Digital Banking & Super Apps

Bridging Real Life to a Single Digital Experience

It’s all about the experience

The digital banking world brought customers intuitive experiences; easy access and convenience are key. Digital banking apps are now reaching into targeted communities like SME banking to expats or students - and into a wider range of lifestyle services like mobility, government, leisure and others.

Super apps - banking and more

Rolling everything customers need to transact through daily life into a SuperApp is one way to core relevance and success.

Anything financial, business, lifestyle, health and even government can be accessed through one app that used to be ‘the bank in a pocket’. No need to invest in and a wide range of other activities.

Managing the network

Digital banking in a SuperApp environment requires more than tech alone. It takes full partner network management and a clear understanding of rights, responsibilities, liabilities and more. It takes the network to commit to further development for the full ecosystem, not just their own share. We build, launch, onboard and maintain large marketplace environments and know what it takes to help you build yours.

Relevance at a click

Relevance at a click

Offer customers the information they need. With personalised overviews and product offers, the SuperApp is always relevant.

Real-time interaction

Real-time interaction

Take interaction with your customer beyond payments. With the SuperApp you can offer services in real-time from fraud prevention to nudges and suggestions.

Super connectivity

Super connectivity

SuperApps require Super Connectivity. BPC offers that through an API experience and BPC Sandbox [link] for a wide range of financial, governmental and lifestyle apps.

