Risk & Fraud Management

Watching any Level on Every Channel

Compliance for trust

Fraud is the one thing you want to prevent. Not just because of the financial losses it causes, but also because it can damage your brand.

Customers need to feel safe, so they can put their trust in you. We take your compliance seriously every step of the way: beyond KYC strategies and payments.

Anywhere any jurisdiction

You can focus on a good relationship with your customers, while SmartVista Fraud Management takes care of your Risk & Fraud Management.

For any jurisdiction and channel, on any level of your organisation.

Beyond a traditional rules engine

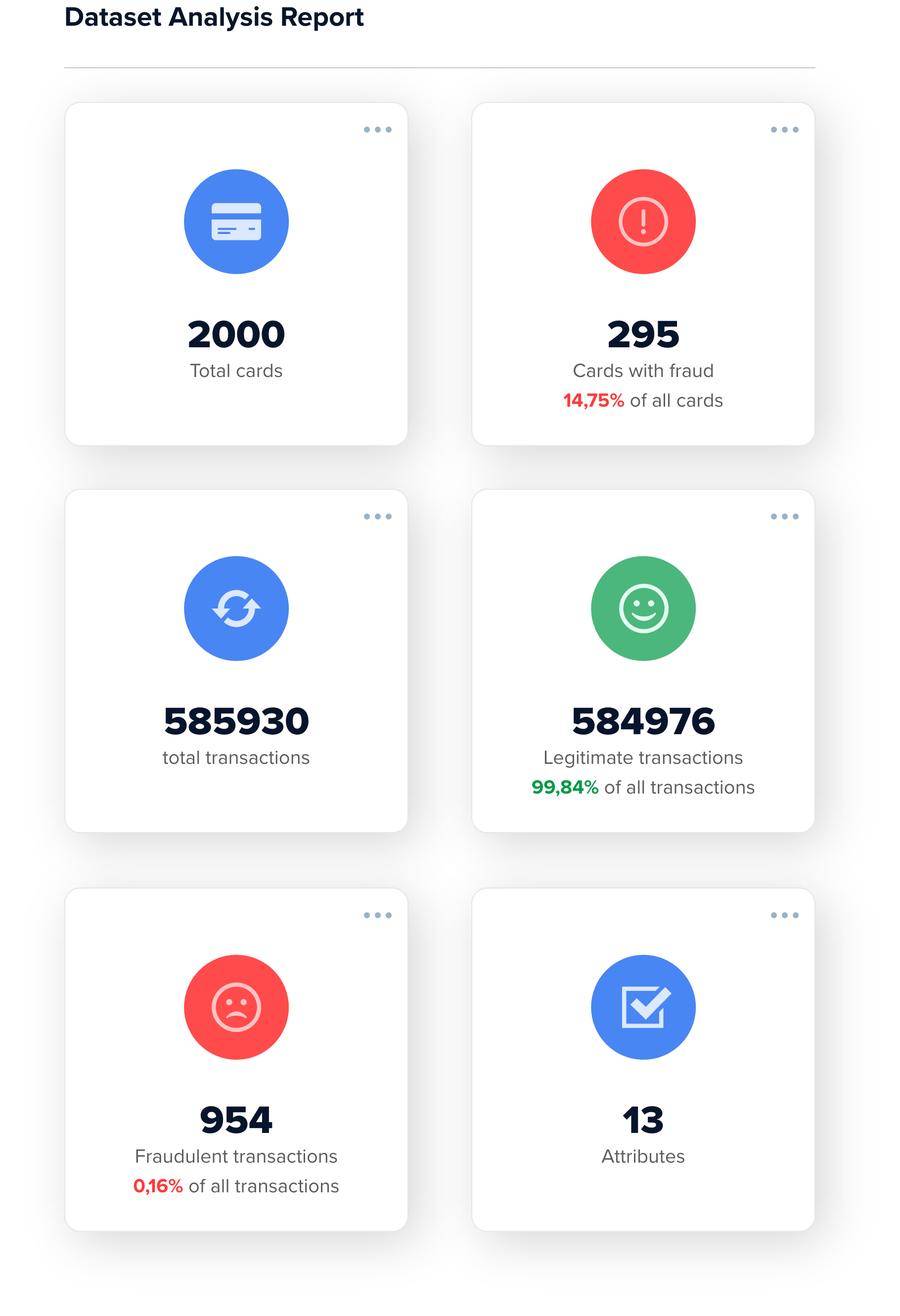

Machine learning is crucial for modern fraud prevention solutions like SmartVista Fraud Management. Machine learning offers speed, efficiency and scalability to combat fraud in an online, hyper-connected world.

This way more fraudulent transactions are identified while at the same time the number of false positives is reduced.

Checking all channels

Checking all channels

Combat the growing threat by monitoring 100% of transactions and drawing a 360 view of the customer across all channels, from his card usage online, in store, in-app, to core banking transactions, all in real-time across all channels in every jurisdiction you need. All information is monitored, used and re-used leading into a precise customer profile with common behaviour patterns.

Always up to date

Always up to date

The powerful and flexible rules engine enhanced with behaviour profiling and machine learning scoring models ensures that you can rapidly implement monitoring policies.

