Switch as a Service

In a study by the Aberdeen Group in North America, the cost of printing cheques by banks is more than $25 billion per year. How to reduce this whopping cost of printing cheques? It is simple, stop printing them. Switching to electronic payment cut down the use of paper for banking

Multiple payment networks and schemes

As part of our comprehensive switching as a service solution, we ensure that your transactions are processed seamlessly and securely, providing a hassle-free payment experience for both you and your customers. You can choose from a variety of payment interfaces, including the most popular ones: Visa, Mastercard, American Express, Discover, CUP, Diners Club, Pulse, SEPA and JCB as well as any local network. Our solution allows you to customise your payment flow based on your business's unique needs and preferences, making it easier than ever to manage your payment processing.

Transactions with no delays

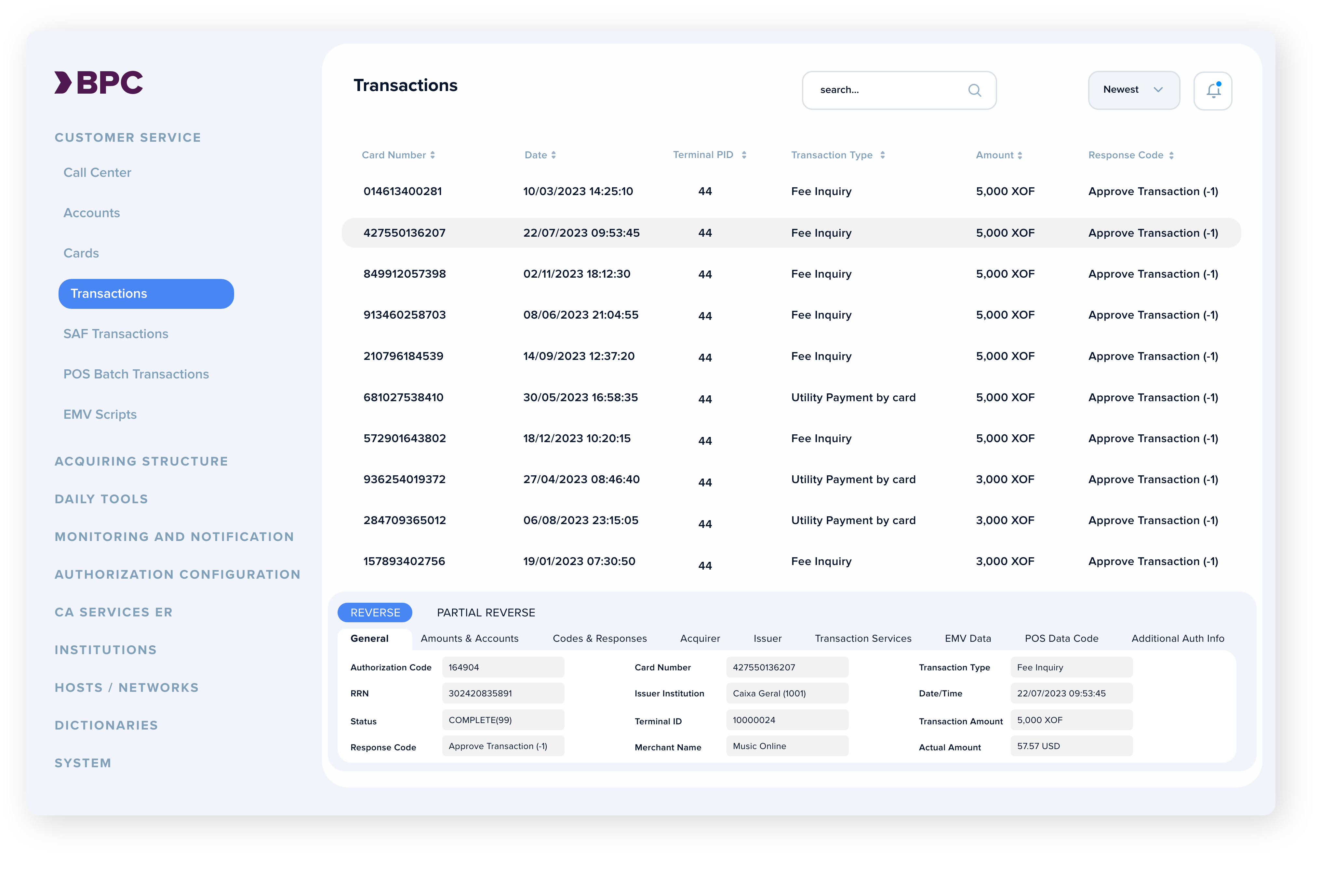

BPC offers cutting-edge technology that allows flexible routing for you to customise your processing flow to fit business's unique needs be it us-on-us, them-on-us, us-on-them or them-on-them. Process your transactions quickly and securely, freeing up time and resources to focus on what really matters - growing your business. Our solution ensures that your transactions reach their intended destination, whether it's issuers, regional payment networks or international payment networks. With SmartVista, you have the flexibility to configure multiple parameters that determine the routing of your transactions such as Bank Identification Number (BIN), Acquiring Financial Institution Identifier, and Issuing Financial Institution Identifier, Bin range, transaction type, service type, terminal group, mcc group, and more.

Scale to any channel

Beyond card and any digital and contactless payment form, we offer acquiring services and solutions for both the merchant, fintech, banks, PSPs in terms of cards, POS/SoftPoS, e-commerce as well as in the form of (customised) ATM offerings. Because of our longstanding track record in this field we can offer these services in literally any corner of the world, from digital dense environments up to solutions for rural ecosystems.

Regulatory framework support

Regulatory framework support

We offer a full range of payments from ISO8583, direct debits, account-based payments, SEPA transfers, BACS, CHAPS, Swift to instant payment support. Increasingly this becomes the payment type of choice for merchant customers of PSPs for the low cost attached and the certainty of instant receipt of funds. The entire payment suite is fully PSD2 ready, API enabled and supports SCA. ISO20022 messaging is fully supported too for Pull, Push and Service messages.

