Urban Mobility & Transportation

Mass Transit the Personal Way

Cities’ magnified challenges

One area where all societal change comes together is the city. Challenges around sustainability, digitisation, inclusion, growth at an unprecedented pace are all magnified in urban spaces where people are on the move. Coupled with unexpected events such as natural disasters, economic swings and pandemics, it is clear that we need a contactless and low impact way to move around. Cities are very aware of this and our SmartCity survey proves that many cities are embracing technology to deliver better services for their citizens.

Keep moving, the ‘do no harm’ way

Investing in a high quality transport infrastructure needs to happen on and below ground, but also in the non-tangible technology infrastructure. Taking out friction with choices across many carriers, automatic best fee calculation and selection and payment as well as physically embarking on and exiting the journey. Topping up, providing payment choices for all types of fares should be seamless, contactless and offer interactive additional services.

One City One Platform

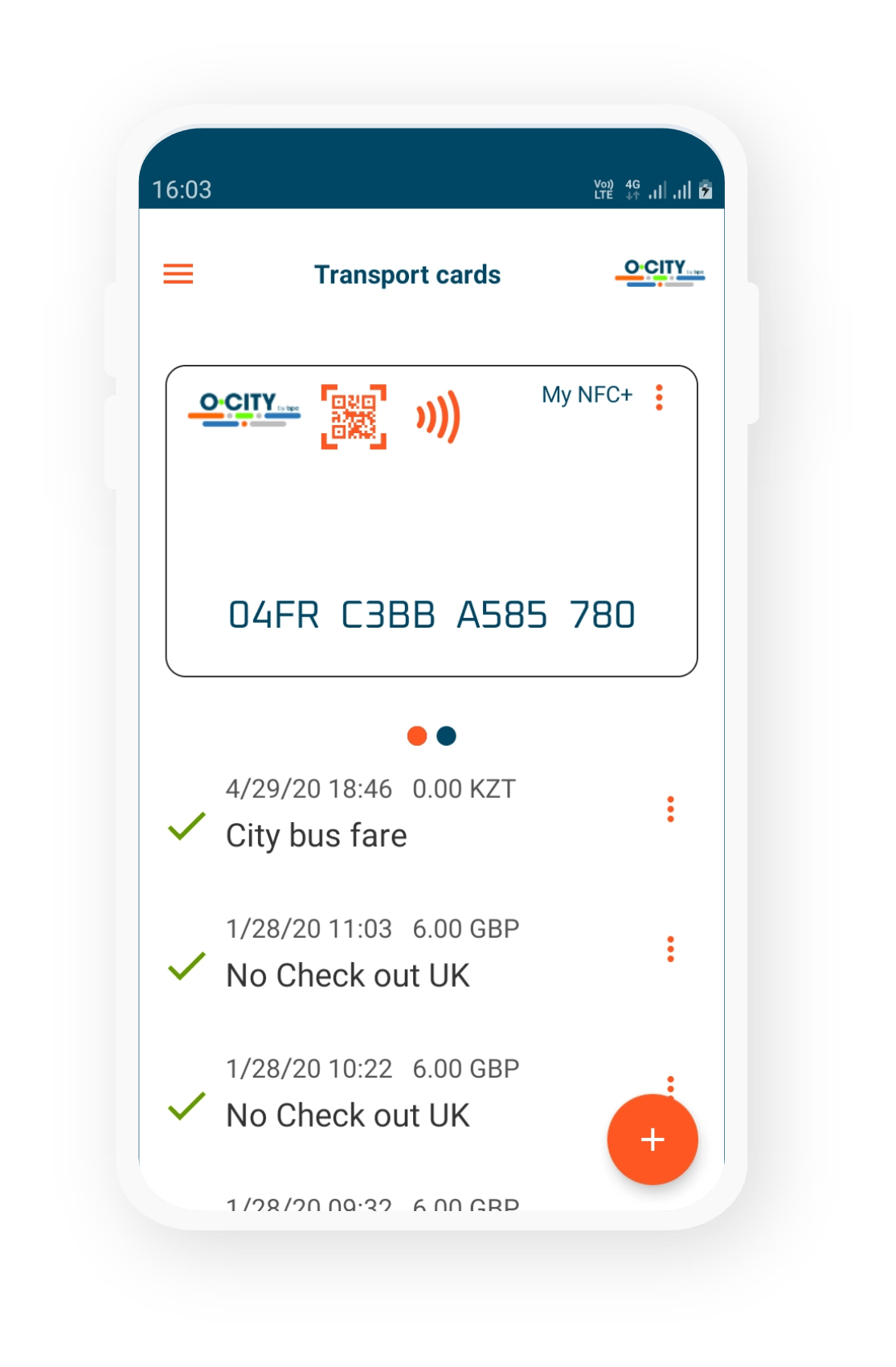

An open city with zero paper and zero barriers is a reality today. Open-loop digital payment technology, delivered through our O-CITY automated fare collection platform. Apart from a ticketless commuter experience with added insights on places to go and see, cities get insights that support the planning of optimal and greener traffic flows. Transport operators get insights that make them run more effectively, but also to deliver hyper personalised contactless services to their travelers across all physical and virtual touchpoints in their journey.

Hardware agnostic freedom

Hardware agnostic freedom

Fast time to market, easy to deploy across any type of transport infrastructure or merchant terminal, mobile device, wearable etc. Centralised platform management through on-premise or SaaS cloud, allowing for upscaling as and when required at no extra cost.

Open and inclusive to all

Open and inclusive to all

A simple to use service, fair and understandable by all, removing the need to search for the best fee. Removing payment barriers allowing people to move freely from metro to bus to train to cab.

Payments inside

Payments inside

Flawless executive of any type of payment as O-CITY is backed up by the most connected global payments hub covering corner to corner around the world, from central switch to the last mile.

One city. One platform.

Adopted by more than 130 cities worldwide, O-CITY is an innovative automated fare collection solution for public transport operators and municipalities. The platform leverages a best of breed payment solution from payment expert BPC available in more than 100 countries.

Related products

Automated Fare Collection

BPC’s Automated Fare Collection module offers operators of public transport services efficient ways to collect fares: across any device, contactless,fast, clean and secure. This way they can provide simple and convenient payment options to make the service attractive to passengers and easy to manage for the operators.

eWallet

eWallets offers everything a classical wallet would offer and more. Digital wallets all start from the same core value proposition: offering mobile payments at large without the need for a bank account. This takes us to the next level of cash freedom anywhere: convenience and safety of a cashless future.

Fleet & Fuel

Fuel and fleet solutions are about much more than allowing drivers to pay for their fuel. A flawless digital user experience provides both fleet managers and drivers with great levels of flexibility and transparency. It is also a convenient way for fuel payment providers to engage and retain their customer base.

QR Payments

QR-enabled payments have grown rapidly worldwide, but particularly in Asia and especially in China and India. They allow merchants, street vendors and taxi drivers to accept payments with a QR code that can be simply printed on paper, eliminating the need for an expensive POS terminal.

Merchant Management

Meeting expectations seems more and more complicated. In the digital world as well as in real life, the bar is set high when it comes to payments. The BPC’s Merchant Management module offers a wide range of payment instruments, and it is vital to propose the right solutions and service levels to merchants.

API Banking

The SmartVista API Banking solution offers you full API management, including a developer portal, monitoring, request throttling and security.