Switch

Travelling a Borderless Grid

Evolve and manage your fast-moving payments landscape

Connect external devices such as EFT/POS terminals, ATMs or Kiosks and integrate with electronic and mobile payments. With SmartVista Switch from BPC, any issuer, acquirer and processor can manage the fast-moving payments landscape and deliver the best levels of service to their customers.

Flawless connection, flexible authorisation

Connect with your online banking systems and interact with external systems providers.

SmartSwitch allows the creation of a transaction template that can be used with a certain set of parameter values, to select and execute an authorisation scenario.

Continuous customer service

Offering services anytime and anywhere is key in the fast moving world of finance. To ensure that a continuous customer service is delivered, Switch monitors the availability of issuers across the network in real-time, providing “stand-in” authorization when core banking is unavailable. This way your customers never miss out on anything.

Multiple channels

Multiple channels

Connect your online and offline business by creating interaction with all payment channels like ATM, EFT/POS, mPOS and Tap to Phone.

Multiple transactions

Multiple transactions

SmartVista Switch supports a wide range of payment types like real-time direct debit, payment by alias, but also supporting services like stand in authorisation, smart filtering and voice authorisation.

A fit for your business

A fit for your business

SmartVista Switch is scalable (in terms of volumes as well as service levels) and adaptable. Offering reliability with an uptime of 99,999 % executing transactions in any corner of the world, up to 7.000TPS. A proven platform: when your business grows, Switch can be adapted and grow with you.

SmartVista Switch

Making a difference

Making a difference

- Flexible Fee Engine for all stakeholders: issuers and acquirers merchants, fintech, banks and more

- Future fit: transit from traditional switch to instant payment network

Working for you

Working for you

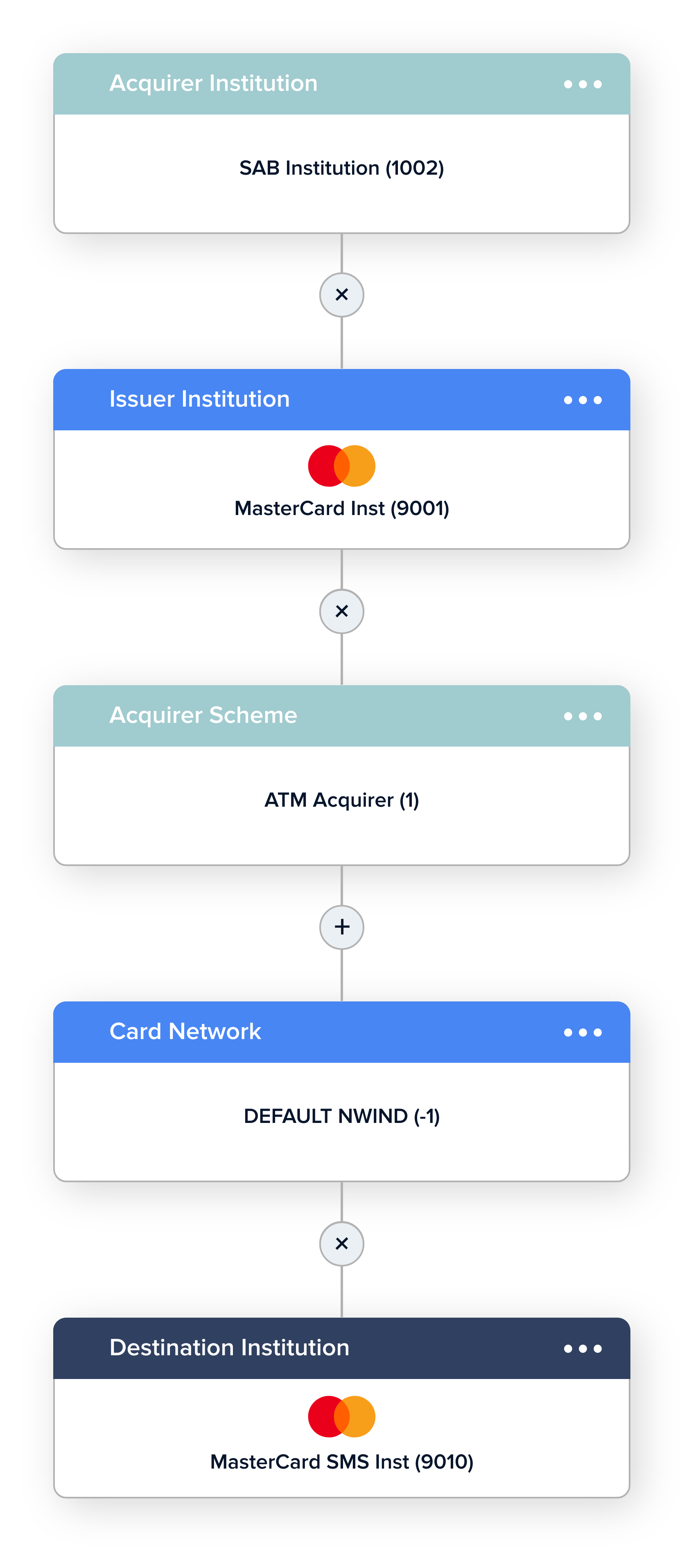

- Flexible transaction routing configuration capabilities

- Support for EMV, NFC, contactless payment instruments

- Hosted Card Emulation support

- Full tokenization capabilities

- Smart routing for efficient billing

Working for your customers

Working for your customers

- User friendly dashboard and reporting

- Extend your business reach: Beyond banking, fintech, fleet and fuel

Related products

ATM and Kiosk Management

Connecting and managing payments in the digital and the physical world can be time-consuming. Here, BPC can unburden banks and third-party processors as much as possible with SmartVista ATM Management for efficient servicing and monitoring of a diverse range of ATMs and self-service kiosks.

eGovernment

The SmartVista Government module is designed to ultimately create a cashless government. It allows tax collection, subsidy distribution and benefit payments, to give a few examples. A range of APIs can be used to integrate with the required systems to offer, manage and monitor public services within your chosen environment.

Acquiring

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for both the merchant (POS) and the banking services world with (customised) ATM offerings, including ATM cash management, (Soft)POS.

Risk & Fraud Management