eWallet

The Freedom of a Cashless Future

The next level of payments

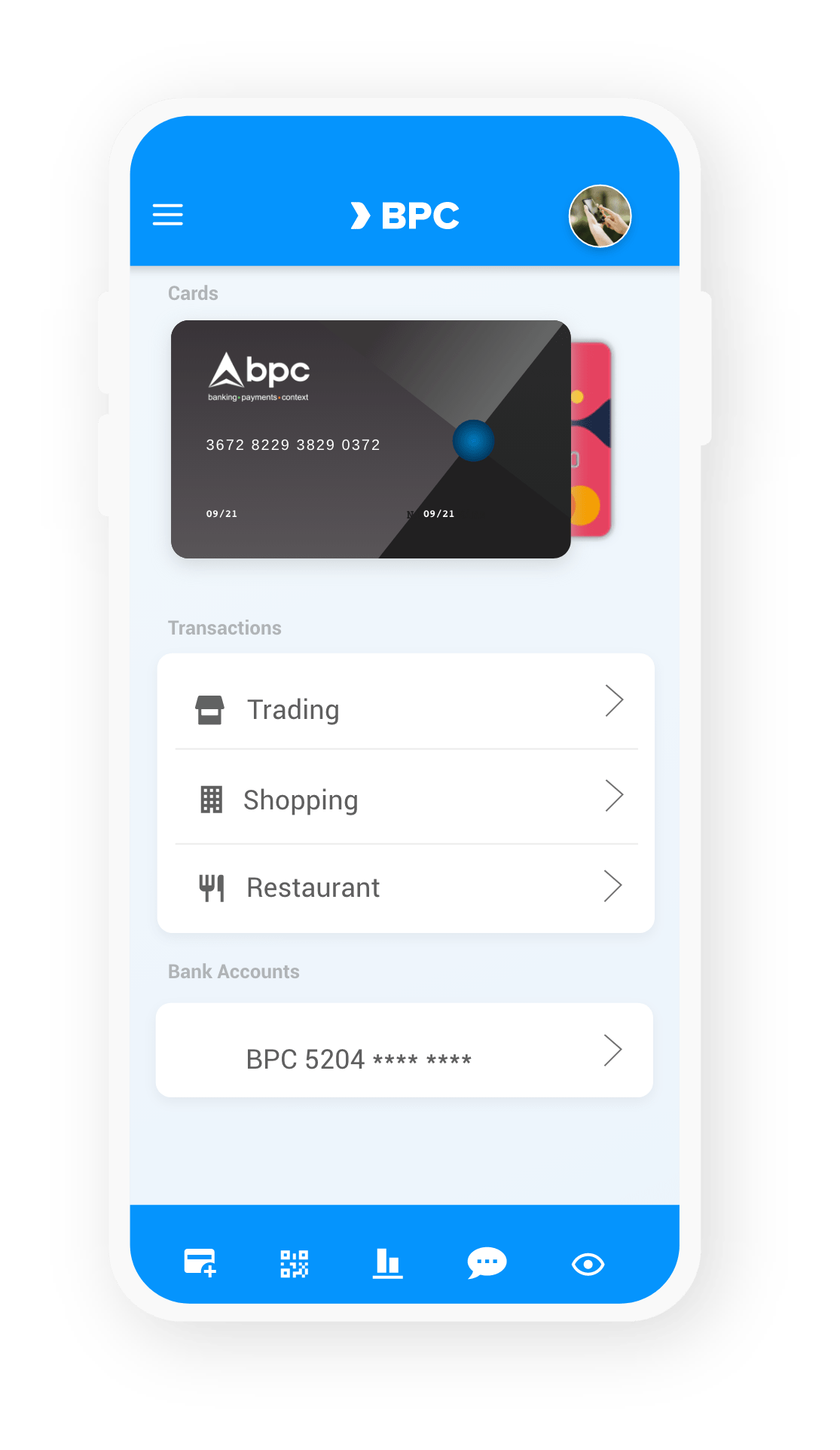

eWallets offer everything a classical wallet would offer and more. Digital wallets all start from the same core value proposition: offering payments at large without the need for a bank account. Be it a QR code, USSD or NFC type of transaction. This takes us to the next level of cash freedom anywhere: convenience and safety of a cashless future.

Single solution, many flavours

In developed markets, there is a wide variety of mobile wallets and their origins are as diverse as they come. In emerging markets, mobile wallets empower people by making financial services available to all everywhere. Mobile network operators play a key role in this and are also often our customers operating the wallet.

Valuable and convenient

With SmartVista’s eWallet merchants can also issue and accept gift cards, vouchers and discount cards. eWallet fits merchants of all shapes and sizes, including traditional merchants. The eWallet is a valuable and convenient addition to their existing payment acceptance options, such as POS, using technologies like QR codes and NFC.

Associated Virtual prepaid cards

Associated Virtual prepaid cards

SmartVista Virtual Card Issuance is an end-to-end platform that lets you quickly create, distribute, and manage virtual cards, which can be linked to an ewallet.

For all payment needs

For all payment needs

A secure, convenient platform for all payment needs, whether those are P2P payments, utility bill payments, buying goods or mobile top-up.

Managing all digital value

Managing all digital value

Consumers can store many types of digital value in their mobile wallet; digital money but also loyalty points, vouchers or gift certificates. eWallet opens up a host of functionalities virtual, debit, tokenized to give customers the option to use their wallet in-store using POS or online during eCommerce transactions.

SmartVista eWallet

Making a difference

Making a difference

- Online control for all parameters: validity, type, access, top-up, limits

- Digital or in branch/agency issuance

Working for you

Working for you

- Full life cycle management

- API/ web services integration

- Supports various payment methods

Working for your customers

Working for your customers

- One wallet for all digital assets

- Instant transacting

Related products

Issuing

Get your personalised payment tool in the hands of the customer and connect them to the world of real money: plastic, metal, contactless and fully virtual cards. Money on any device.

Digital Banking & Super Apps

Digital banking apps are reaching into targeted communities like SME banking to expats or students - and into a wider range of lifestyle services like mobility, government, leisure and others. Igniting any market with a secure relevant banking app to Super Apps fuelling fast developing markets and their demanding customers.

API Banking

The SmartVista API Banking solution offers you full API management, including a developer portal, monitoring, request throttling and security.

Microfinance

With SmartVista Microfinance, you provide financial services to underserved or excluded communities. With this solution, MFI agents can make real-life connections and connect the unbanked to a digital microfinance infrastructure. Services are delivered where the clients are, even in the most rural areas.