Microfinance

Financial Inclusion for Anyone, Anywhere

Real-life finance - city buzz to remote and rural

With SmartVista Microfinance, you provide financial services to underserved or excluded communities. With this solution, MFI agents can make real-life connections and connect the unbanked to a digital microfinance infrastructure.

Services are delivered where the clients are, even in the most rural areas.

Flexible and mobile service for growth

Microfinance access for anyone means banks need a flexible and mobile solution.

A flexible microfinance-infrastructure uses technology already in place and mobile phones, mobile internet, Point-of-Sales devices and ATMs. Reach out to potential clients anywhere.

Financial inclusion

Banks and financial institutions contribute to the financial inclusion for the ‘unbanked’ by offering microfinance services.

This way more and more people can connect to the safe and stable financial services that play a major part in the realisation of their plans and ambitions.

Suitable for any scheme

Suitable for any scheme

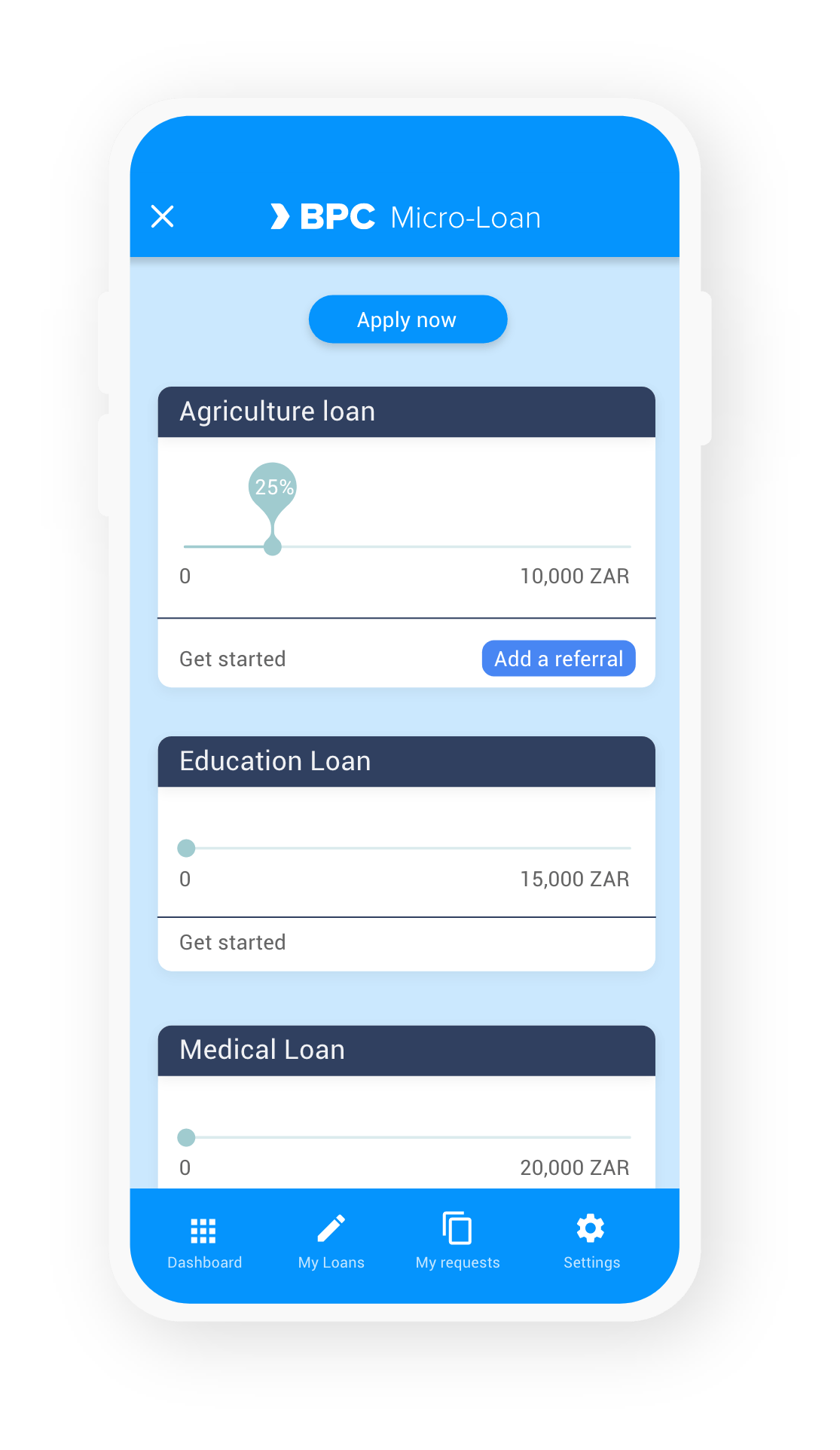

SmartVista for Microfinance is suitable for all microfinance schemes and policies. From individual credit to solidarity lending, factoring, financing and more.

Scaleable and flexible

Scaleable and flexible

Create valuable customer relations with comprehensive functionality combined with unrivalled scalability, built-in security and complete flexibility. Personalise around the finance needs and capability of customers leveraging KYC and behavioural data.

Create and innovate

Create and innovate

With SmartVista Microfinance you can rapidly create and innovate your financial products and services, stand-alone or as part of a wider ecosystem.

SmartVista Microfinance

Making a difference

Making a difference

- Smart orchestration around micro-lending

- Alternative and flexible credit scoring model

- Any to any: onboard and lend: self-service, agent, kiosk, marketplaces

Working for you

Working for you

- Simplified KYC with account opening

- Matrix-based with instant loan calculation

- Real time configuration

- Multi-loan application across multiple banks

- Fraud prevention with tailored business rules

Working for your customers

Working for your customers

- Transparent application process with status tracking

- Digitised and simplified KYC

Related products

Agent Banking

SmartVista’s Agent Banking solution allows agents to offer a full range of transactions and services. These include cash deposits and withdrawals, money transfers, account to account payments, loan repayments, bill payments or mobile top-up. Agents, when authorised, are able to onboard new customers and perform KYC instantly.

eWallet

eWallets offers everything a classical wallet would offer and more. Digital wallets all start from the same core value proposition: offering mobile payments at large without the need for a bank account. This takes us to the next level of cash freedom anywhere: convenience and safety of a cashless future.

QR Payments

QR-enabled payments have grown rapidly worldwide, but particularly in Asia and especially in China and India. They allow merchants, street vendors and taxi drivers to accept payments with a QR code that can be simply printed on paper, eliminating the need for an expensive POS terminal.