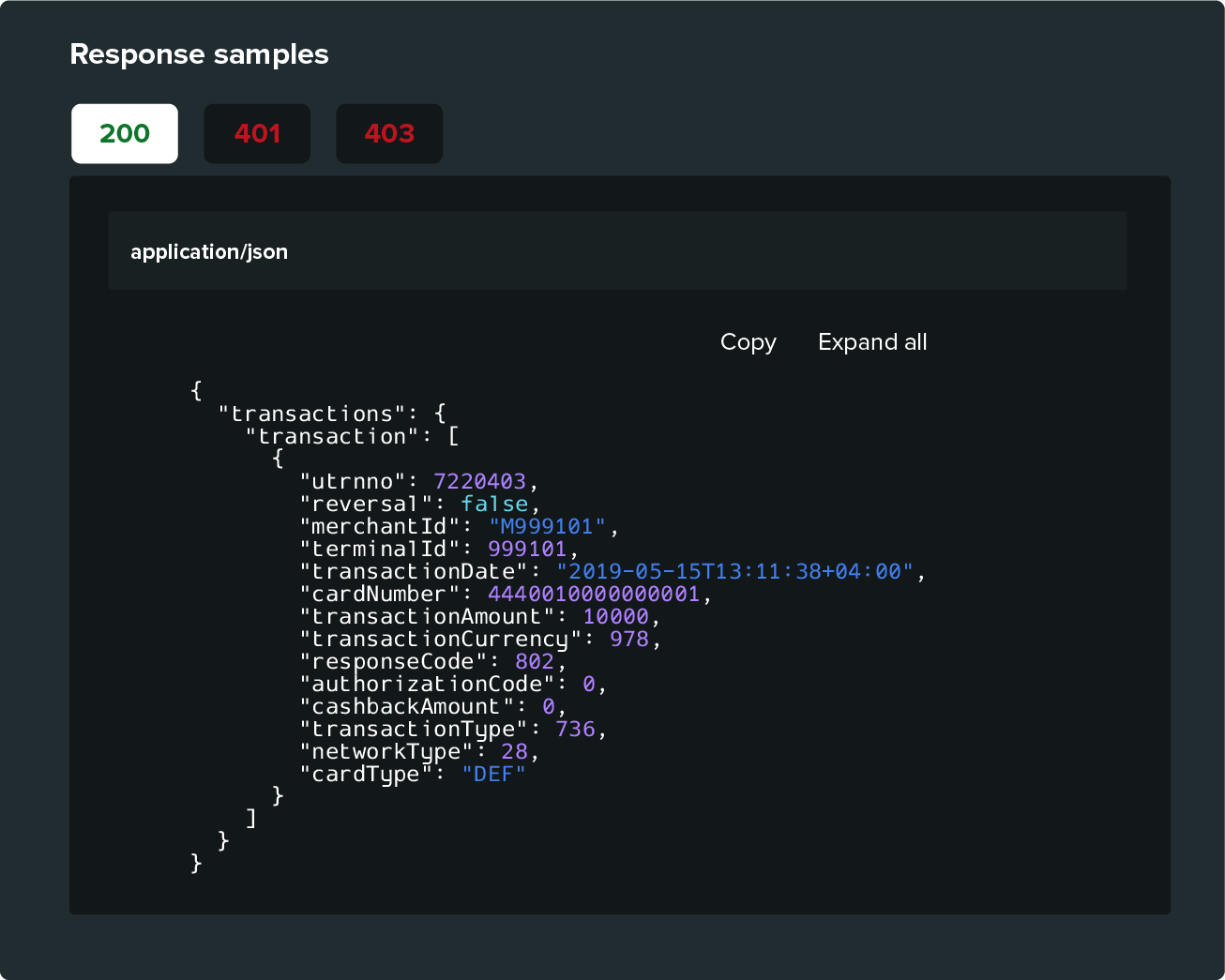

Join up with hundreds of acquirers and issuers through our Developers Portal and Sandbox where together we rethink the way we pay and get paid.

