Touching the boundaries of digital acceptance

Experience seamless, efficient and customizable ATM management

End-to-end, secure, and integrative payment solutions

A white-label, user-friendly platform for secure, versatile payment solutions

Engaging employees to learn, improve and master BPC solutions

Robust fraud detection, risk-based authentication, and multi-institutional security

Streamlining payments and enhancing merchant experiences with seamless solutions

Streamlining and securing multi-network transactions while enhancing efficiency

Deliver hyper-personalized experiences with BPC AI

Operate seamlessly with large data sets, source documents, and generate insightful reports with BPC AI Virtual Assistant.

From enabling banks to enabling banking

The building blocks for next gen banking delivered today

Global banking fit for local needs

Stack to Service - white label payment excellence

More and Better Together

Mass transit the personal way

Enhancing the real life of citizens

Mass transit the personal way

Connecting payment rails to the last mile

Creating relevant industry-led ecosystems

Integrate our APIs on your apps.

The latest developer docs, including tutorials, sample code, and API reference.

Experience seamless, efficient and customizable ATM management

End-to-end, secure, and integrative payment solutions

A white-label, user-friendly platform for secure, versatile payment solutions

Engaging employees to learn, improve and master BPC solutions

Robust fraud detection, risk-based authentication, and multi-institutional security

Streamlining payments and enhancing merchant experiences with seamless solutions

Streamlining and securing multi-network transactions while enhancing efficiency

Deliver hyper-personalized experiences with BPC AI

Operate seamlessly with large data sets, source documents, and generate insightful reports with BPC AI Virtual Assistant.

From enabling banks to enabling banking

The building blocks for next gen banking delivered today

Global banking fit for local needs

Stack to Service - white label payment excellence

More and Better Together

Mass transit the personal way

Enhancing the real life of citizens

Mass transit the personal way

Connecting payment rails to the last mile

Creating relevant industry-led ecosystems

Integrate our APIs on your apps.

The latest developer docs, including tutorials, sample code, and API reference.

Digital acceptance is vital to the success of virtual payment schemes, it is important I acknowledge that many customers want to retain physical payment options.

One of the most interesting current trends in the payments space is the use of wearables. Perhaps the most high profile example is the Amazon Ring, which can be used to make payments using NFC technology as well as perform other tasks such as unlocking mobile devices. The next phase of this development is the integration of a microphone and speaker into the ring, which will allow the wearer to interact with the wearable and issue commands – such as initiating a payment.

There has similarly been a lot of innovation around the use of smart watches to make payments, using biometrics such as finger vein pattern recognition as an additional layer of security.

Biometrics is a particularly interesting topic given the emergence of biometric payment cards. Merchants like the fact that these cards are compatible with their POS terminals, although they are expensive and the enrolment process is cumbersome. The implementation of facial recognition system (e.g. FaceID on iPhone) could also be challenging given the number of sensors required to achieve a proper secure authentication.

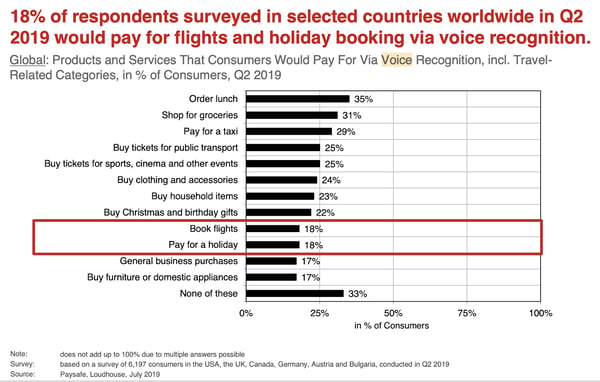

Smart devices such as Alexa are becoming commonplace, yet research suggests many people are only comfortable making relatively small payments via voice-enabled devices.

These issues underline the importance of ease of use and usefulness to the adoption of digital payment technology. However, our experiences with customers such as TymeBank in South Africa also demonstrate that a 100% digital solution is not always the optimum approach.

In this case customer due diligence was an issue, so we helped TymeBank install physical touch points in shops where customers could enroll, check payments and order debit cards.

This experience echoes the findings of research in Singapore and other countries where the majority of people want to maintain physical contact with their bank even if they also have an account with a digital-only bank.

Paycode is a prime example of the continuing importance of offering non-digital payment methods. In this case an online business – Amazon – is allowing customers to make physical payments for their purchases rather than having to use payment cards or virtual payment methods.

There is an assumption that high levels of cash payments are linked to large numbers of unbanked consumers, but this is not necessarily true. In the Philippines, a large percentage of the money withdrawn from ATMs is used to make in-store purchases because disruptions to the power supply affect merchant terminals more often than the ATM network.

There are also regulatory factors that prevent payments becoming completely digital, such as One-Time Password received via SMS when making online payments not being recognised, across EU, as a second factor of authentication under PSD2 SCA.

More than 20 years ago, Bill Gates wrote a seminal essay entitled ‘Content is King’. For payment systems providers, we should now say that Context is King.

In fact it’s beyond King; it’s Context or Nothing.