The BPC Blog: | Payments

Latest Posts

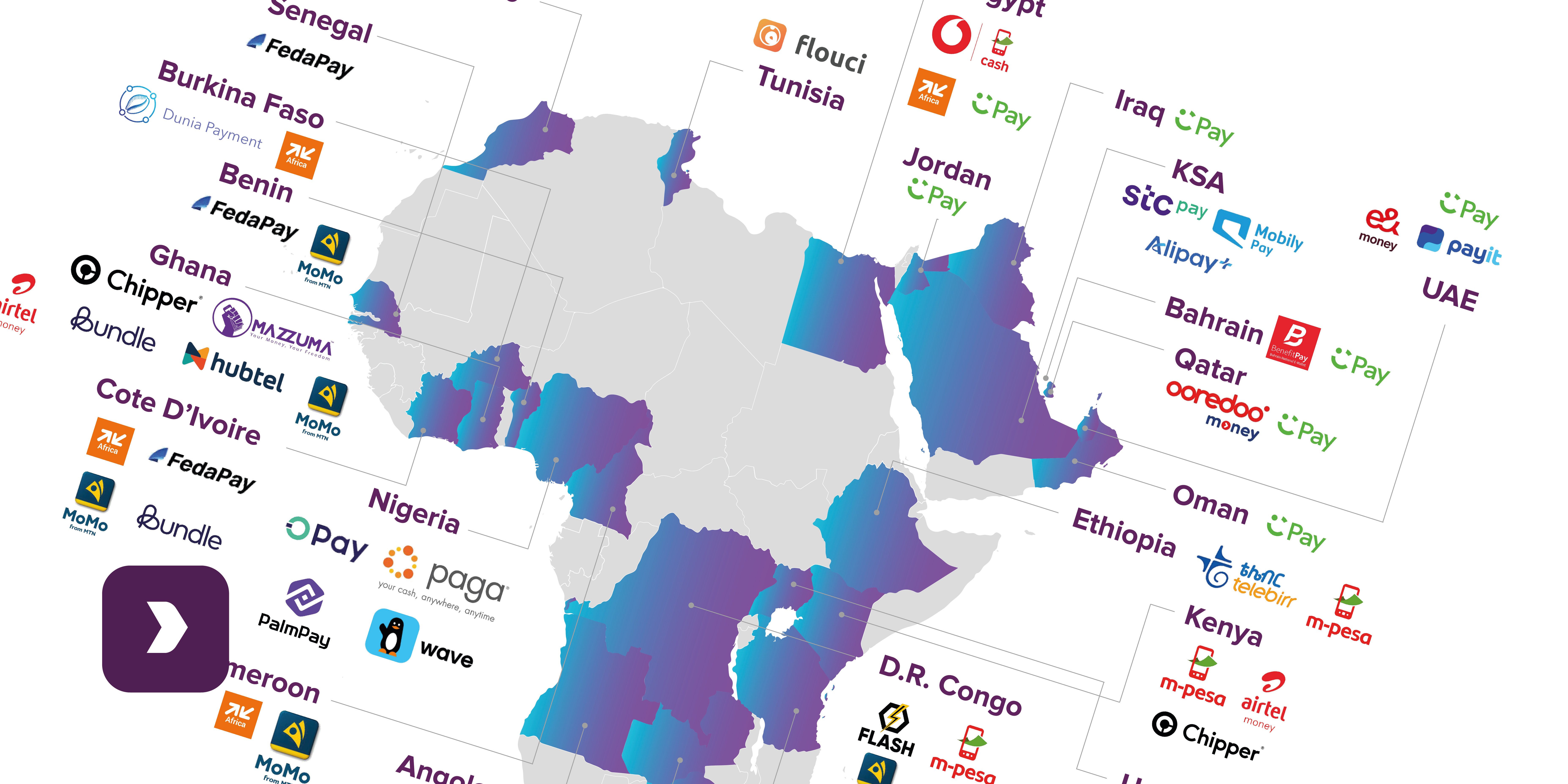

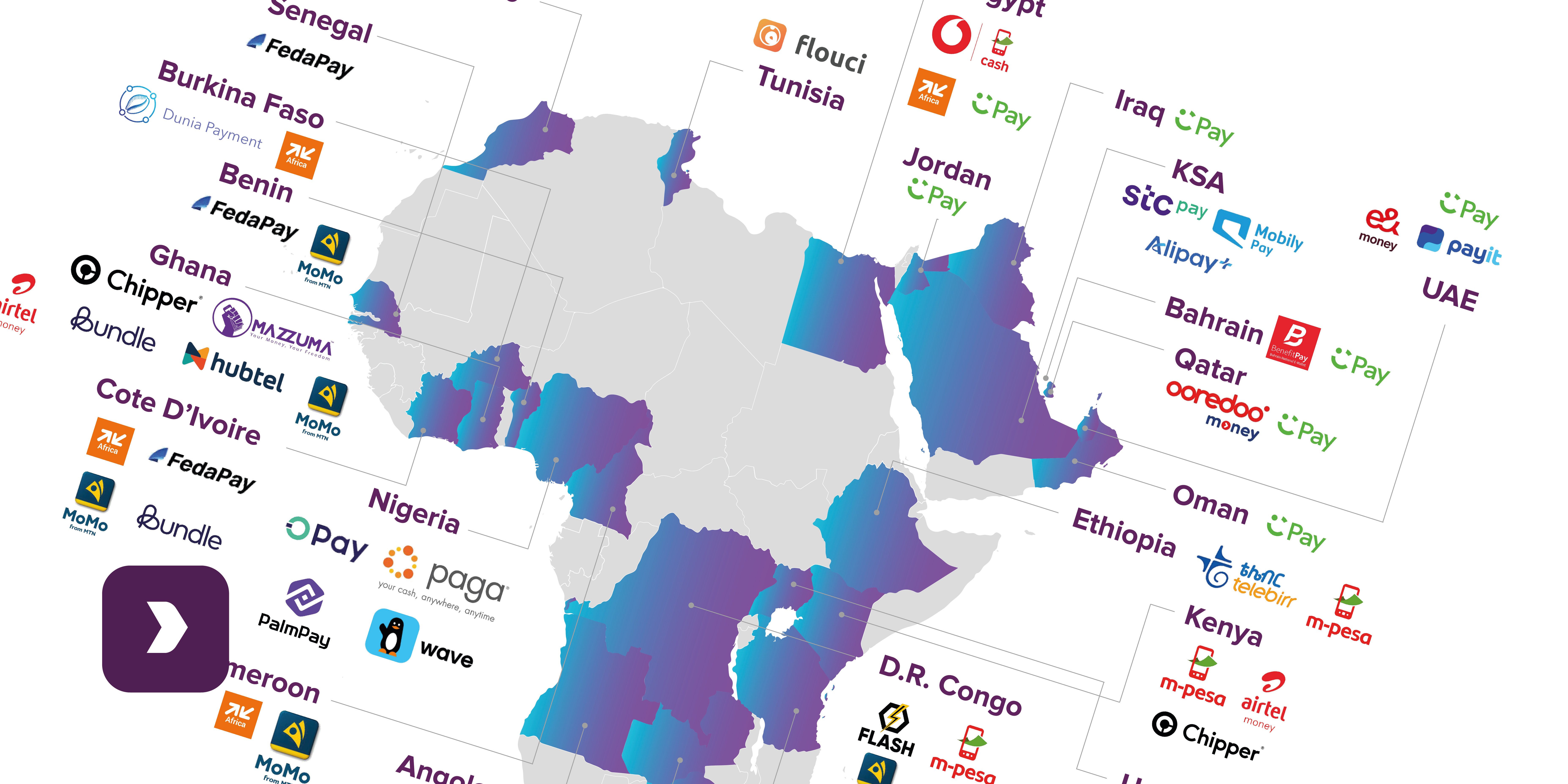

MEA’s dual wallet landscape

Across the Middle East and Africa, wallet ecosystems have evolved in line with local market realities, from telecom-led payment platforms to interoperable digital wallets. The..

From Plastic to Platforms: The new rules of Card Issuing

Ten years ago, card issuing was a stable business built on plastic and interchange revenue. Five years ago, the shift to contactless, basic mobile wallet provisioning, and 24/7..

Beyond Just Payments: The Diversity of APAC’s E-Wallet Market

In Asia Pacific, digital wallets are no longer viewed as experimental add-ons to cash or cards. They have become everyday tools used to pay, transfer, and save, with adoption..

Europe’s Wallet Evolution

Europe is undergoing a decisive shift in the way people manage their financial lives. Digital wallets already represent 44 percent of e-commerce payments across the continent, a..

The Next Frontier: unlocking opportunities in Laos’ Card Management industry

Across the APAC region, economies are rapidly transitioning from cash to digital payments, with credit and debit cards expected to dominate new sales over the next four years...

How global payment trends are rewriting Issuers’ playbook

Plastic still rules global payments, yet its position weakens. From London commuters who now tap a virtual card on their phone to travel to South-African shoppers who pay with QR,..

Building an Acquiring System for Tomorrow - Today

The payments market is evolving rapidly. With emerging technologies, diverse payment methods, and shifting regulatory frameworks like PSD3 and DORA, acquirers face increasing..

Why Acquirers Need to Move Beyond Legacy Systems

The payment landscape is evolving rapidly. With electronic transactions expected to more than double - reaching over 4 trillion globally by 2030 (source: PwC), the pressure on..

Key Factors Driving the Payments Landscape in 2025

The payments industry is experiencing a transformative shift. While digital innovation has been reshaping payments for over a decade, a second wave of digital revolution is now..