Automated Fare Collection

Keep on Moving

Driving economic growth

Mobility is one of the key success factors for economic growth. So, governments and municipal public and private transportation companies need to focus on what people need for easy access to mobility services whilst running an optimal infrastructure and service schedule.

Experience is everything

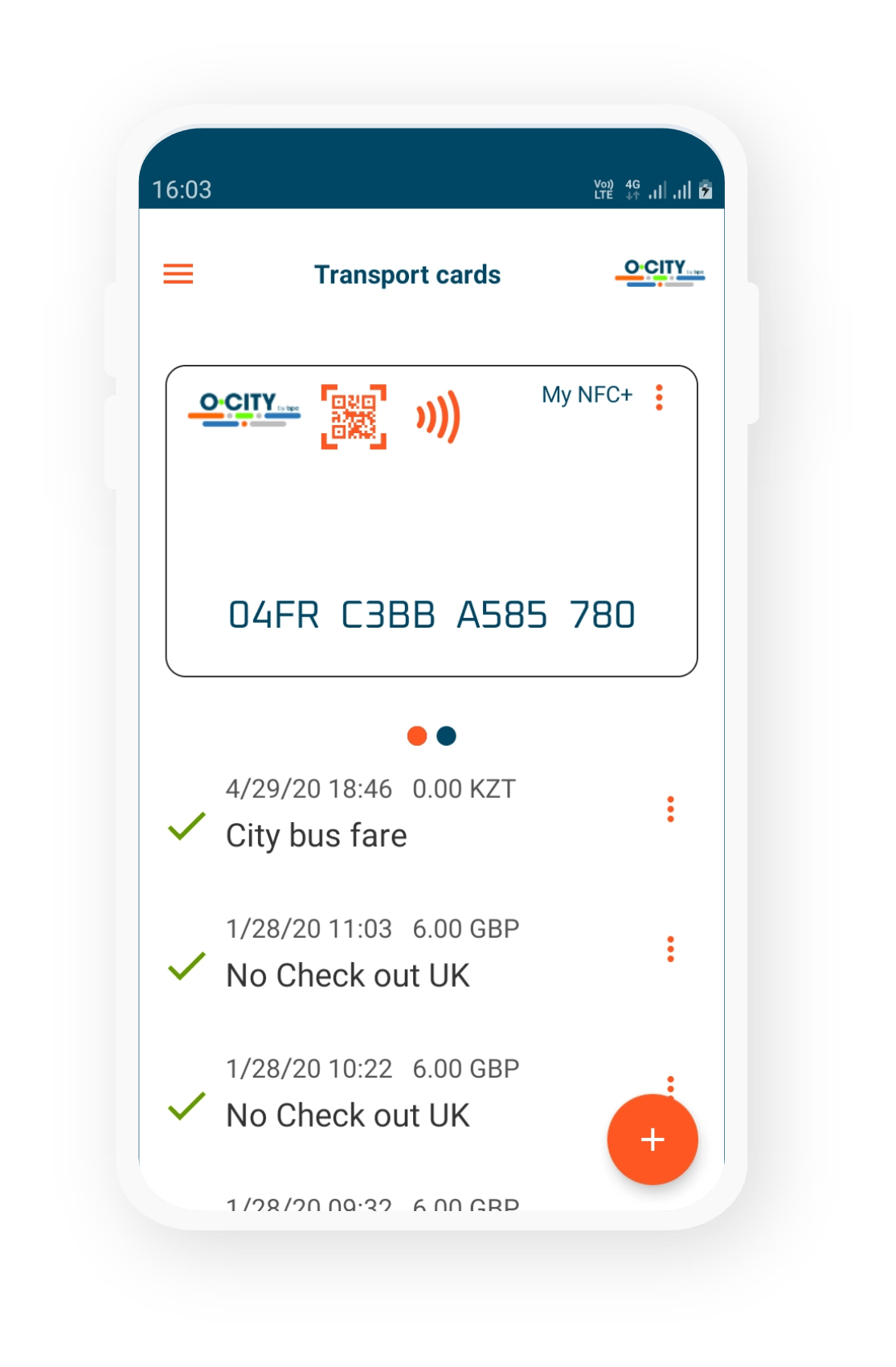

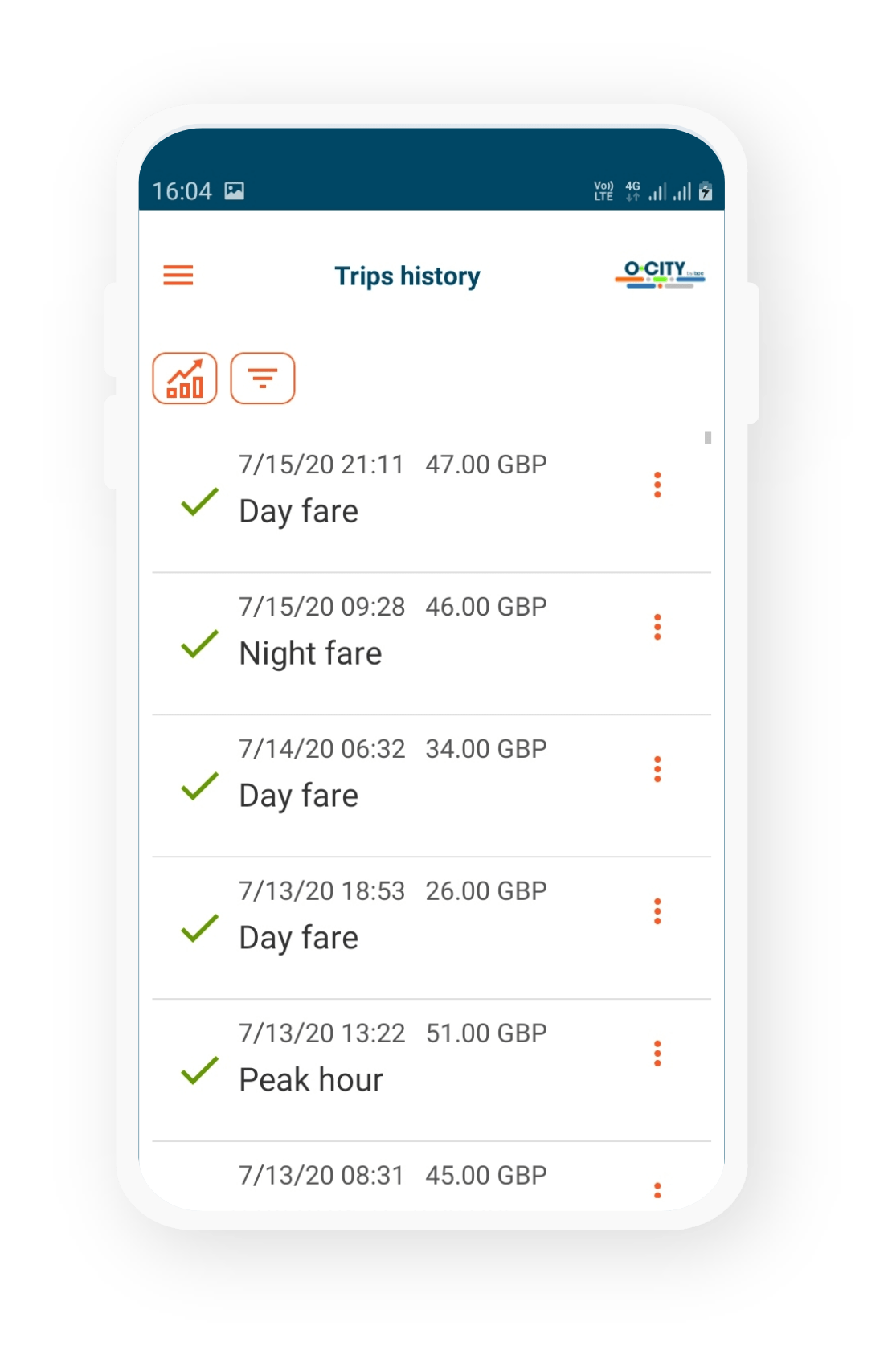

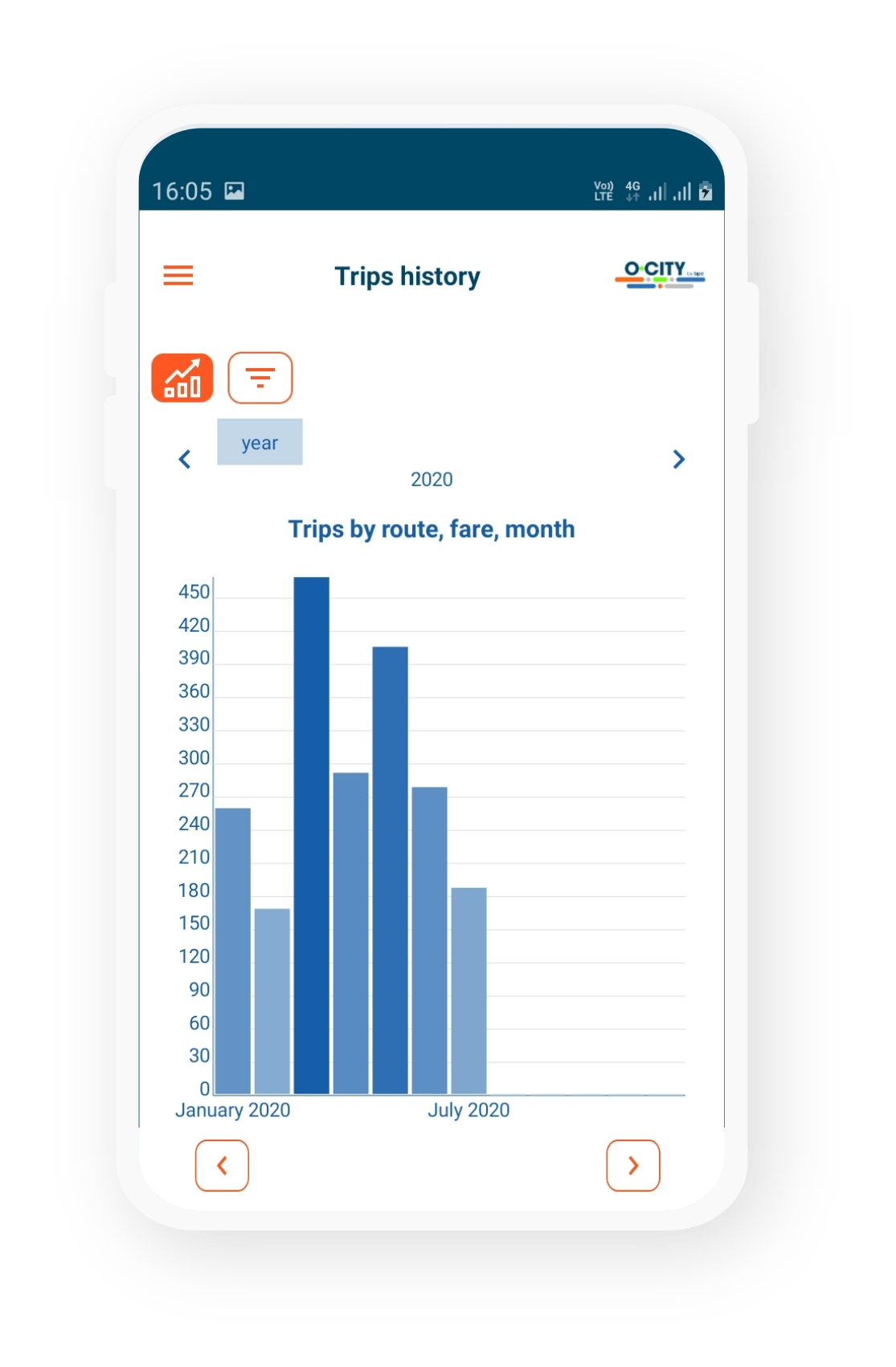

BPC’s Automated Fare Collection solution offers operators of commuter transport services efficient ways for mobile ticketing and collecting fares: across any device, contactless,fast, transparent and secure. This way they can provide simple and convenient payment options to make the service accessible to any commuter and easy to centrally manage for the operators.

Transparency for security

Mobile ticketing and Automated Fare Collection offer the high levels of transparency customers and business owners wish for. Give insights into ticket prices and significantly reduce the levels of abuse, theft, and fraudulent behaviour from drivers with digital payment for transport fares.

Hardware agnostic

Hardware agnostic

BPC’s Automated Fare Collection solution is hardware agnostic and can be installed on existing infrastructure, allowing to quickly add new fleet to the system within 24h

Reducing costs

