Microfinance & Inclusion

Global Banking fit for Local Needs

Banking for life and living

Exclusion from financial services is a global problem keeping people and entire nations out of the loop of progress. And although MEA (50%) and South and Central America (38%) are most in demand for inclusion, even in Europe (6%) and the United States (21%) people are excluded, and daily risk falling in the hands of unscrupulous operators.

This is an issue that calls for collective action but also a real business opportunity. Whereas it used to be hard to serve those segments competitively with the technology at the time, today such an excuse no longer exists.

We have the global expertise and technology to support people and communities at the smallest micro level.

Sow and harvest life

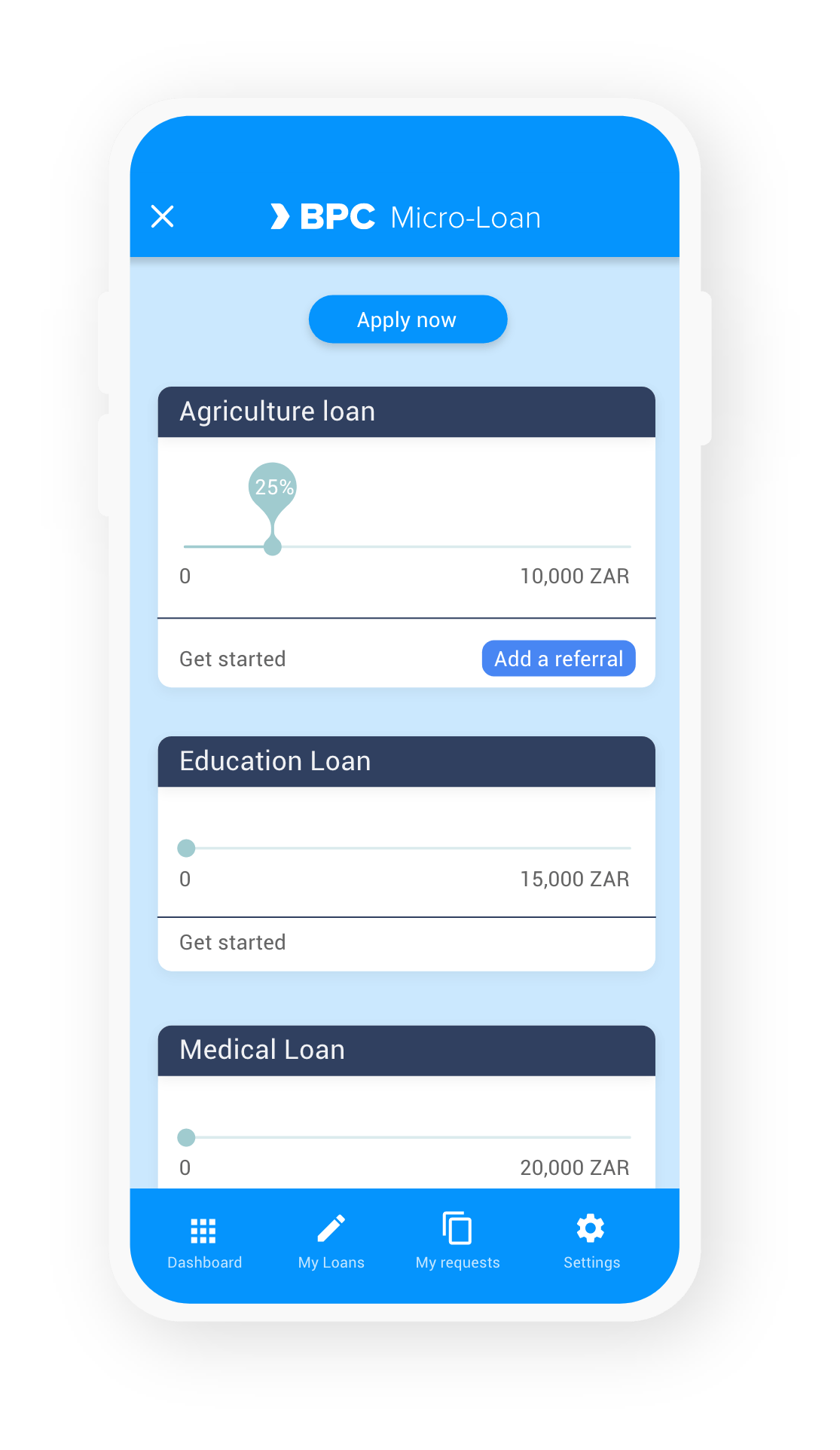

Any relevant financial service from microlending to payments to wallet based accounts that can mature into true savings schemes can be made available at a rate that benefits the user and the bank.

The bank here often being a fintech, an ecosystem player, a telco or a governmental taskforce. Customer identities can be digitally verified for KYC, G2P payments offer support and set off a chain of P2ALL payments.

Investments in raw materials and equipment can come from crowdfunding or through 3rd (API) party connectivity.

