Payment Hub

Future Fit Payments Orchestration

Integrating payments

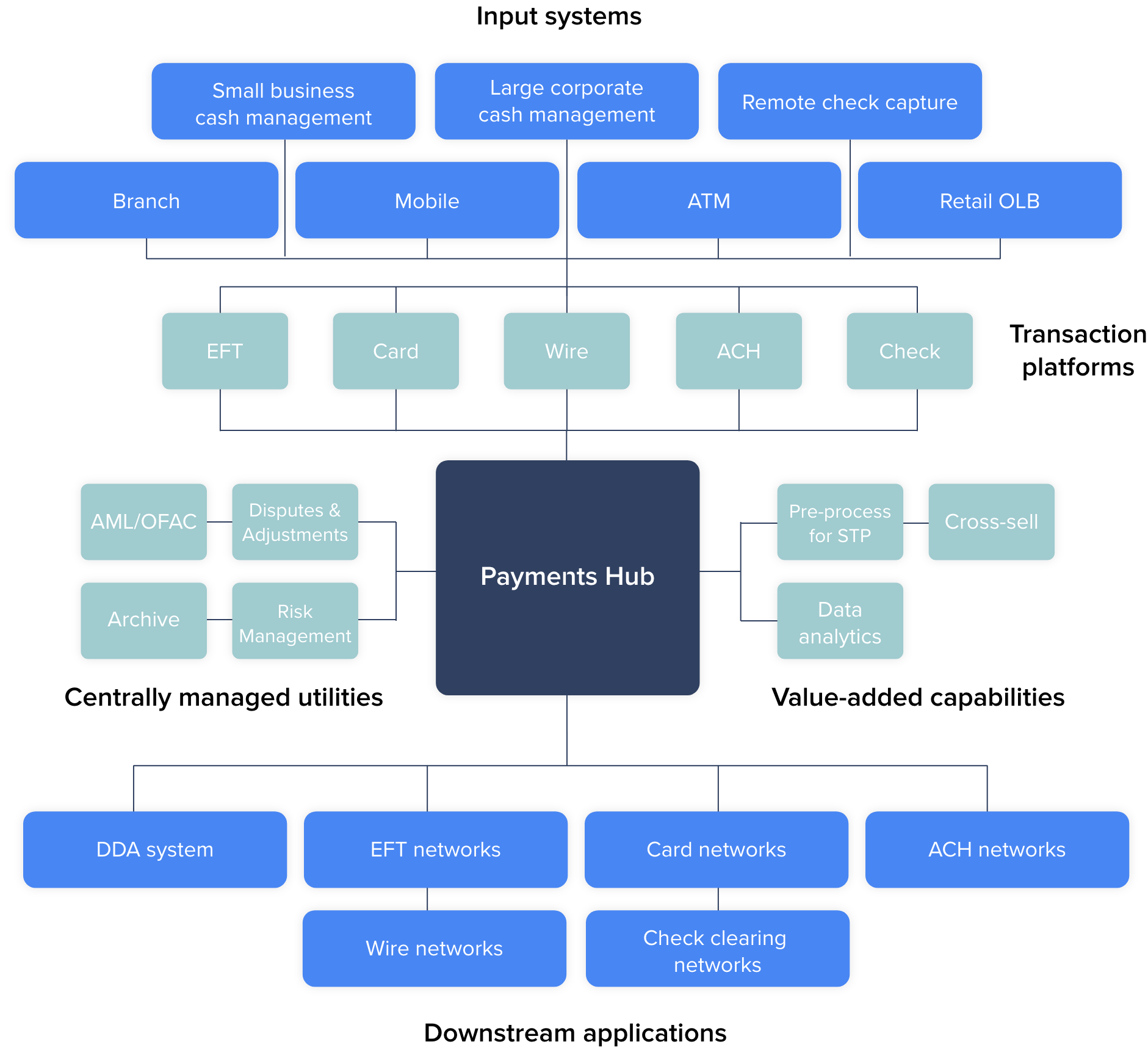

Payments applications never operate in isolation. A significant portion of the effort required to implement a new software system at a financial institution revolves around integrating it into a variety of software systems and gateways - internal and external – and connecting it to multiple payment networks.

BPC’s Digital Payment Hub takes care of the integration and connectivity.

Work smarter not harder

There is no need to put more effort into integrating your payment systems than needed. With the embedded business process management (BPM) engine, users design their integrations through a visual toolkit.

Business logic supports the building of business processes in a low code manner, freeing up your valuable IT resources for other vital functions.

A long, winding and never-ending road

Integration is not a one-off effort. The bulk of the work may be required during the initial setup of a new payments system, but this is never the end state.

Payment rails are being extended, payment types are added on an ongoing basis and compliance requirements, sanctions lists are updated on an ongoing basis.

Point to point connectivity is therefore untenable and a payment hub the only logical solution.

Comprehensive integration platform

Comprehensive integration platform

The Payment Hub uses the latest technology with a focus on the payment Industry's needs and tools for flexible configuration and integration. Connectivity to switches, bank’s back offices and payment networks, but also to eCommerce, retailer, utility providers and HSMs are part of a library allowing you to make connections to and in over 90 countries.

Standards and protocols apply

Standards and protocols apply

To make sure you get what you need, the latest payments specific protocols and connectors are used including ISO8583, IS20022, XML, Swift MT/MX. The architecture allows us to always and rapidly embrace new standards and protocols.

Mature open-source

Mature open-source

Offering the latest technological stack that is based on open standards and mature open-source software. Opening up the payment engine to collaboration with other market players and entrants.

SmartVista Payment Hub

Making a difference

Making a difference

- Stand alone or an extension of your existing banking, payments and cards management applications

- Horizontal scalability and vertical volume tuning

- Database independence

Working for you

Working for you

- Built for configuration and integration

- An industry standard approach for a payments environment

- Point to point connectivity

Working for your customers

Working for your customers

- Visual toolkit to easily design integrations

- Business logic supports the building business processes in a low code manner

- The latest payments specific protocols and connectors

Related products

Real-time Payments

Acquiring

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for both the merchant (POS) and the banking services world with (customised) ATM offerings, including ATM cash management, (Soft)POS.

API Banking

The SmartVista API Banking solution offers you full API management, including a developer portal, monitoring, request throttling and security.