Check before you block

Check before you block

Check-in with your customers when abnormal payments are spotted. There is no need to stop or postpone a payment or block a payment instrument the time of the investigation,, which saves you and your customers a lot of hassle.

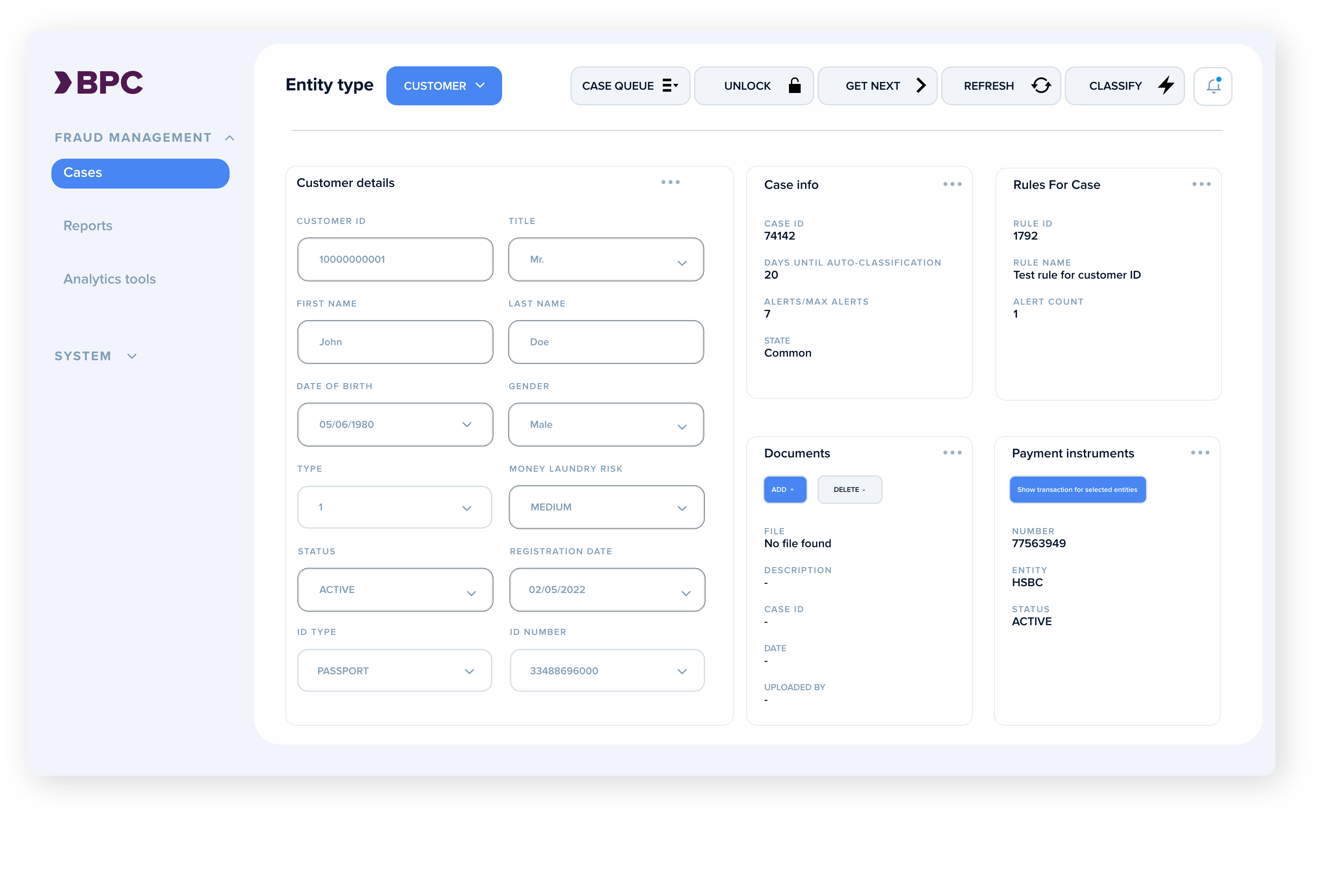

SmartVista Fraud Management

Making a difference

Making a difference

- Flexible and configurable data model, interface mapping and UI

- Machine learning models managed by end user

- Openness for configurable integration and customisation

Working for you

Working for you

- Multi-institution, enterprise prevention: internal and channels

- Customer profiling and case management

- White/Black/Fraud list management

Working for your customers

Working for your customers

- e-Commerce protection

- Dashboard and reporting

- Real-time transaction and behaviour monitoring

Related products

ACS 3D secure

The SmartVista Access Control Server (SV ACS). supports the maintenance of card enrolment, authentication of card and payment requests, and cardholder notification fully compliant with PA-DSS requirements and thus is ready for PCI DSS audits.

eCommerce

The BPC e-commerce modules are easy to integrate with almost any CMS, in order to optimise the transaction flow. No need to worry about currencies either, you select the ones you need, and the system will cover any. Connection is key, so you can offer your ecommerce solutions on any device needed without limitations.