Banking

From Enabling Banks to Enabling Banking

Tier One to Ambitious Startups

Inside any bank thousands of customers’ dreams are hidden. Whether you are a large universal bank or an agency bank in a rural village, society calls on banks to take their responsibility very seriously and to offer inclusive, fair priced, transparent services that are accessible to all.

With today’s technology banks can indeed service any customer in any country with whatever they need at a fair price.

Heritage to universal to neo - we have your back.

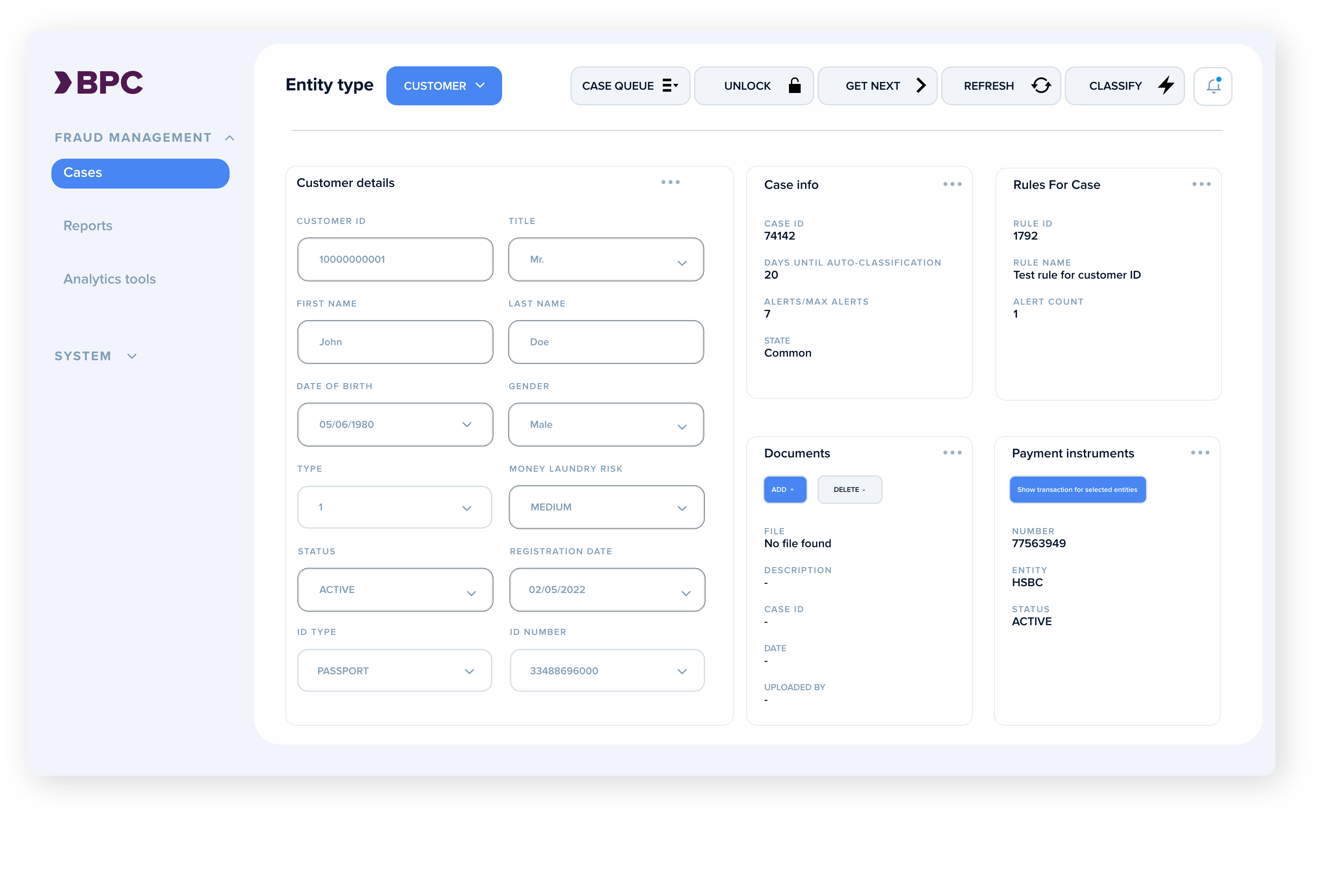

