Real-time Payments

The Instant Alternative

Ever since the rise of real-time payment schemes around the world, instant payments - with not only direct initiation but also direct execution and settlement - have grown at an unprecedented pace. One only needs to look at what instant payments have done in India on the back of the UPI scheme. With settlement times of five seconds or less, it is easy to see how they are invading the traditional cards market share.

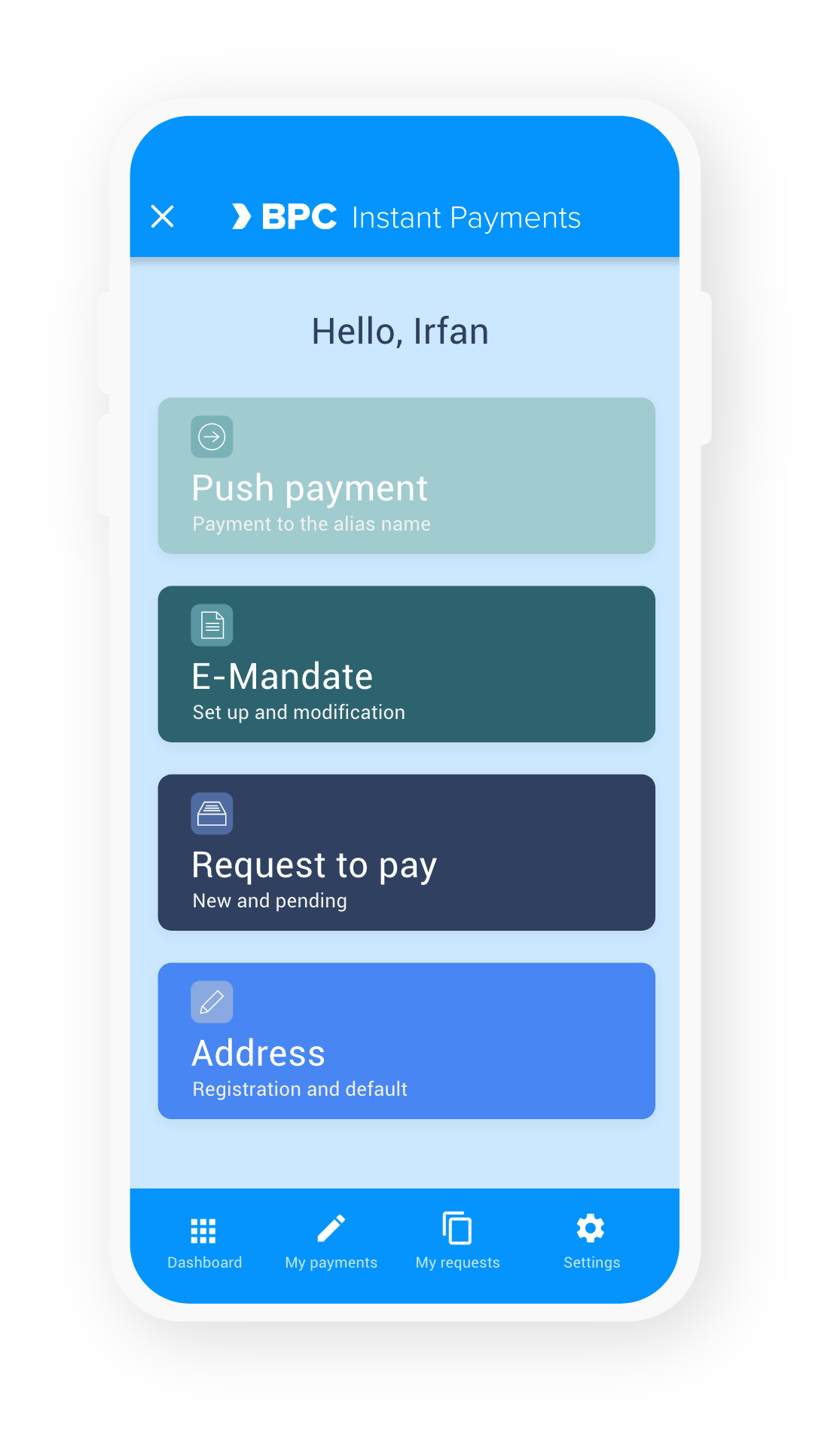

Consumers benefit, but small businesses even more. Request to Pay solutions too are built on the back of instant payments. They are here to stay and grow. Banks and PSPs need to embrace incoming and outgoing payments in real-time and connect them to their transaction banking platforms. It is therefore that SmartVista offers a scheme agnostic solution,enabling the connection to any instant payment scheme.

More than a payment - data puts instant on steroids

Real-time payments are great in terms of instant settlement, but the true value lies in connecting that payment to smart data. Think embedded payments without a POS device, in store or online where an entire eCommerce transaction is finalised with instant payments.

In the commercial world we see developments where duties are settled 24x7 independent of the availability of a customs officer, letters of credit attached to larger instant payment for critical shipments. Think adding a bill to instant delivery of food supplies to hotels and restaurants, enabling drivers to work faster and be safe without the need to carry cash.

SmartVista Instant Payments allows for the integration of real-time payments to a wide range of data sources through APIs. Together this forms a sound foundation for future facing digital banking.

Instant payments - instantly deployed

When entering the market with real-time payments, time is of the essence.

SmartVista Instant Payments has been designed to integrate into virtually any infrastructure. Implementation is speedy for a range of pre-configured online, offline and near real-time options are live today to integrate with core banking, channels but also affiliate solutions like sanctions screening, business activity monitoring and other solutions.

Having implemented instant payments around the world is an additional benefit in that experience counts for a lot when needing to ‘travel fast’.

Full circle instant payments support

Full circle instant payments support

The system allows for end to end processing of both inbound and outbound instant payments.

Pre-configured for ‘instant’ integration

Pre-configured for ‘instant’ integration