Reducing costs

By automating the fare collection process, the costs of cash collection, ticketing, processing and encoding is reduced significantly.

Tap and go

Tap and go

Commuters can pay for their fares from a single account through the app, link their card to it and top up anywhere anytime.

O-CITY Automated Fare Collection

Working for Operators

Working for Operators

- Eliminate cost of cash handling

- Reduce operational expenditure associated with paper-ticket sales

- Efficiency gain by encoding, processing and distributing tickets electronically

- Cost reduction as a result of centrally managed ticketing system

- Reduced ticket fraud thanks to eliminating cash payments

- Manage data centrally and generate reports from dedicated portal

- Start operating quickly as a result of hardware agnostic properties

Working for Municipalities and Governments

Working for Municipalities and Governments

- Reduce expenditure on infrastructure servicing

- Unified e-ticketing system for access to various public services

- Gain easy way to manage and allocate subsidies

- Improve accessibility and attractiveness of services

- Transparent settlement with transport and other services

- Reduce fare evasion and free-rider problem

Working for the passengers

Working for the passengers

- Payment from a single account

- Account top up with a payment instrument of choice

- Seamless, rich customer experience

- Automatically getting access to best rates

- Loyalty programs, discounts and rewards

One city. One platform.

Adopted by more than 130 cities worldwide, O-CITY is an innovative automated fare collection solution for public transport operators and municipalities. The platform leverages a best of breed payment solution from payment expert BPC available in more than 100 countries.

Related products

eWallet

eWallets offers everything a classical wallet would offer and more. Digital wallets all start from the same core value proposition: offering mobile payments at large without the need for a bank account. This takes us to the next level of cash freedom anywhere: convenience and safety of a cashless future.

eGovernment

The SmartVista Government module is designed to ultimately create a cashless government. It allows tax collection, subsidy distribution and benefit payments, to give a few examples. A range of APIs can be used to integrate with the required systems to offer, manage and monitor public services within your chosen environment.

Fleet & Fuel

Fuel and fleet solutions are about much more than allowing drivers to pay for their fuel. A flawless digital user experience provides both fleet managers and drivers with great levels of flexibility and transparency. It is also a convenient way for fuel payment providers to engage and retain their customer base.