SmartVista Digital Banking

Making a difference

Making a difference

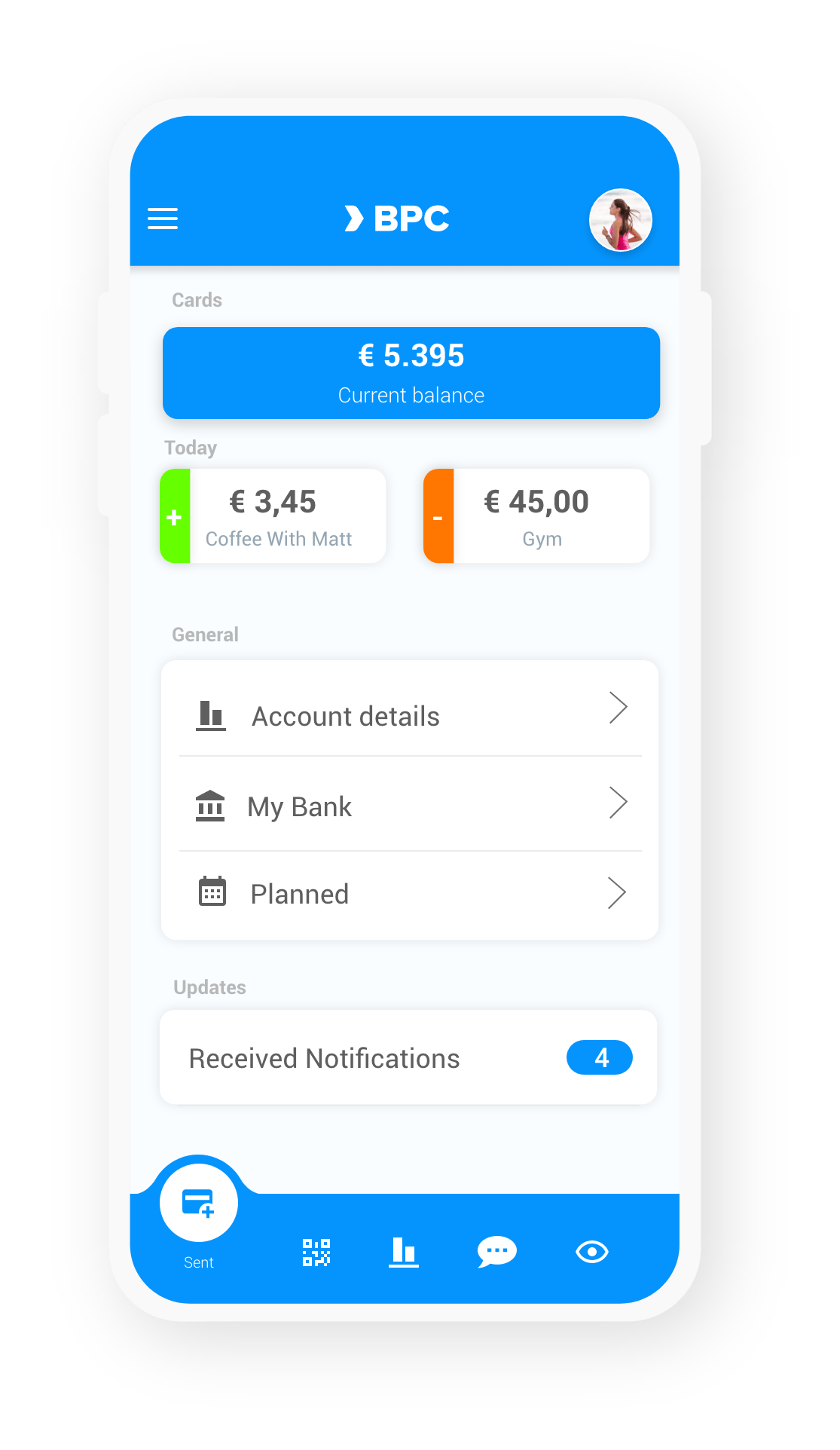

- A multi-role app that switches between consumer, business, agent

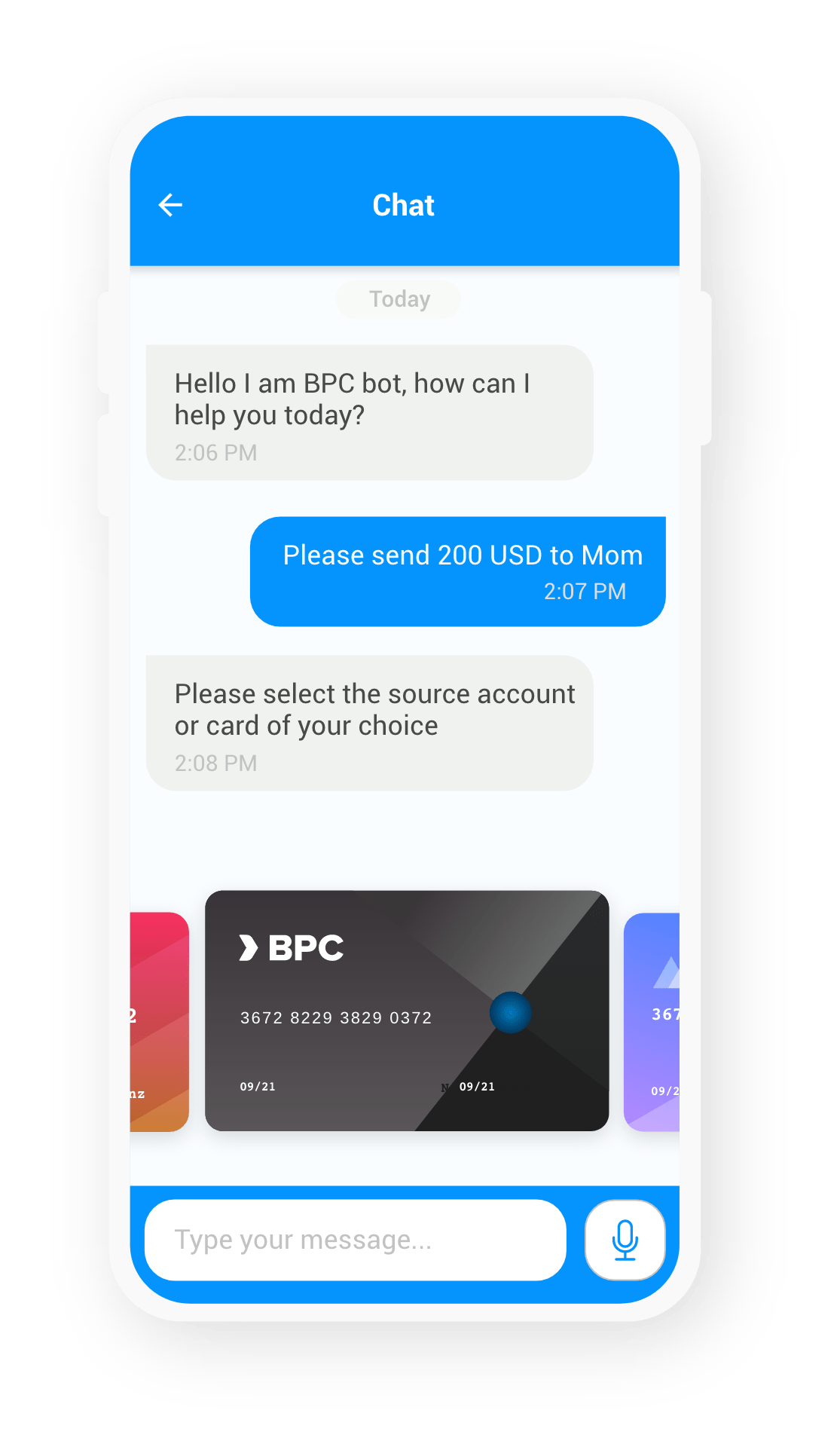

- Integrated Chatbot and speech to text in multi-languages virtual advisor

- Ecosystem building and smart marketplaces

- Cards, accounts, wallets management

Working for you

Working for you

- End to end digital processes from KYC onboarding to digital contracts

- White label UX templates

- Payments, transfers, remittance, top ups and withdrawals

- Integrated marketing and segmentation tools

Working for your customers

Working for your customers

- Digital analytics and marketing with customer segmentation

- Supervised products for parents and companies

- Personal finance management and goals, investments and trading

Related Products

eWallet

eWallets offers everything a classical wallet would offer and more. Digital wallets all start from the same core value proposition: offering mobile payments at large without the need for a bank account. This takes us to the next level of cash freedom anywhere: convenience and safety of a cashless future.

Card Management

Marketplace

In contrast with traditional markets, a digital marketplace enables buyers and sellers of all walks of life to discover items and opportunities quickly without physically meeting at a particular time and location. This way, digital platforms facilitate greater reach and direct delivery to the buyer; faster, fresher, wider.

API Banking

The SmartVista API Banking solution offers you full API management, including a developer portal, monitoring, request throttling and security.