Digital Lending

Personal Touch, Played by the Rules

Financial dreams for growth

Businesses need to grow, but to fulfil their dreams and needs, extra financial room is needed. Whether it is micro loans, or larger sums of money that are needed: the process can be digitalised resulting in top-notch service to both financial institutions and their customers.

The personal yet digital touch

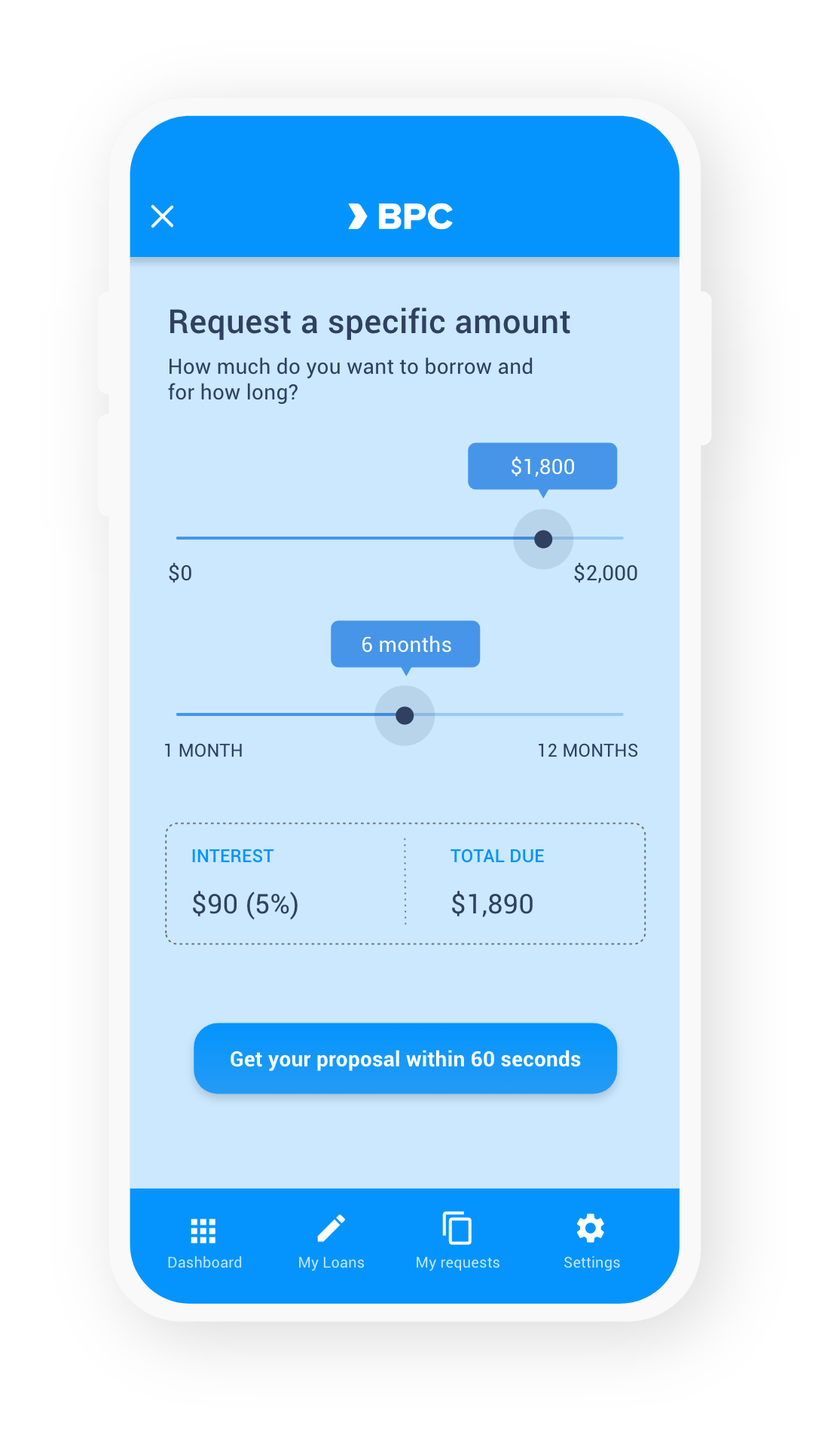

‘Digital lending’ might sound quite different from ‘personal service’, but it actually means that more tailor-made loans can be offered.

As the digital lending solution has access to all the financial data, the needed details can be checked instantly to make the best lending decisions in each situation.

No need for uncertainty

The process of applying for a loan can be stressful. People have a dream and hope to match their finances with it.

By digitising the lending process, a lot of time can be saved and the outcome of the loan application can be shared in an instant.

Low risk lending

Low risk lending

By automatically checking all financial data, the risks of the loans can be mitigated to the lowest possible levels.

Minimal input

Minimal input

As more and more financial data is digitised, the lender needs to submit less paperwork to submit a loan.

Real-time parameterisation

Real-time parameterisation

The built- in rules engine makes sure all loan parameters can be checked immediately.

SmartVista Digital Lending

Making a difference

Making a difference

- Easy integrated multi-loan application

- Matrix based immediate loan calculation

Working for you

Working for you

- Account opening with application status tracking

- Multiple verifications and checks during onboarding

- Real time parameterization

Working for your customers

Working for your customers

- Web based LOS for farmers

- Instant (dis-)approval

Related products

Digital Banking & Super Apps

Digital banking apps are reaching into targeted communities like SME banking to expats or students - and into a wider range of lifestyle services like mobility, government, leisure and others. Igniting any market with a secure relevant banking app to Super Apps fuelling fast developing markets and their demanding customers.

Microfinance

With SmartVista Microfinance, you provide financial services to underserved or excluded communities. With this solution, MFI agents can make real-life connections and connect the unbanked to a digital microfinance infrastructure. Services are delivered where the clients are, even in the most rural areas.