API Open Banking

Unleash your Potential

With or Without Support

Doing more together by doing less

Offering transparent competitive and fair priced solutions that enhance any customer’s life is the promise of Open Banking worldwide, regulated or not. Open APIs are the major enabler to achieve just that.

The SmartVista API Banking solution comes packaged with a sandbox to allow third-party developers to test their solutions. Don’t build connectors, empower your implementation teams to adjust connectors built by others.

Secure data exchange

Imagining, planning, testing and releasing new services with a wealth of (fintech) means building connections that protect and extend your customer reach.

Data is a key and precious ingredient, breaches are lethal. In the SmartVista API solution all data exchange is monitored, tracked and documented in order to assure consented data use where needed and compliant use at every single instance.

Let tech lead the way

In a world where tech talent is scarce, it is imperative to re-use well built technology and deploy any tech that connects. Dive into a wealth of business processes, library of integration interfaces and support to connect your financial institution to an unlimited world of services outside your own domain.

Finding it still hard to navigate this ‘no code-low code world’? BPC offers this as a service too, our engineers and business analysts will guide you through.

Full API management

Full API management

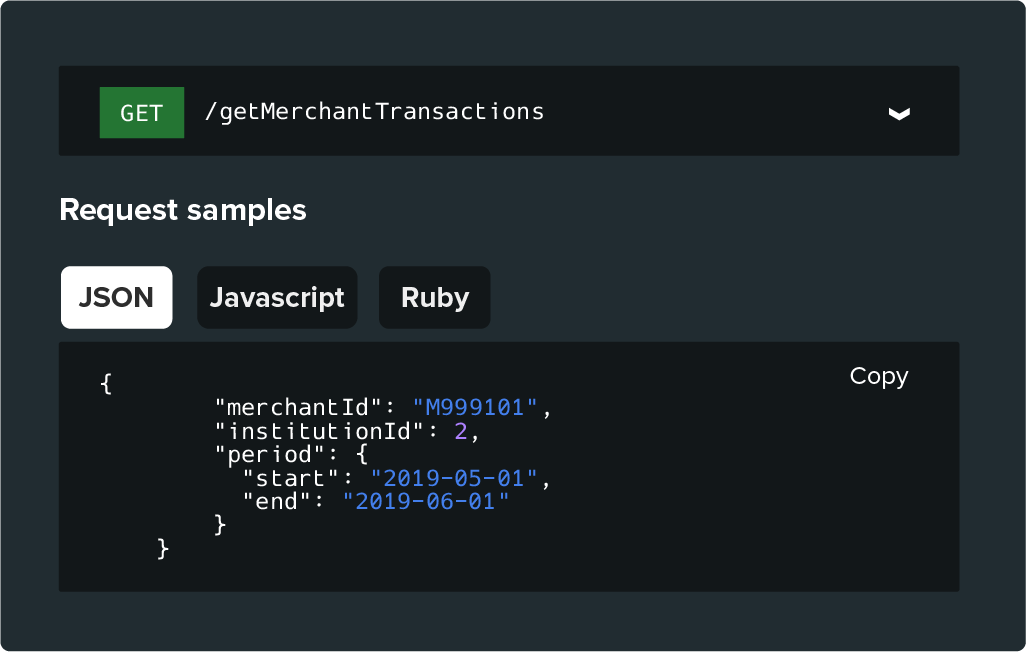

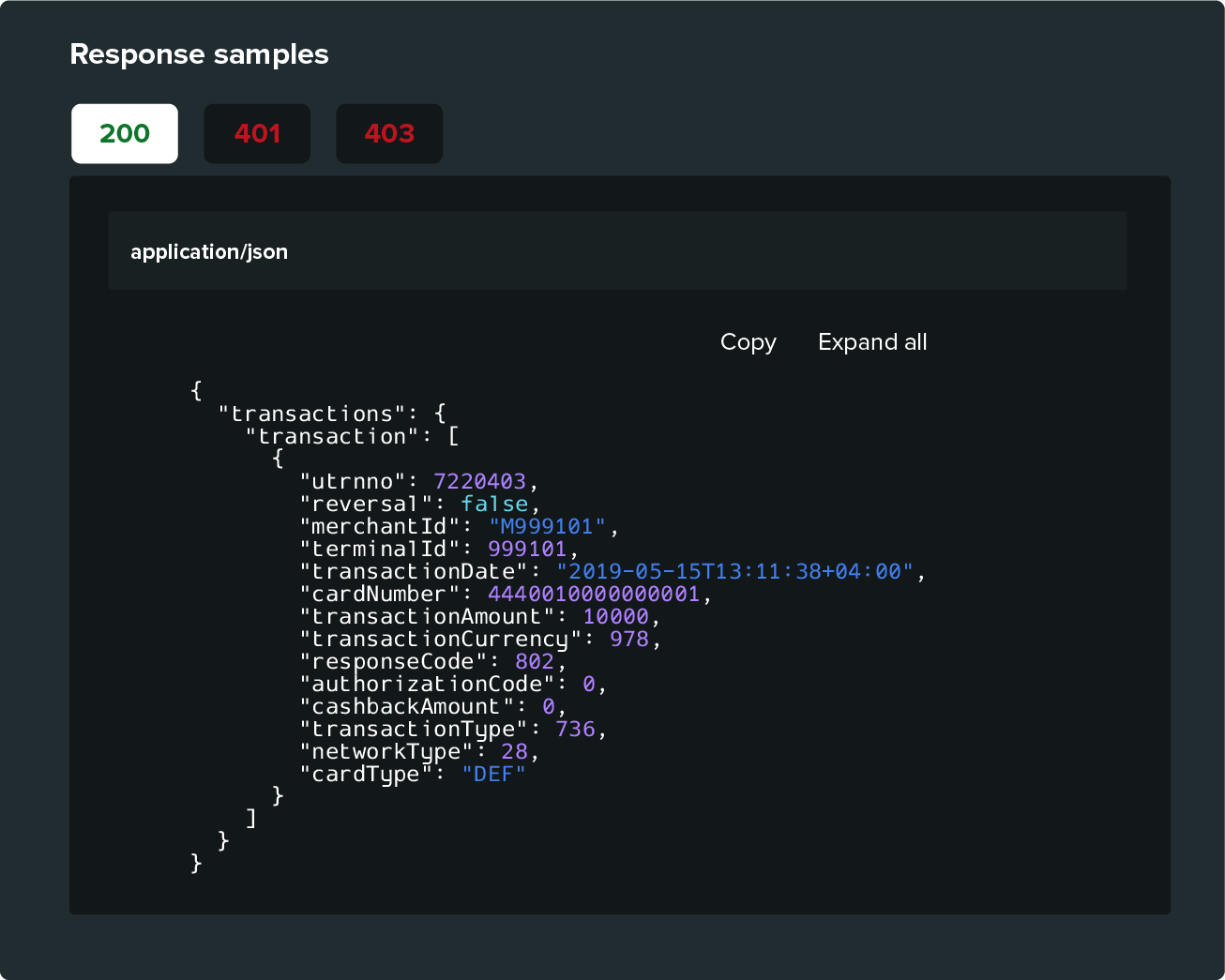

The SmartVista API Banking solution offers you full API management, including a developer portal, monitoring, request throttling and security.

Integration engine

Integration engine

With our powerful integration engine, you can easily implement APIs in your system (low code or no-code) and connect to others.

