Billing & invoicing

Staying Accurate yet Flexible

Claim your success

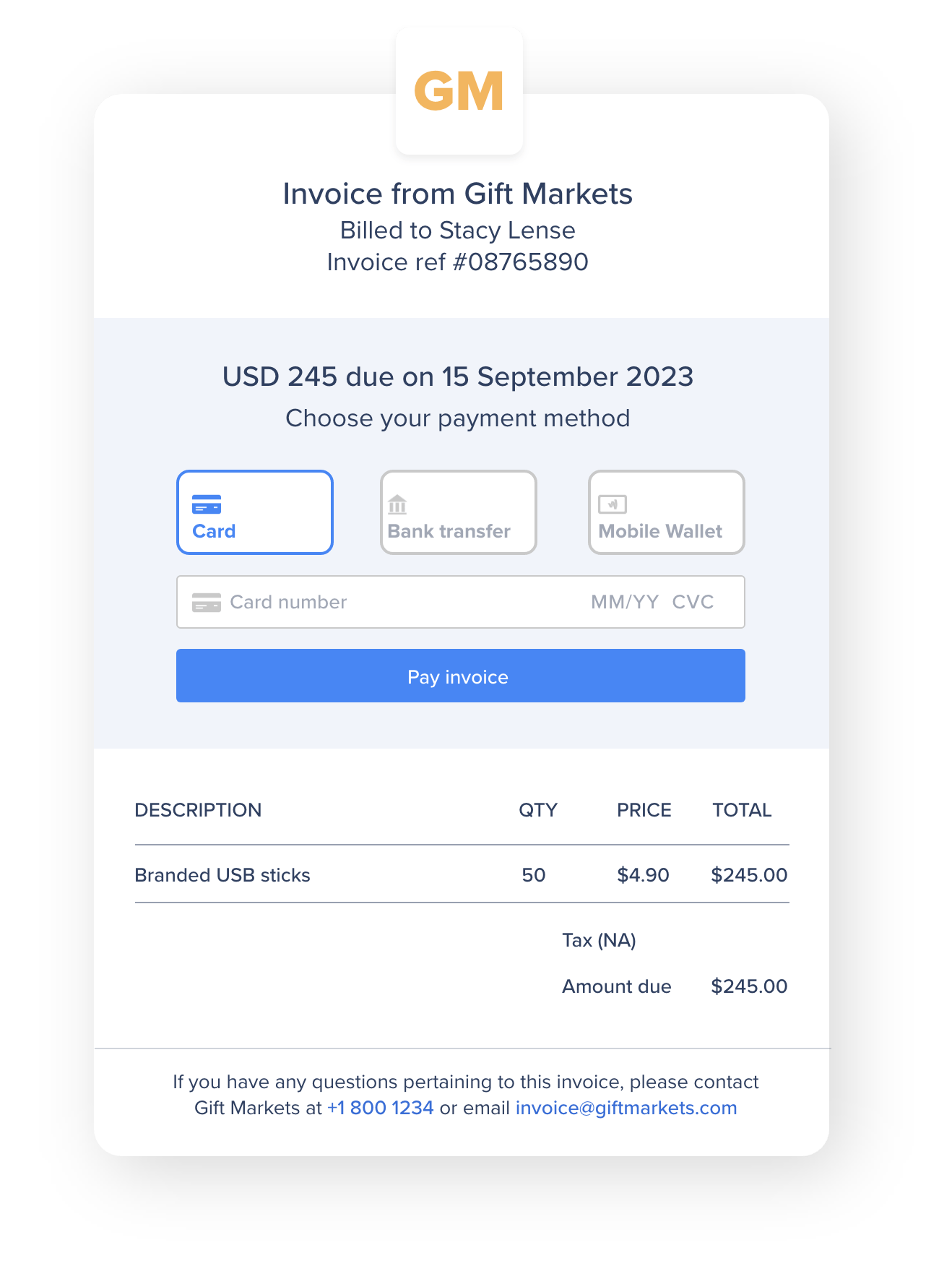

Not payments but receivables are crucial to any business. Billing and invoicing are where it all starts. Speed, but also accuracy is key to stay away from time-consuming conflicts and needless corrections. With the merchant administration and portal tools, invoices can be automatically generated and payment statuses are always accessible and up-to-date.

The personal connection

The invoice is an important part of managing your customer relationship and personalisation is key. Agreed terms and conditions must be correctly reflected, as well as the correct VAT status. The merchant administration tools allow the use of custom templates, the import of invoice data such as goods or services. The tool orchestrates the automatic delivery of invoices via email to customers, with easy to use click and pay buttons.

Easy consolidation

Even when (a part of) administrative work is already automated by accounting software, many tasks, like reconciliation are still done ‘manually’ or across different platforms. BPCs Merchant and Back Office tools, allows for easy consolidation with existing accounting packages.

Right in one

Right in one

Avoid mistakes and misunderstandings by automating your billing and invoicing end-to-end, saving time and costs. Speed up receivables and thus enhance your liquidity position.

Built-in compliance

Built-in compliance

All invoice payments, either with cards or any other channel are checked immediately, so rules and regulations can be met and risks exposed.

Instant on any channel

Instant on any channel

Connect all your payment channels, from eWallets to cards, with your billing and invoicing for a seamless payment experience and accurate registration.

Billing and Invoicing

Making a difference

Making a difference

- Instant billing based on customer profile

- Personalised billing re terms and conditions

- Applicable VAT rules automatically applied

- Multiple pricing options

Working for you

Working for you

- Easy integration with accounting and cash management solutions

- Broader customer reach through full circle end to end eCommerce

- Faster access to capital through short invoice and billing loop

Working for your customers

Working for your customers

- Accurate invoices and automatic payments

- Cost savings due to no late payments

- Sector specific modules: government, eCommerce, utilities, etc.

Related products

Acquiring

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for both the merchant (POS) and the banking services world with (customised) ATM offerings, including ATM cash management, (Soft)POS.

eCommerce

The BPC e-commerce modules are easy to integrate with almost any CMS, in order to optimise the transaction flow. No need to worry about currencies either, you select the ones you need, and the system will cover any. Connection is key, so you can offer your ecommerce solutions on any device needed without limitations.

ACS 3D secure

The SmartVista Access Control Server (SV ACS). supports the maintenance of card enrolment, authentication of card and payment requests, and cardholder notification fully compliant with PA-DSS requirements and thus is ready for PCI DSS audits.

Risk & Fraud Management

Buy Now Pay Later

The Buy Now Pay Later service to consumers opens revenue streams for merchants by reaching new customer segments and extending existing ones.. The global Buy Now Pay Later industry was estimated at $90.69 billion in 2020, and is anticipated to hit $3.98 trillion by 2030.

QR Payments

QR-enabled payments have grown rapidly worldwide, but particularly in Asia and especially in China and India. They allow merchants, street vendors and taxi drivers to accept payments with a QR code that can be simply printed on paper, eliminating the need for an expensive POS terminal.