Payment Orchestration

Become a payments maestro

Unified checkout experience

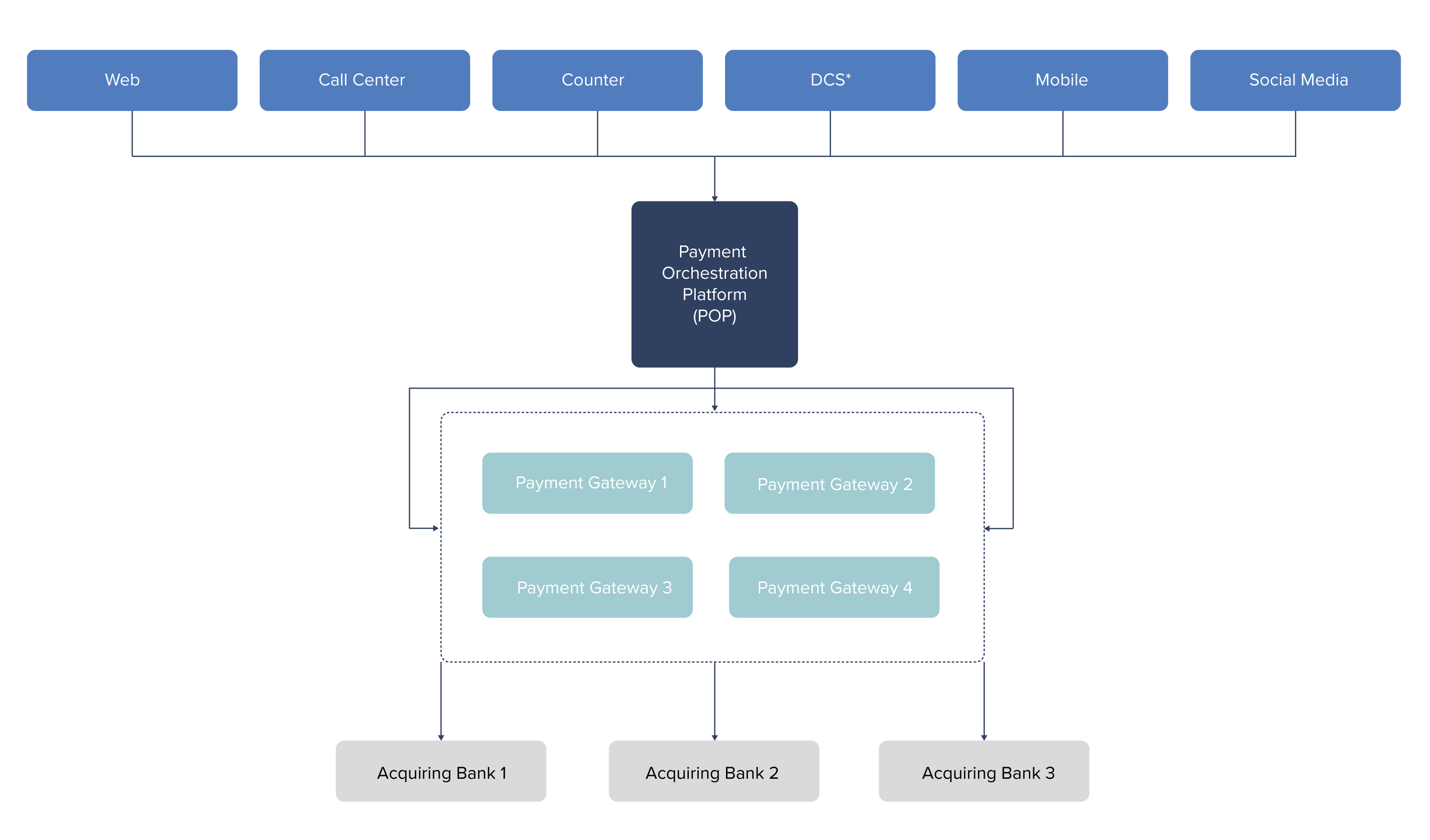

Today's retail businesses and merchants face numerous challenges when it comes to managing their payment processes, especially those operating in multiple countries. With widely varied payment methods, offering customers a seamless payment experience can be difficult, leading to frustration and lost sales.

As the financial industry embraced API technology, payment orchestration has emerged as a critical component of modern payment systems. The availability of microservices in payment software and the increase in payment methods have changed the game to a complex nonlinear space.

Simultaneously optimising various payment flows requires precision, while managing acquiring rates can become a complex exercise. BPC’s Payment Orchestration solution addresses these challenges, offering a unified checkout experience through a centralised platform that enables businesses to manage multiple payment options.

Payments made easy

By leveraging the latest technology and data analytics, businesses can stay ahead of the curve and drive revenue growth. With SmartVista payment orchestration, financial organisations can streamline their payment processes, increase customer satisfaction, and improve their bottom line.

Payments vary across countries, cultures, and currencies. BPC’s Payment Orchestration also enables retailers and merchants to let their customers pay in local currencies from familiar wallets, performing the currency conversion not at PSP but at merchant level, leading to a faster checkout experience, lower cart abandonment rates, and increased revenues.

Acquiring rates management

Acquiring rates management

Payment orchestration allows businesses to manage global acquiring rates centrally, enabling them to expand their reach and tap into new markets.

Customise the options

Customise the options

When we speak about the best payment method or currency, there is no jack-of-all-trades. Taking into consideration your customers' choices is important. It's you who can decide what currency or payment method users will see. Build rules to change zone based on location, transaction value or other parameters.

Fewer costs, more flexibility

Fewer costs, more flexibility

Flexibility doesn't always equal more expense. Reduce the costs of developing, establishing, and maintaining over hundred separate integrations to various payment service providers through a centralised approach. Being a part of the BPC processing suite, launching orchestration is quick and easy.

SmartVista Payment Orchestration

Making a difference

Making a difference

- A single integration with any number of PSPs and acquirers to manage the entire payment lifecycle

- Over 150 payment integrations available in a library of pre-approved PSP

- Smart routing and automated retries of payments

- Part of the BPC processing suite

Working for you

Working for you

- Decrease in acquiring fees

- Processing optimisation

- PCI compliance

- Full automated payment flows and payment traffic distribution

- 3DS Support

- Cloud deployment either on hardware, Oracle, or Amazon AWG

Working for your customers

Working for your customers

- Allow preferred payment methods or wallets to be used

- Real-time payment analytics

- Smooth checkout experience

Related products

Acquiring

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for both the merchant (POS) and the banking services world with (customised) ATM offerings, including ATM cash management, (Soft)POS.

Payment Hub

Payments applications never operate in isolation. A significant portion of the effort required to implement a new software system at a financial institution revolves around integrating it into a variety of software systems and gateways - internal and external – and connecting it to multiple payment networks. BPC’s Digital Payment Hub takes care of the integration and connectivity.

Integration Platform

Using an integration platform that accelerates and simplifies implementation is the answer. SmartVista means the end of siloed systems and problematic integration projects. The future is digital, and smart financial institutions get there with a ‘smart’ service bus that’s designed with the industry in mind.