Speedy implementation is key, so a range of pre-configured assets are ready to connect you to any core, mobile banking, fraud, AML or other affiliate system. A range of APIs as well as full PSD2 readiness enable you to add value from the moment of launch.

Ready for any eventualities

Ready for any eventualities

Support for recalls and returns ensures all payments are handled appropriately. Time out management makes sure payments are picked up, checked and executed at the earliest instance.

Multi CSM and message format support

Multi CSM and message format support

The system is scheme and CSM agnostic and supports the most up to date range of real-time payments schemes live in the market today.

SmartVista Real-time Payments

Making a difference

Making a difference

- Established consultant to instant payment schemes

- Wide and tested connectivity to central bank interfaces

- Broad experience in IPS schemes globally

Working for you

Working for you

- Push and pull support

- Sophisticated realtime fraud prevention (SCA)

- Flexible configuration of payment flows & online editing

Working for your customers

Working for your customers

- Online limits and fee calculation

- Fully API enabled and PSD2/ UK Open Banking ready

- Mission critical updates and upgrades without service interruption

Related products

Payment Hub

Payments applications never operate in isolation. A significant portion of the effort required to implement a new software system at a financial institution revolves around integrating it into a variety of software systems and gateways - internal and external – and connecting it to multiple payment networks. BPC’s Digital Payment Hub takes care of the integration and connectivity.

Switch

Connect external devices such as POS terminals or ATMs and integrate with electronic and mobile payments. With SmartVista Switch from BPC, any issuer, acquirer and processor can manage the fast-moving payments landscape and deliver the best levels of service to their customers.

eGovernment

The SmartVista Government module is designed to ultimately create a cashless government. It allows tax collection, subsidy distribution and benefit payments, to give a few examples. A range of APIs can be used to integrate with the required systems to offer, manage and monitor public services within your chosen environment.

ATM and Kiosk Management

Connecting and managing payments in the digital and the physical world can be time-consuming. Here, BPC can unburden banks and third-party processors as much as possible with SmartVista ATM Management for efficient servicing and monitoring of a diverse range of ATMs and self-service kiosks.