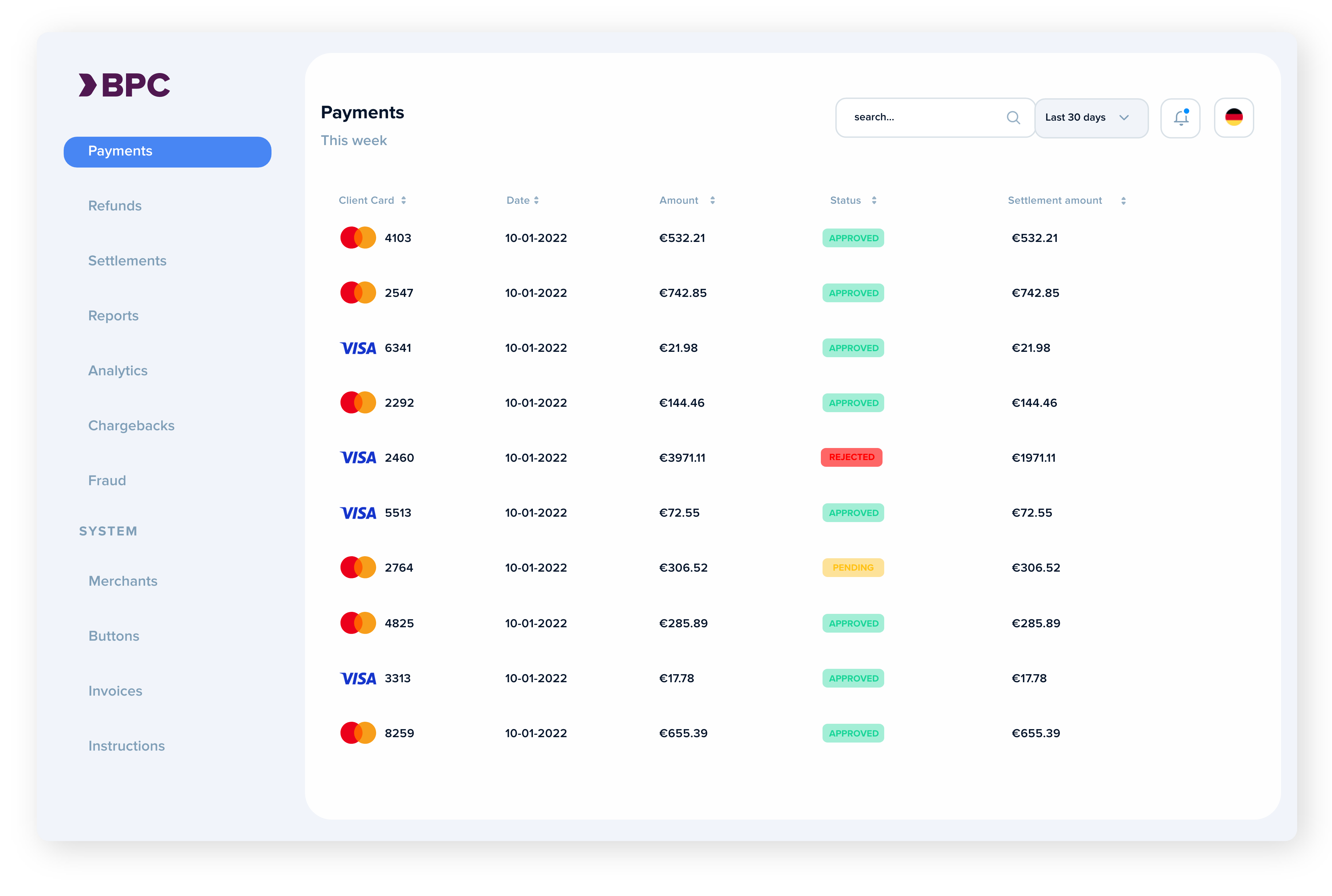

Payments

Payments

From acquiring and issuing, physical,virtual, prepaid cards, A2A, debit, BPNL, wallets, with or without a BIN sponsor and more, there is no payment type we do not run or process. Moreover, we simplify the world of payments for you, one processor that does it all.

Commerce

Commerce

Services based KYC, digital onboarding, billing & invoicing, Softpos, shopping carts, check out pages and more. Equipping any size from online shop to full blown marketplaces for government, communities, transport & ticketing and more.

Data

Data

Data is the value driver in any business. By analysing consented and metadata, we create actionable insights to extend your footprint. Impactful dashboard and reporting and access to full customisable data analytics.

Related products

Acquiring

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for both the merchant (POS) and the banking services world with (customised) ATM offerings, including ATM cash management, (Soft)POS.

eCommerce

The BPC e-commerce modules are easy to integrate with almost any CMS, in order to optimise the transaction flow. No need to worry about currencies either, you select the ones you need, and the system will cover any. Connection is key, so you can offer your ecommerce solutions on any device needed without limitations.

Merchant Management

Meeting expectations seems more and more complicated. In the digital world as well as in real life, the bar is set high when it comes to payments. The BPC’s Merchant Management module offers a wide range of payment instruments, and it is vital to propose the right solutions and service levels to merchants.