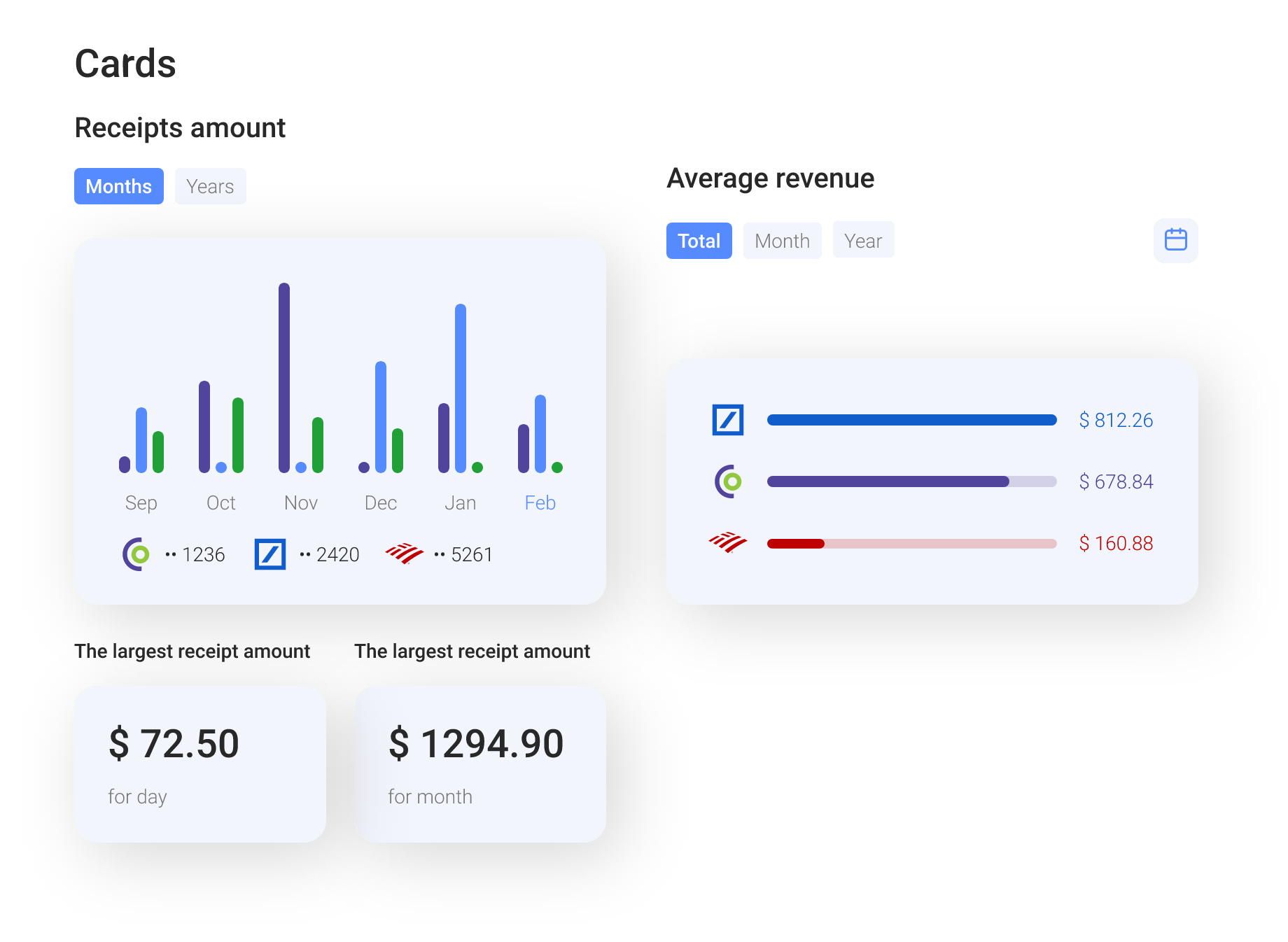

Smaller, faster, fit

Run like real banks but made to measure, in terms of volume efficiencies as well as micro personalised services. Pools of liquidity can be efficiently distributed through digital and agent channels and managed with the latest AI analytics and data technologies. Invoicing and Receivables can be easily implemented for micro businesses leading to people being able to join cost-effective savings schemes.

A fit infrastructure in terms of size and operations as well as readiness can be deployed and run in the cloud.

Removing barriers

Removing barriers

Entry barriers like KYC for consumers can be managed through alternative digitally based ID check and issues on the supply side around distribution can be elevated through working with a local partner for last mile delivery. An agent creates the trust local communities need when it comes to managing their finance. New touch points using simple feature-phone mobile can help unlock new financing solutions including microloans or buy now pay later (BNPL) purchases. All powered by BPC’s microfinance suite: low cost infra by means of a lean cloud based microservices architecture.