Fraud detection

Fraud detection

For a complete and secure environment, the BPC’s API Banking solution is Integrated with the SmartVista Fraud module for fraud prevention and detection.

SmartVista API Open Banking

Making a difference

Making a difference

- Developer sandbox for no-code and low-code deployment with built-in test tools

- API banking as a service for business only teams

- Infrastructure for PSD2 and UK Open Banking compliance as an AS PSP, extendable in other API domains

- Security-first, second and last

Working for you

Working for you

- Powerful integration engine with full API management

- Highly configurable workflow

- Sophisticated PSU consent management

- Integration with strong customer authentication solution

- Management of SCA exemption rules

- Third Party onboarding

- Account aggregation capability

- Integrated with SmartVista Fraud

Working for your customers

Working for your customers

- Payment initiation Service Provider capability as an extension on existing card based e-commerce offerings

- Endless and secure extension into fintech, eCommerce, eGovernment and other domains

Related products

Digital Banking & Super Apps

Digital banking apps are reaching into targeted communities like SME banking to expats or students - and into a wider range of lifestyle services like mobility, government, leisure and others. Igniting any market with a secure relevant banking app to Super Apps fuelling fast developing markets and their demanding customers.

Marketplace

In contrast with traditional markets, a digital marketplace enables buyers and sellers of all walks of life to discover items and opportunities quickly without physically meeting at a particular time and location. This way, digital platforms facilitate greater reach and direct delivery to the buyer; faster, fresher, wider.