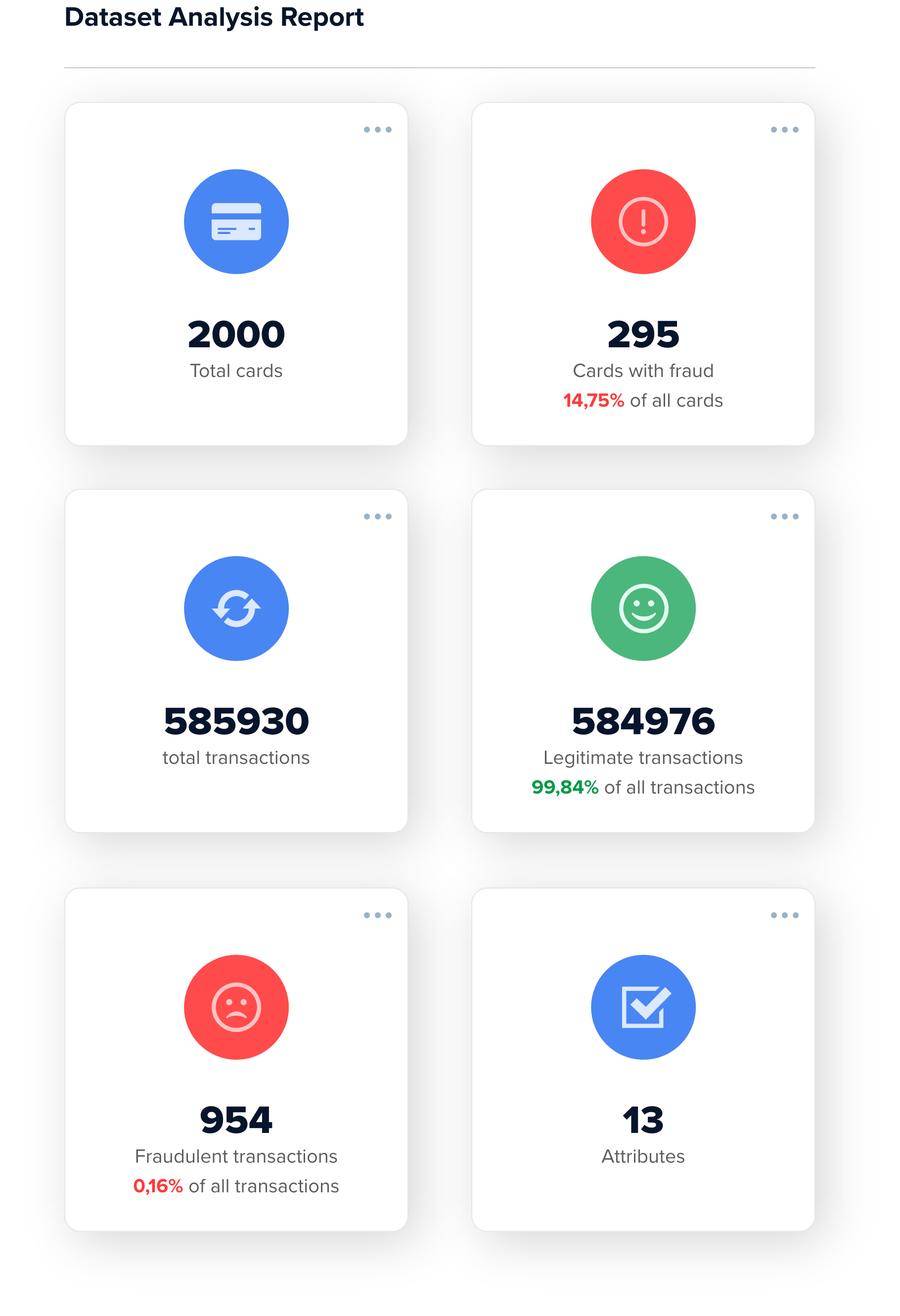

Fraud: the Herculean task

The majority of banks’ IT resources does not go to innovation as one would expect, but to fraud management as criminals have become the innovators of our time

Detecting, disabling and preventing fraud has - in line with an immensely heavy list of changing compliance requirements - become commonplace for banks.

Fraud prevention has therefore become a key consideration in anything from onboarding to transaction processing, and identity management.

Embedded banking

In no category more apps are being downloaded than in finance, three times as many.