ACS 3D secure

The SmartVista Access Control Server (SV ACS). supports the maintenance of card enrolment, authentication of card and payment requests, and cardholder notification fully compliant with PA-DSS requirements and thus is ready for PCI DSS audits.

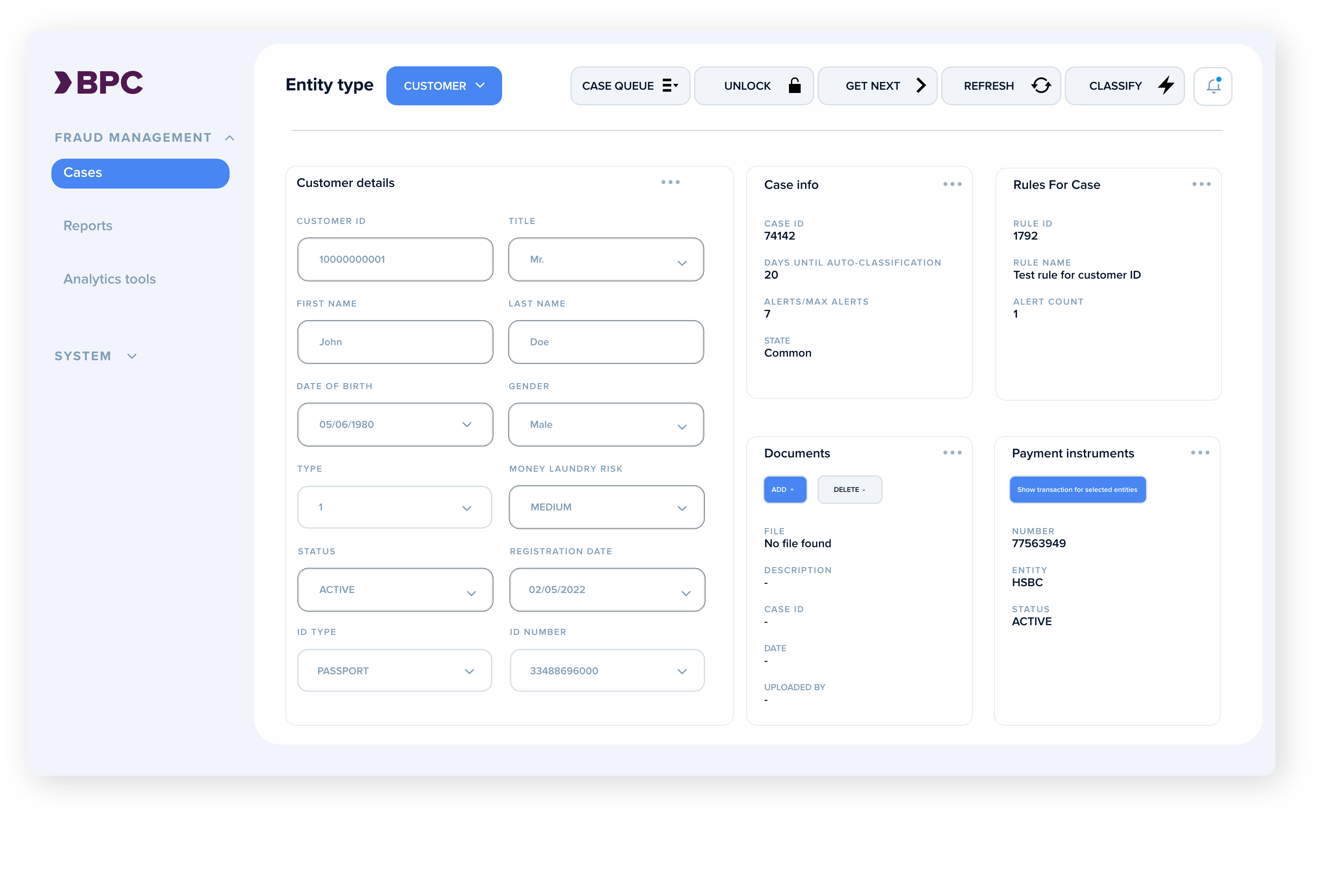

Risk & Fraud Management

Billing & Invoicing

Not payments but receivables are crucial to any business. Billing and invoicing are where it all starts. Speed, but also accuracy is key to stay away from time-consuming conflicts and needless corrections. With the merchant administration and portal tools, invoices can be automatically generated and payment statuses are always accessible and up-to-date.