Card Management

Less Plastic, More ‘Cards’

From card issuance to scheme management

The closed loop card systems we have known for decades excelled in many ways and to this very day. Global connectivity and access, an instant and securely funded experience for buyer and seller and a wealth of added benefits. No wonder these schemes are laying the foundation for the ultimate contactless experience in payments today.

Niche value adds per segments for fleet, corporate, device independent from wallet to wearables, embracing any payment type: credit and debit, crypto and more.

Decades of experience focus the BPC global teams on building the very best in Card Management Systems for all players in this widening world:banks, fintechs, corporates, governments, transport operators and marketplace facilitators.

Low in code, high in service

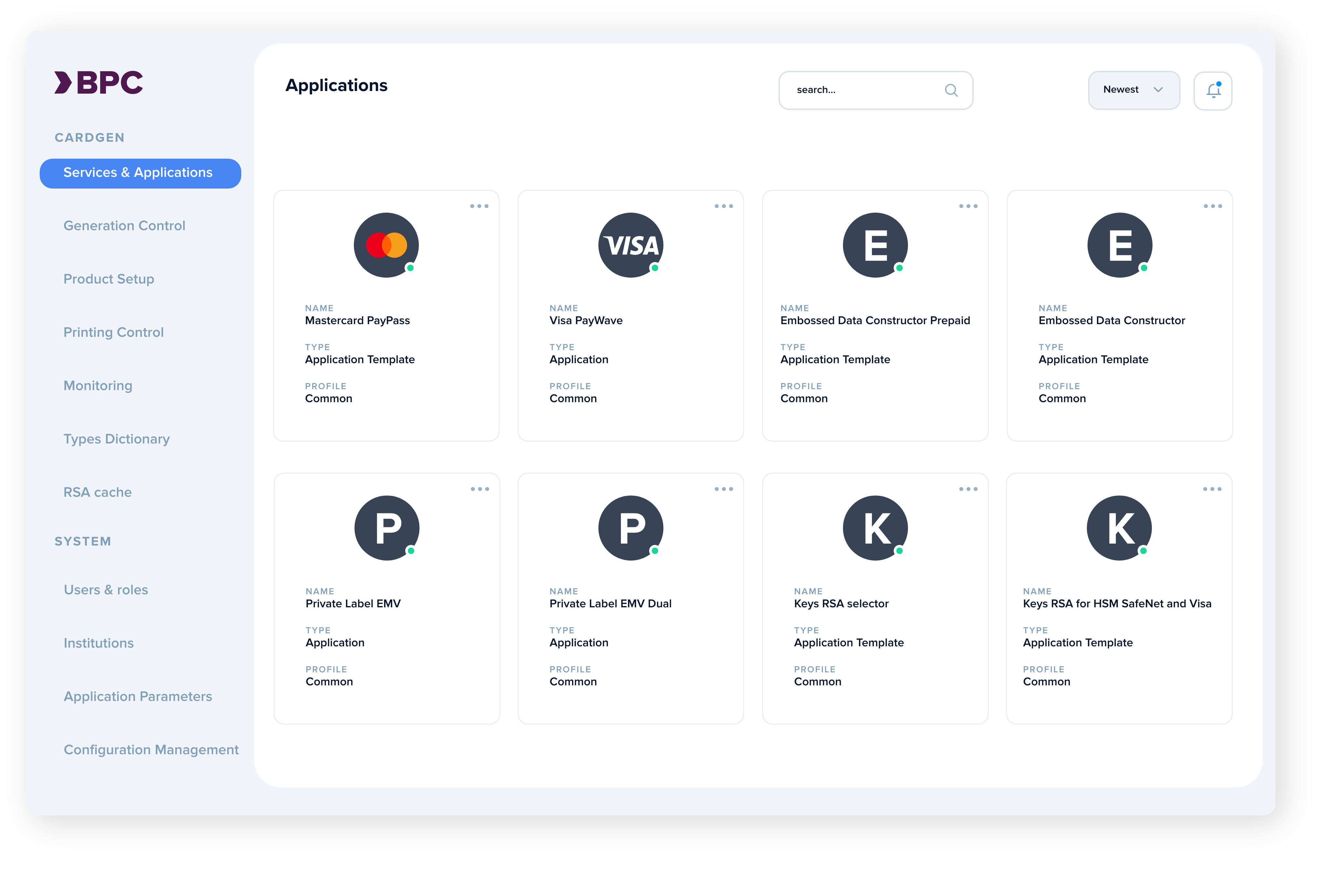

Covering the entire spectrum of card and scheme management, our template library allows you to build any function in a codeless manner, whilst the API Sandbox allows you to connect to a host of CMS functions. All prioritised by you, putting you in control.

The great differentiator is our intuitive customer service portal aimed at lead generation and profile management, all driven by you. Setting you up to extend your card business into new ecosystems in close cooperation with business partners of your choice.

Launch a digital identity card with governmental services, get your city on the move with a transport banking card or extend the payment choices with services like BNPL to attract new segments. Your business, your choice.

One solution fits all

One solution fits all

From card processing to managing wide reaching ecosystem schemes, one extendable solution - heritage rich and future proof - puts you in control to migrate, transform or extend over time.

Any card, any type, any play

Any card, any type, any play

Plastic and virtual, wallets and prepaid, credit and debit, fleet and fuel, crypto, and identity, embedded or stand alone.

Migrate now, build out later

Migrate now, build out later

Marketleader then, leading the market today and tomorrow. We understand where you migrate from and where you want to go. Try and test us, guaranteed you will want to switch on more functionality over time to extend your business.

In control

In control

When complexity and uncertainty are rife, control matters most. When global events touch your customer base you want to reach out and be relevant. Taking care of your customers whilst using the same technology to reach out and find more. Templates, low code, anyone can.

SmartVista Card Management

Making a difference

Making a difference

- Powerful integration capability with adjacent systems

- The advanced tool to manage the complexity and sophistication of the payments business

Working for you

Working for you

- Multi currency Support with rules to define fund sources, accommodating different account debiting options and Dynamic Currency Conversion (DCC) across all channels

- Comprehensive set of standard reports, including reports required by local regulators or payment schemes, operational reports, and management reports

Working for your customers

Working for your customers

- Efficient onboarding by capturing data from core banking or other external personal data management systems

- Powerful product development tools offering complete flexibility and at the same time offering product templates to simplify product setup and maintenance

- Comprehensive cardholder information for operators to better manage the customer relation

Related products

Issuing

Get your personalised payment tool in the hands of the customer and connect them to the world of real money: plastic, metal, contactless and fully virtual cards. Money on any device.

Loyalty

Building lasting relationships is essential in this fast-moving world where clients are easily distracted. Loyalty schemes are embraced around the world, but with huge differences, determined by culture and behaviour. Loyalty types range from bonus and point schemes to discounts and mixed packages. Creating a win-win situation is key for all.

Fleet & Fuel

Fuel and fleet solutions are about much more than allowing drivers to pay for their fuel. A flawless digital user experience provides both fleet managers and drivers with great levels of flexibility and transparency. It is also a convenient way for fuel payment providers to engage and retain their customer base.