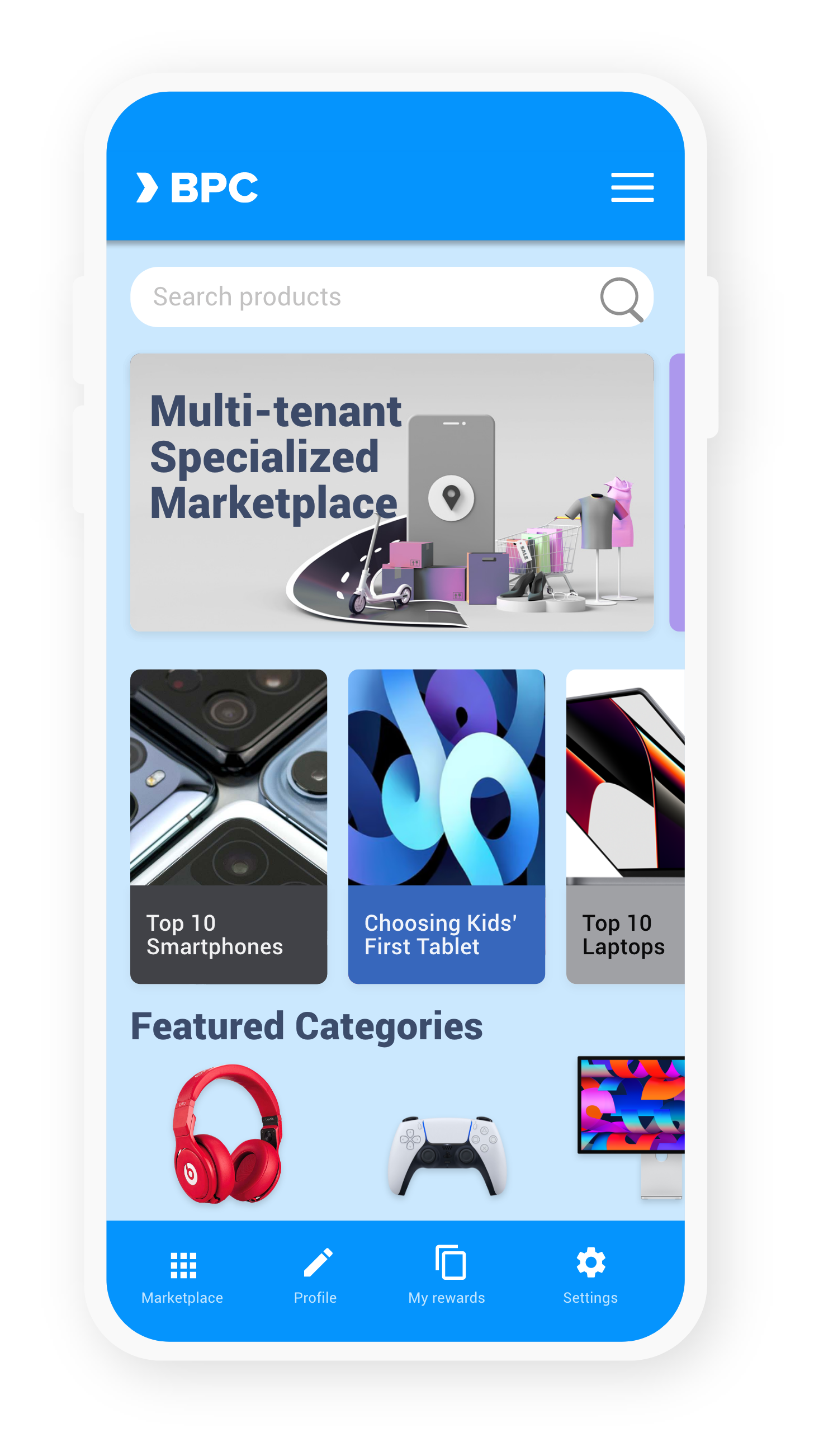

Marketplace

Creating Relevant Industry-led Ecosystems

Making customers happy at all time

In contrast with traditional markets, a digital marketplace enables buyers and sellers of all walks of life to discover items and opportunities quickly without physically meeting at a particular time and location.

This way, digital platforms facilitate greater reach and direct delivery to the buyer; faster, fresher, wider, with instant payment at core.

More traceability and transparency

Through the digital marketplace, customer and vendor details are available in real-time. This enables tracing the origin of a product (ESG) but it also provides more transparency to an optimised supply chain.

Sellers can be verified, credit checks and credit insurance can be issued instantly, and the digital payment system offers a safe transaction environment.

Connect financials

Connect financials

The digital marketplace connects all players in the ecosystem and financial institutions beyond payments, like insurance, scoring agents and loan providers.

Put wrongs right quickly

Put wrongs right quickly

Time consuming tasks like dispute management and cancellations are automated with immediate, rules-based credit back and goods return for a smooth cooperation.

Order & payment options

Order & payment options

All order and payment options can be done on the same platform. One-click orders, re-order and recurring services are handled within the Marketplace.

SmartVista Marketplace

Making a difference

Making a difference

- Minimised credit risk

- Improved credit scoring capabilities

- Access to new markets

- Multi-industry

Working for you

Working for you

- Cost efficiency

- Low entry level access to financial products for micro enterprises

- Reducing paper based, manual processes

- Reducing fraud/corruption risk

- Service based offering - no licence based model

Working for your customers

Working for your customers

- Access to financial products without credit history

- Ability to build a credit profile over time

- Access to a full ecosystem to support business

- Access to additional supplier options

- Platform for distribution of produced goods

Related products

API Banking

The SmartVista API Banking solution offers you full API management, including a developer portal, monitoring, request throttling and security.