Merchant Management

Data Dashboarding for Merchants

The bar is set high

Meeting expectations seems more and more complicated. In the digital world as well as in real life, the bar is set high when it comes to payments.

BPC’s Merchant Management module offers a wide range of payments, and it is vital to propose the right solutions and service levels to merchants and their clients. Whatever the payment channel, POS, SoftPOS, eCommerce or QR based, Merchant Management is able to manage.

Customise to connect

Although the balance is shifting towards digital, the merchant of today has absolute reliance on a hybrid payments infrastructure, online, in-app, in-store.

SmartVista allows creating customised products and services to ensure relevant solutions for the acquirer and merchants alike.

Multi-currency environment

Multi-currency environment

Manage finances in a multi-currency environment through a variety of account types such as merchant accounts, settlement accounts, MSC accounts or fee accounts.

Banking on data

Banking on data

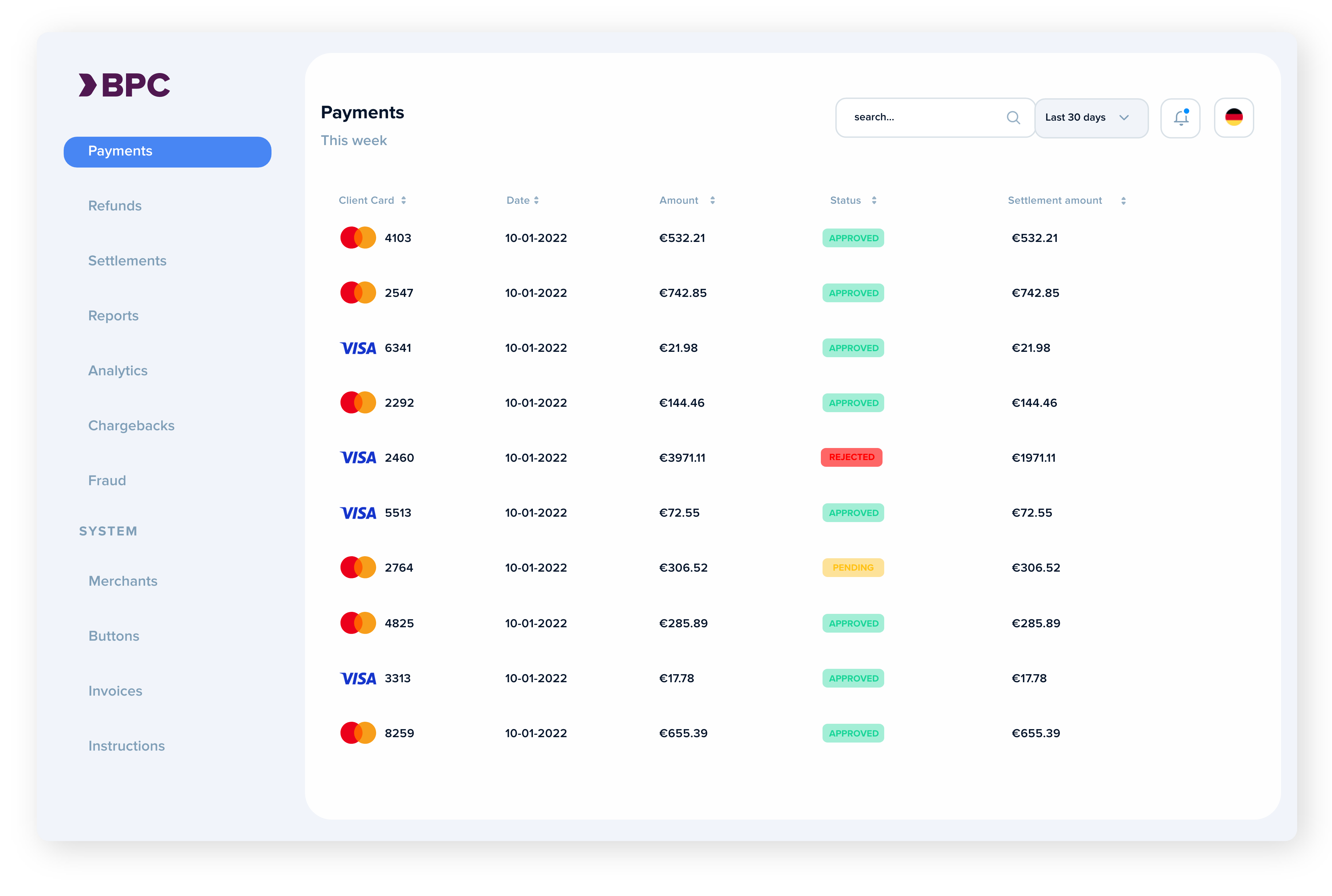

Multilevel data aggregation and reconciliation capabilities cover the entire spectrum of data streams. Build on the insights straight from the merchant’s operations propagated to a meaningful dashboard on which to tune your operation.

Creating an overview

Creating an overview

SmartVista offers your merchants full control, from fees and disputes to rolling reserves on different merchant accounts and terminals.

SmartVista Merchant Management

Making a difference

Making a difference

- Risk management

- Pricing / fees management

- Interchange management

- Rolling reserves management

Working for you

Working for you

- Merchants onboarding

- Terminal management

- Merchants accounts management

- Merchants reimbursements and statements

Working for your customers

Working for your customers

- Merchant portal and app

- Disputes management

- Reporting

- Multi-institution

- Multi-currency

Related products

Acquiring

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for both the merchant (POS) and the banking services world with (customised) ATM offerings, including ATM cash management, (Soft)POS.

Billing & Invoicing

Not payments but receivables are crucial to any business. Billing and invoicing are where it all starts. Speed, but also accuracy is key to stay away from time-consuming conflicts and needless corrections. With the merchant administration and portal tools, invoices can be automatically generated and payment statuses are always accessible and up-to-date.

Buy Now Pay Later

The Buy Now Pay Later service to consumers opens revenue streams for merchants by reaching new customer segments and extending existing ones.. The global Buy Now Pay Later industry was estimated at $90.69 billion in 2020, and is anticipated to hit $3.98 trillion by 2030.

eCommerce

The BPC e-commerce modules are easy to integrate with almost any CMS, in order to optimise the transaction flow. No need to worry about currencies either, you select the ones you need, and the system will cover any. Connection is key, so you can offer your ecommerce solutions on any device needed without limitations.

ACS 3D secure

The SmartVista Access Control Server (SV ACS). supports the maintenance of card enrolment, authentication of card and payment requests, and cardholder notification fully compliant with PA-DSS requirements and thus is ready for PCI DSS audits.