Buy Now Pay Later

Tapping into New Segments

A 3,98 trillion market by 2030

The Buy Now Pay Later service to consumers opens revenue streams for merchants by reaching new customer segments and extending existing ones.. The global Buy Now Pay Later industry was estimated at $90.69 billion in 2020, and is anticipated to hit $3.98 trillion by 2030.

No missed payments

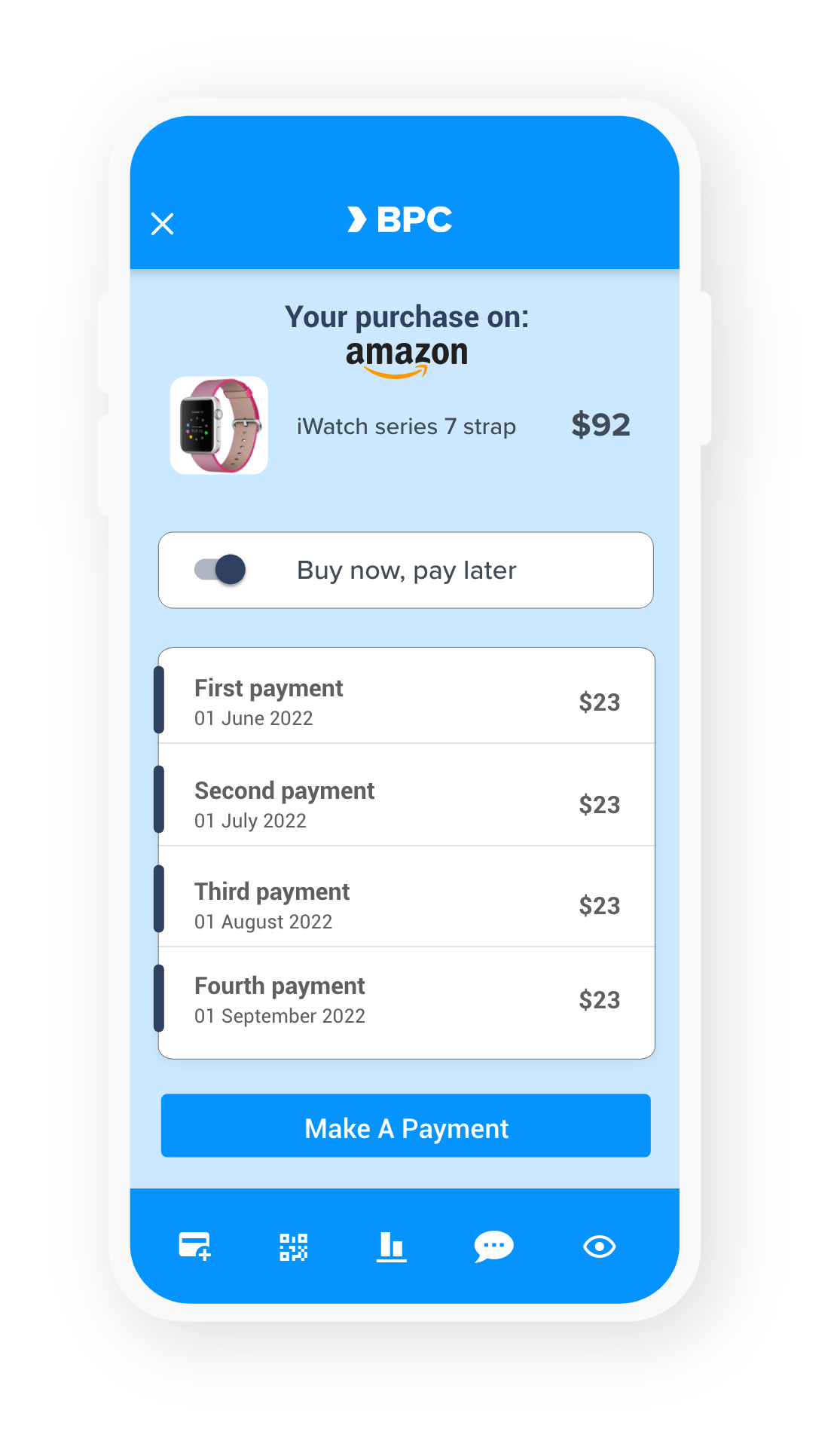

Customers register their payment data once for the first payment. The remaining payments are processed automatically, based on the payment calendar agreed upon. This gives peace of mind to merchants and customers.

Full life cycle

BPC supports the full life cycle of a DPP (Debt Payment Programme). From the time of registration of the operation in instalments, until the final settlement in accordance with the plan. This also can include fixed, annuity, differentiated, scheduled and split payments.

Set your own rules

Set your own rules

Financial institutions can set personalised and analytics based credit limits and time periods for customers to pay in instalments with Buy Now Pay Later.

All payment channels

All payment channels

The Buy Now Pay Later solution can be built in all your checkout channels including EFT/POS, mPOS, internet or mobile app touchpoints.

Grow your business

Grow your business

Through spaced-out payments, more customers can make their desired purchase when they need it. This is especially important for communities with limited access to credit and youngsters.

SmartVista Buy Now Pay Later

Making a difference

Making a difference

- BNPL for both issuers and acquirers

- Embedded BNPL across all customer touch points

- BNPL on any payment type of choice

Working for you

Working for you

- Highly flexible product configuration

- 3DS security

- Multi-language and multi-currency

- Tokenised payments (Apple/Google/Samsung Pay)

Working for your customers

Working for your customers

- Fully customised payment experience

- Credit scoring builder for personalised profile

Related products

Acquiring

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for both the merchant (POS) and the banking services world with (customised) ATM offerings, including ATM cash management, (Soft)POS.

eCommerce

The BPC e-commerce modules are easy to integrate with almost any CMS, in order to optimise the transaction flow. No need to worry about currencies either, you select the ones you need, and the system will cover any. Connection is key, so you can offer your ecommerce solutions on any device needed without limitations.