There is a need for specific tailor made financial services, a need for fairness and transparency. But do customers over time want to manage say 40 apps, remember 40 passwords? Banks know they need to go where the customer is. That may very well be their own channel, bring all other services into your bank and be your customers’ SuperApp. Others opt to join the SuperApp of their customers' choice.

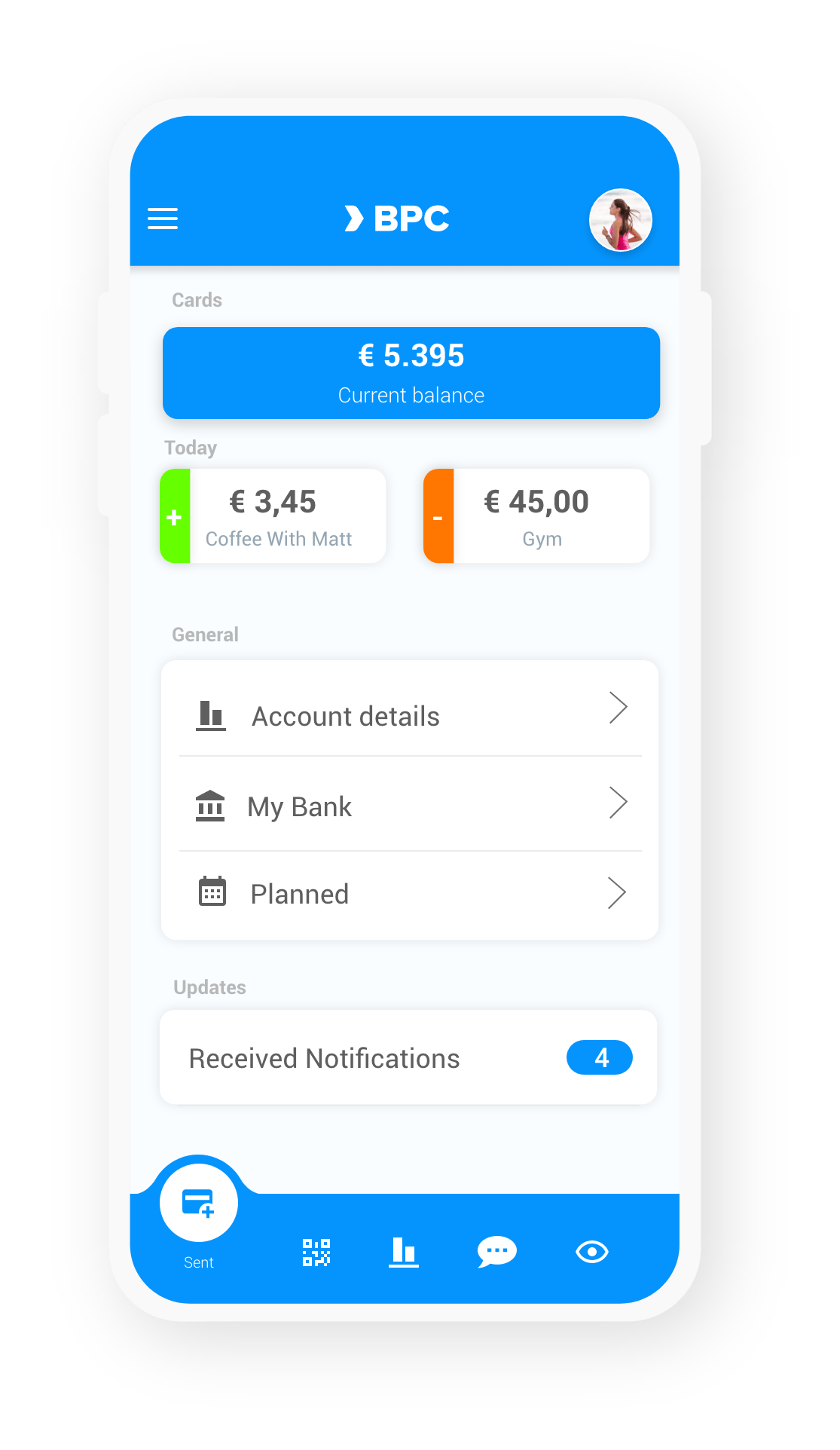

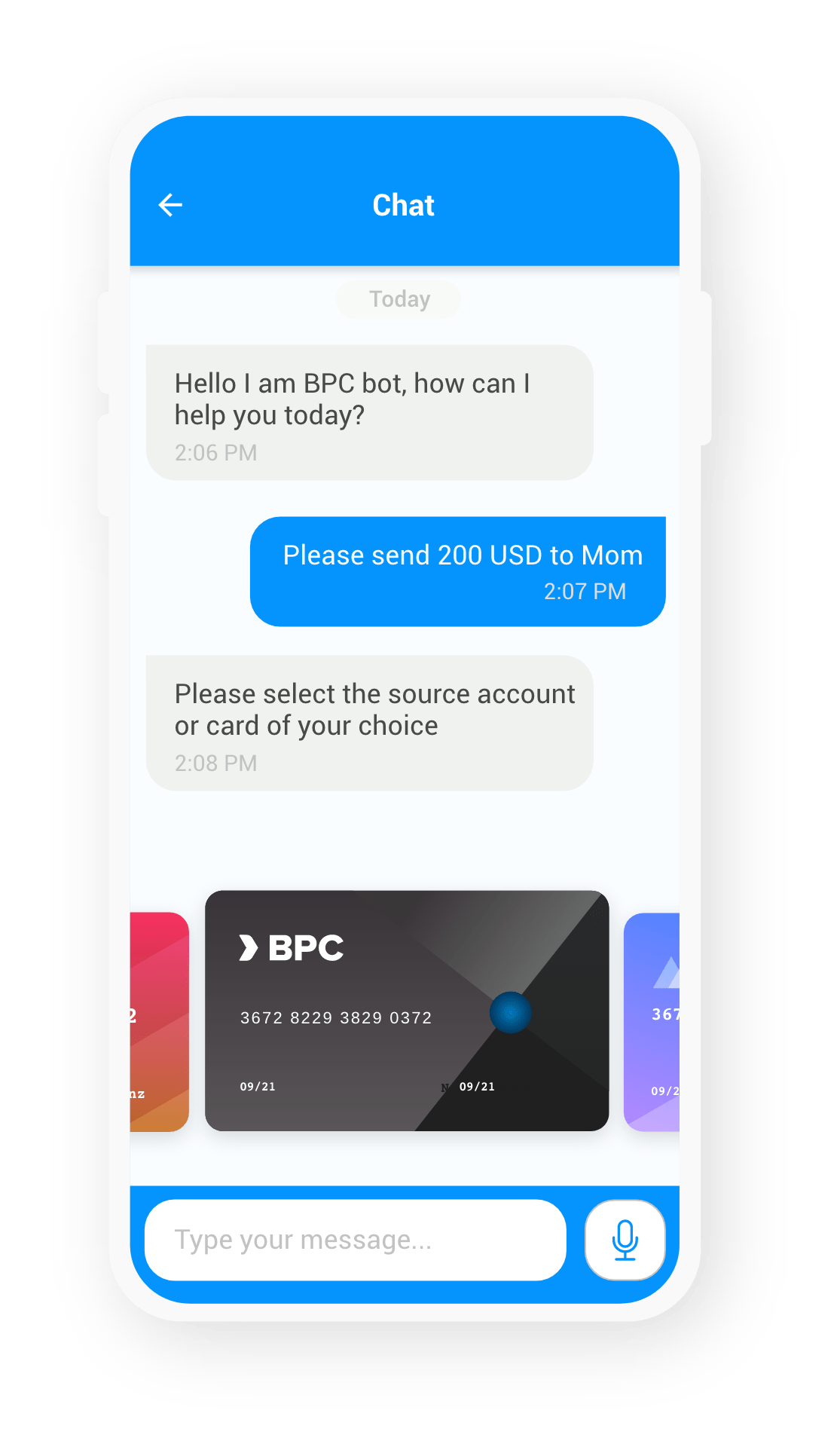

Our solution delivers a customer centric experience in any channel.

Contextual & realtime

Contextual & realtime

A digital banking experience delivered in the context of the customer, real-time anywhere

Hyper personalised

Hyper personalised

Unparallelled data driven marketing ability to offer the right service or product at the right moment on interaction based

Multi-roles app

Multi-roles app

Any user in the banking environment has a relevant and authorised view based app experience: merchant, banker, agent, business client or consumer.