Keep it flexible

Keep it flexible

Our Switch solution supports normal authorisation, which is responsible for card-related checks and stand-in authorisation on behalf of your CBS. Our service allows you to stay flexible if you wish but configuring your own set of authorisation checks, or go with a preconfigured algorithm suggested by our experts.

End-to-end service

End-to-end service

Going SaaS possesses lots of benefits such as quick onboarding, cost-effectiveness, and end-to-end service. You can start using the software right away, save money by paying only for what you need, while BPC supports you on your journey.

Switch as a Service

Making a difference

Making a difference

- Transaction processing

- Flexible routing

- Global and local schemes and interfaces

- E2E service

Working for you

Working for you

- Online acquirer and issuer fee calculations

- Limit control

- Reduction in costs

- Stand-in support

Working for your customers

Working for your customers

- Flexible authorisation modes

- Any payment scheme acceptance

- Quick onboarding

Related services

ATM Acquiring

Experience seamless, efficient and customizable ATM management with BPC's ATM Acquiring as a Service - a 24/7 real-time network operations solution offering modern transactional support, tailored hierarchical configurations, remote control and zero-maintenance for a diverse range of ATMs and self-service kiosks.

Card Management

BPC's Card Issuing and Management as a Service provides end-to-end, secure, and integrative payment solutions - offering efficient card issuance, seamless payment operations management, advanced tokenisation security, and personalised customer connectivity for diverse card types.

E-commerce

Embrace the future of retail with BPC's E-commerce as a Service, offering a secure, customisable, and user-friendly platform with white-label solutions, flexible payment methods, rapid merchant onboarding, and end-to-end service for seamless online transactions and business growth.

Fraud Management

Shield your transactions with BPC's Fraud Management as a Service - a comprehensive, real-time solution leveraging advanced analytics and machine learning for robust fraud detection, risk-based authentication, and multi-institutional security.

POS Acquiring

Transform your payment experience with BPC's POS Acquiring as a Service - an efficient, cost-effective solution enabling seamless transactions, diverse payment method acceptance, effortless merchant management, and superior settlement experiences.