Set up for growth

Set up for growth

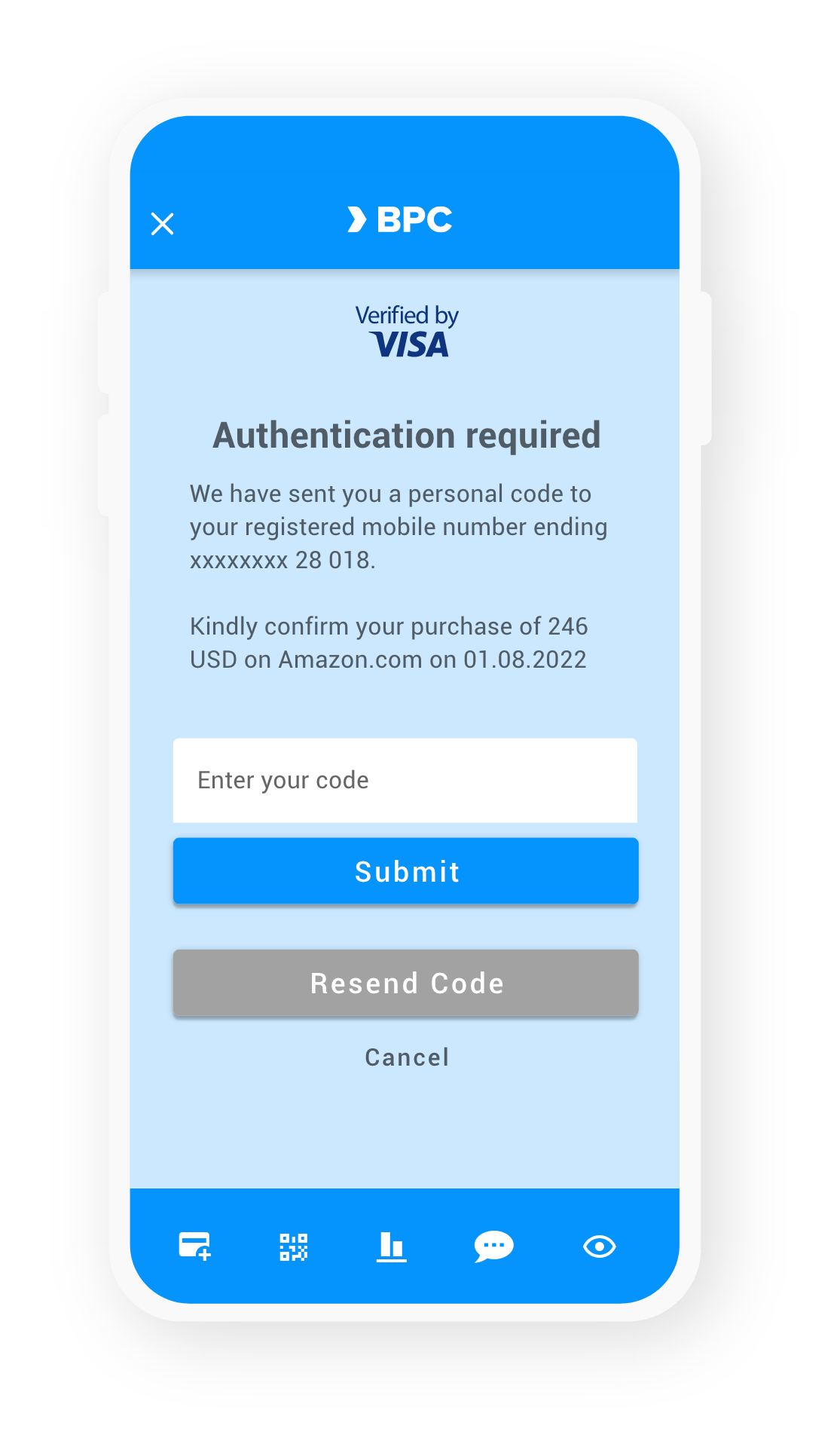

Key financial inclusion initiatives are true banks at the core and operate with a backbone, full omni-channel touch points, a microcredit engine, personalised Super- or EcoApps and full compliance. Data governance, customer protection and regulatory compliance, all offered and managed as a service.

Ecosystem thinking

Ecosystem thinking

Ecosystems flourish around the world in various shapes and forms. From cities in Asia in the street food and stalls scene to rural areas in Africa and India. In all those places BPC powers agricultural marketplaces encompassing embedded banking & payments, supplier side offers and fulfillment, partners around logistics, onboarding and contracting. National and local government services complete those marketplaces that turn into inclusive value-creators for all participants. We have a wealth of expertise in bringing together ecosystem participants to add value, be it financing and microlending solutions, supply to logistic services and access to buyers. Together we are stronger.

Related products

Microfinance

With SmartVista Microfinance, you provide financial services to underserved or excluded communities. With this solution, MFI agents can make real-life connections and connect the unbanked to a digital microfinance infrastructure. Services are delivered where the clients are, even in the most rural areas.