Everything you need to run your bank

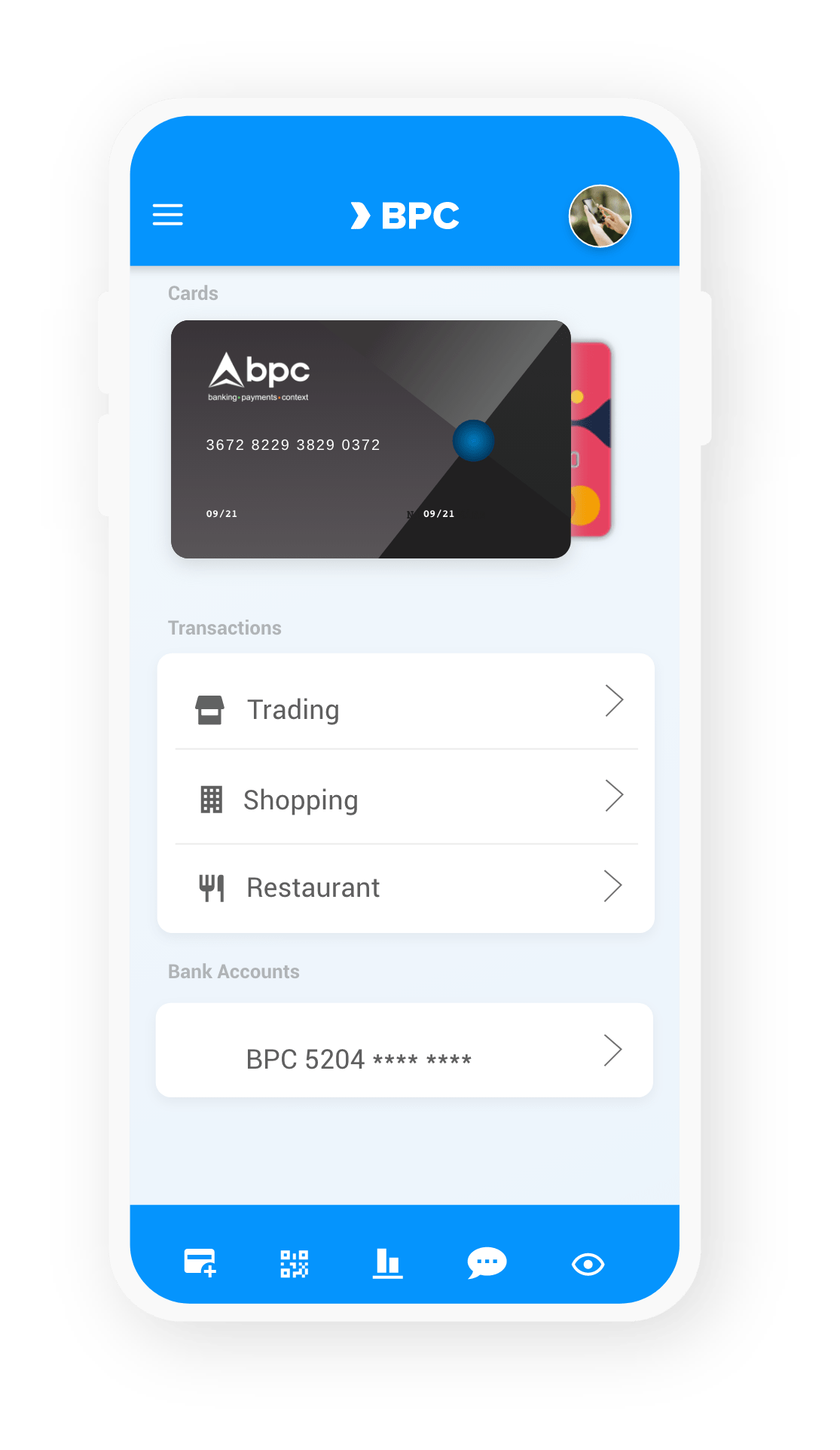

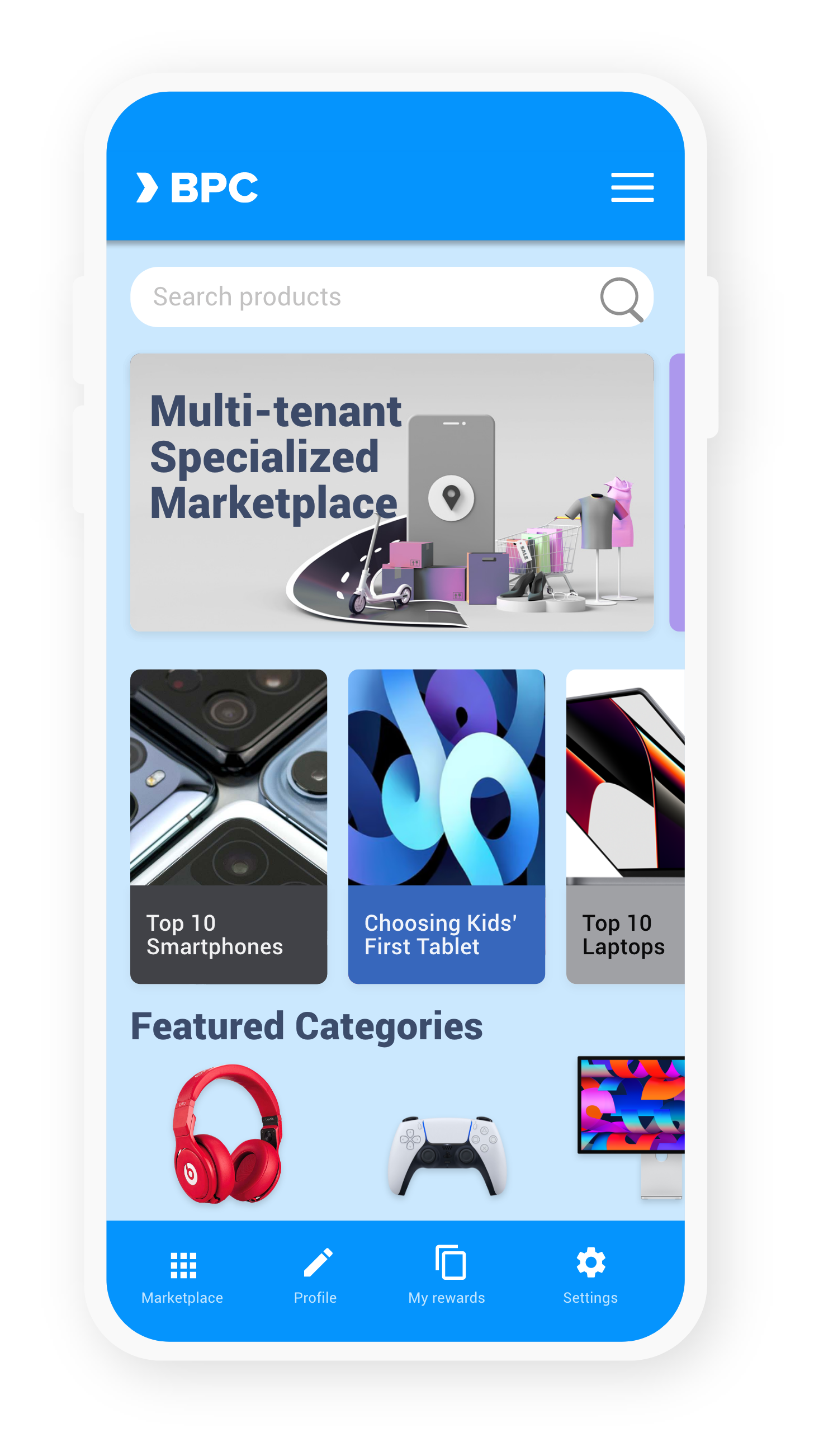

Digital Banking & Super Apps

Digital banking apps are reaching into targeted communities like SME banking to expats or students - and into a wider range of lifestyle services like mobility, government, leisure and others. Igniting any market with a secure relevant banking app to Super Apps fuelling fast developing markets and their demanding customers.

ATM and Kiosk Management

Connecting and managing payments in the digital and the physical world can be time-consuming. Here, BPC can unburden banks and third-party processors as much as possible with SmartVista ATM Management for efficient servicing and monitoring of a diverse range of ATMs and self-service kiosks.

Merchant Management

Meeting expectations seems more and more complicated. In the digital world as well as in real life, the bar is set high when it comes to payments. The BPC’s Merchant Management module offers a wide range of payment instruments, and it is vital to propose the right solutions and service levels to merchants.

Buy Now Pay Later

The Buy Now Pay Later service to consumers opens revenue streams for merchants by reaching new customer segments and extending existing ones.. The global Buy Now Pay Later industry was estimated at $90.69 billion in 2020, and is anticipated to hit $3.98 trillion by 2030.