October 2, 2025

Chief Bank launches “Chief Mobile 3.0” with BPC’s SmartVista digital platform, raising the bar for mobile banking in Cambodia, and winning Cambodia’s Mobile Banking tech award

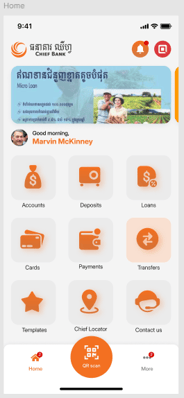

Chief Bank, a fast-growing Cambodian bank serving micro, SME and large enterprises, has partnered with BPC, a global leader in payment solutions, to revamp its mobile channel on the modern SmartVista digital platform. The result is Chief Mobile 3.0 - a redesigned, mobile app that turns any smartphone into a 24/7 branch, deepens support for KHQR and Bakong payments, and has been recognized in 2025 with the Asian Business Review “Cambodia Technology Excellence Award for Mobile – Banking.”

In line with Cambodia’s growing digitalisation and pro-innovation agenda, Chief Bank chose BPC’s SmartVista to enhance its mobile channel. The upgrade integrated nationwide QR payments, allowing secure acceptance at merchants nationwide, and delivered a redesigned mobile app with a modern UI, significantly boosting usability, navigation, and accessibility for all customer segments. Over 20,000 users enrolled immediately after the launch.

“Winning the Cambodia Technology Excellence Award for Mobile - Banking is a proud moment for Chief Bank and our customers. It reflects our vision to provide every Cambodian, whether individual, SME, or enterprise, with simple, secure, and innovative digital banking. With BPC as our partner, we are delivering a platform that is not only modern today but also a roadmap prepared for the future of Cambodia’s digital economy,” commented Mr. Kishore Kumar, Head of the IT Division, Chief Bank.

“SmartVista provides Chief Bank with a strategic shortcut to becoming digital-first,” said Imran Vilcassim, Global Chief Commercial Officer, Digital Banking, BPC. “Because it’s cloud-native and modular, all our customers can innovate, launch, and scale quickly. We’re proud to partner with Chief Bank and proud that our joint efforts earned this prestigious award.”

Throughout the project, BPC upgraded the bank's mobile application to Chief Mobile 3.0, which offers seamless, secure onboarding and biometric sign-in using Touch ID and Face ID, with interfaces in Khmer, English, and Chinese. Everyday financial services are now consolidated into a single app: KHQR/Bakong QR payments, instant transfers to bank accounts and wallets, bill payments, mobile top-ups, card linking (local, Visa, Mastercard), card controls, goal savings, and instant micro-loans, all supported by real-time integration with the previously implemented SmartVista card management system, live push notifications, reusable templates, and scheduled payments.

A major milestone of the project is the mobile-first UI overhaul— a user-friendly design that makes everyday banking, like checking balances, loan schedules, funds transfers, QR and bill payments, faster and easier for everyone. Chief Mobile 3.0 surpassed 20,000 downloads within months of launch, and increased monthly digital transactions past 30,000, with continued growth expected as adoption expands.

“Chief Mobile 3.0 is not only a significant enhancement in how our customers bank, but also supports Cambodia’s national drive towards a cashless society through Bakong and KHQR, reinforcing Chief Bank’s role as a trusted partner in the country’s secure digital financial ecosystem.” said Mr. Mam Chandara, Chief Operating Officer, Chief Bank.

Beyond Chief Mobile 3.0, Chief Bank and BPC are already working closely to co-create new innovations that support Cambodia’s journey towards a digitally inclusive economy. Together, both organisations are exploring advanced digital capabilities such as incorporating Artificial Intelligence for personalisation and fraud prevention, financial wellness planning tools to promote responsible money management, and chatbot-driven digital assistants to enhance customer service accessibility for every Cambodian.

This collaborative spirit highlights BPC’s strong commitment to the Cambodian market and to Chief Bank’s long-term digital transformation plans. As customer lifestyles rapidly change, BPC continues to support Chief Bank by anticipating trends, adapting swiftly, and delivering innovative solutions that meet the expectations of modern consumers—ensuring the bank remains a trusted digital-first partner for individuals, SMEs, and enterprises alike.

"Chief Bank has a clear vision, and we are proud to continue supporting it," said Somboon Mongkolsombat, Country Manager Cambodia, BPC. “With SmartVista as its digital foundation, Chief Bank is well placed to rapidly expand and improve features, offering more inclusive services to Cambodia’s underserved communities, future-proofing the bank’s mobile channel while reducing time-to-market for what is next."

Eager to find out more?

If you’d like to know more about this particular case or BPC’s SmartVista suite, reach out to our experts.