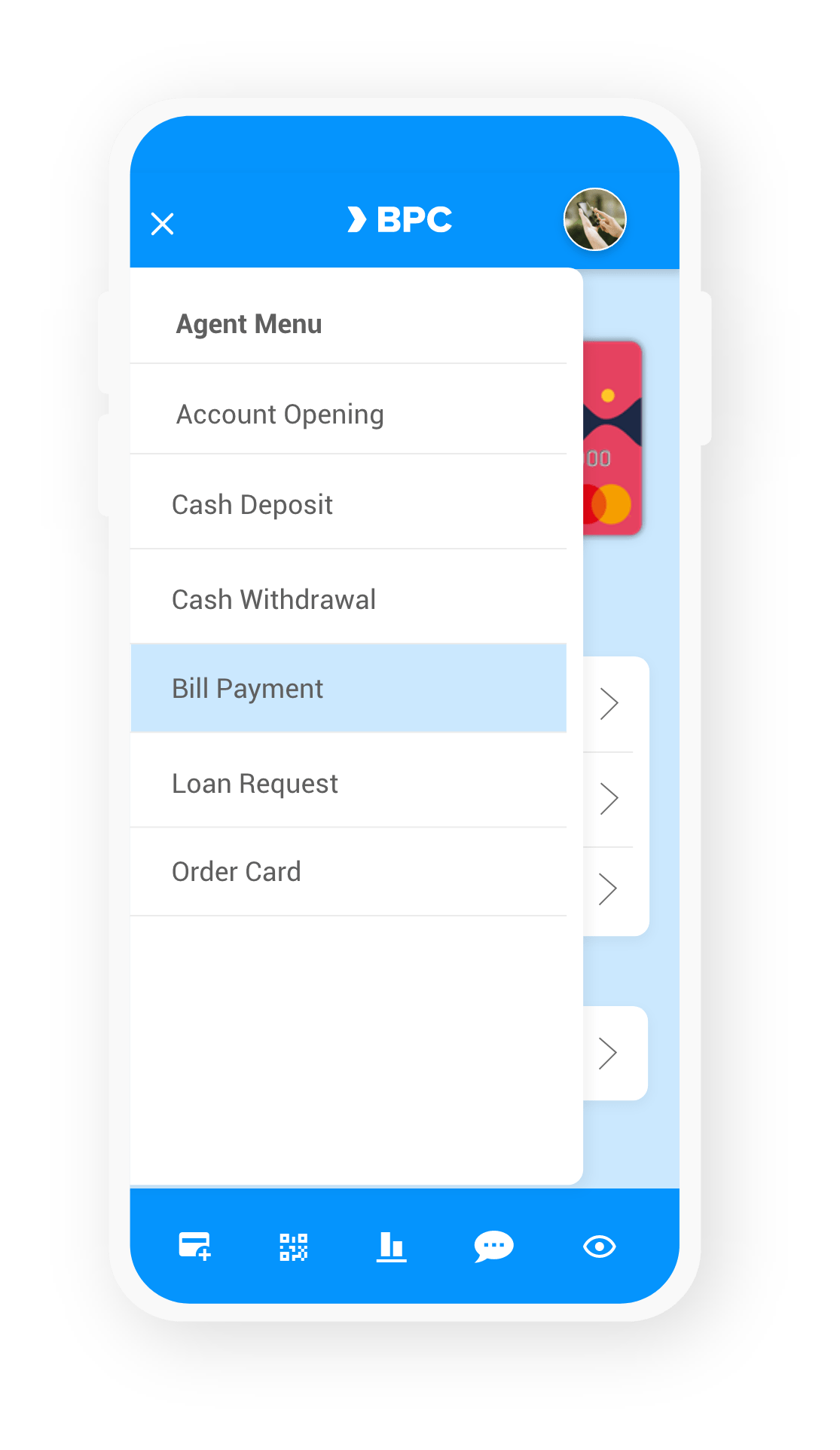

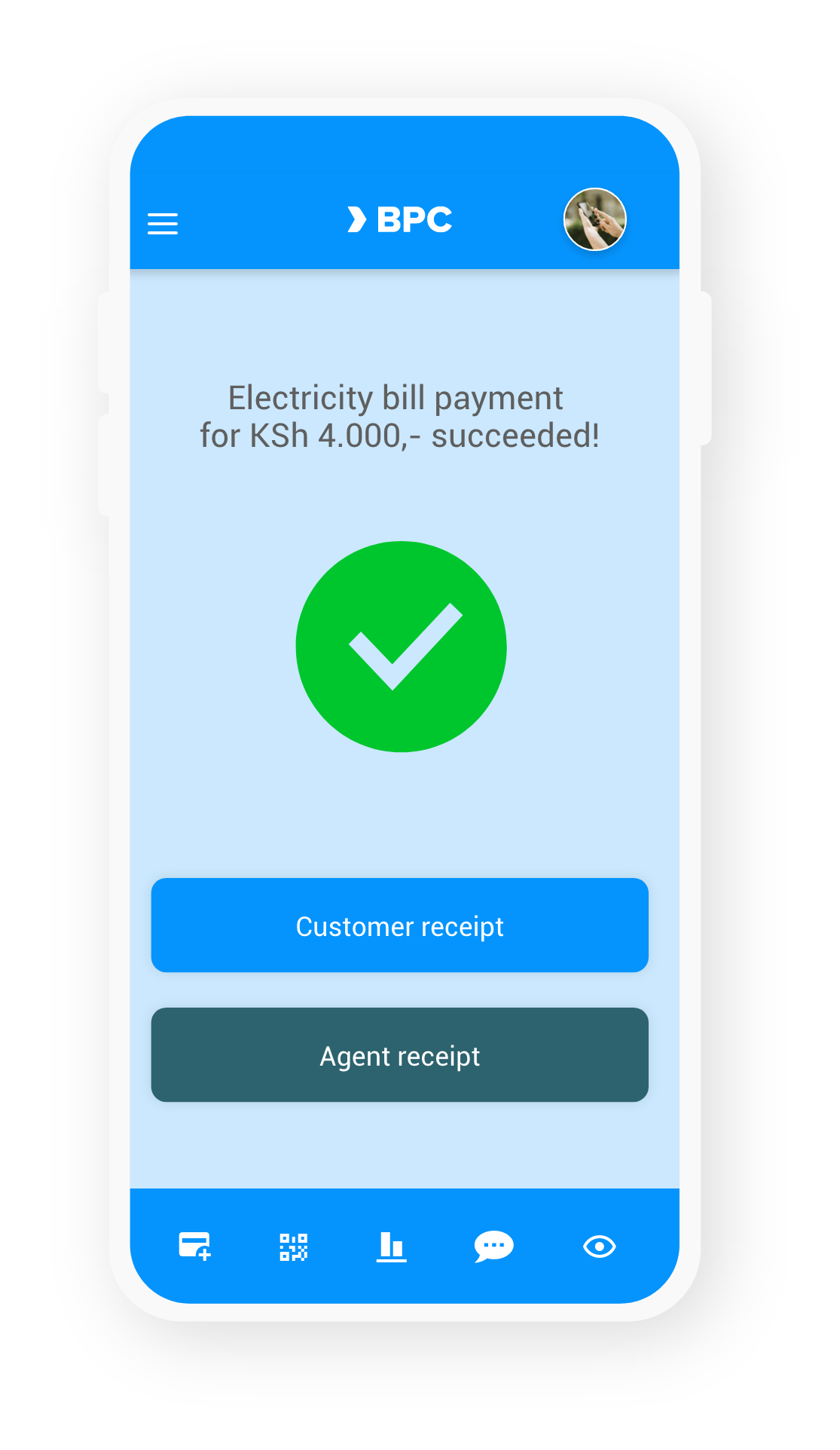

Agent Banking

SmartVista’s Agent Banking solution allows agents to offer a full range of transactions and services. These include cash deposits and withdrawals, money transfers, account to account payments, loan repayments, bill payments or mobile top-up. Agents, when authorised, are able to onboard new customers and perform KYC instantly.

eWallet

eWallets offers everything a classical wallet would offer and more. Digital wallets all start from the same core value proposition: offering mobile payments at large without the need for a bank account. This takes us to the next level of cash freedom anywhere: convenience and safety of a cashless future.

QR Payments

QR-enabled payments have grown rapidly worldwide, but particularly in Asia and especially in China and India. They allow merchants, street vendors and taxi drivers to accept payments with a QR code that can be simply printed on paper, eliminating the need for an expensive POS terminal.

Digital Lending

Les entreprises ont besoin de se développer, mais pour réaliser leurs rêves et leurs besoins, une marge financière supplémentaire est nécessaire. Qu'il s'agisse de microcrédits ou de sommes d'argent plus conséquentes : le processus peut être numérisé, ce qui permet d'offrir un service de premier ordre aux institutions financières et à leurs clients.