Nobody likes fraudsters and we tend not to think about them too much. But the lack of knowledge about the fraudster might be a huge disadvantage. Because when you don’t know who you’re dealing with, how do you recognise a fraudster?

To get an answer to that question, we first have to get to know the fraudster on a more intimate level. To really get to know fraudsters; one has to take a look at them closely. Let’s dive into the fraudsters’ world to understand their anatomy.

Internet: the natural habitat of the new fraudster

In a way, fraudsters are just like the rest of us ordinary people. For example, they’ve experienced digitalisation of their ‘profession’, just like any other person that legally tends to their needs. The new natural habitat of the fraudster is the internet: this is where they can find ways to enrich themselves at others’ expense.

Since 2020 online behaviour has changed a lot due to the global health crisis. People tended to do their shopping more and more online because of lockdowns, curfews and forced physical distance. E-commerce boosted, and this led to the massive adoption of online payments worldwide. Never before has cash usage been this low. A trend that is seen worldwide, but especially in mature digitalised countries. Internet is now the place to be for any entrepreneur, and fraudsters tag along.

Fraud in the digital payment market

As of 2020, payment with alternative payment methods has accelerated: contactless NFC and QR codes and bank apps are connected with the most popular marketplaces. The payments at Amazon, eBay, AliExpress, Mercado Libre, Rakuten and Zalando have never been this high and this frequent.

Many things are changing, and this might have consequences for the damage fraudsters can cause:

- The global payments market is estimated to be worth $2 trillion by 2025,

- Over the next five years, the global payments market is expected to lose up to $200B due to fraud.

- The payment business faces a sharp increase in card fraud, particularly in the Card-not-Present (CNP) space.

- CNP Fraud increased by 70% in 2020

- According to the latest Nilson report, global card fraud losses will have exceeded $32 billion by 2021.

These figures show you the immense range of the payment market where fraudsters will try to take their chance. The more reason to look at the anatomy of fraudsters for better protection against their practices.

The fraudster you already know

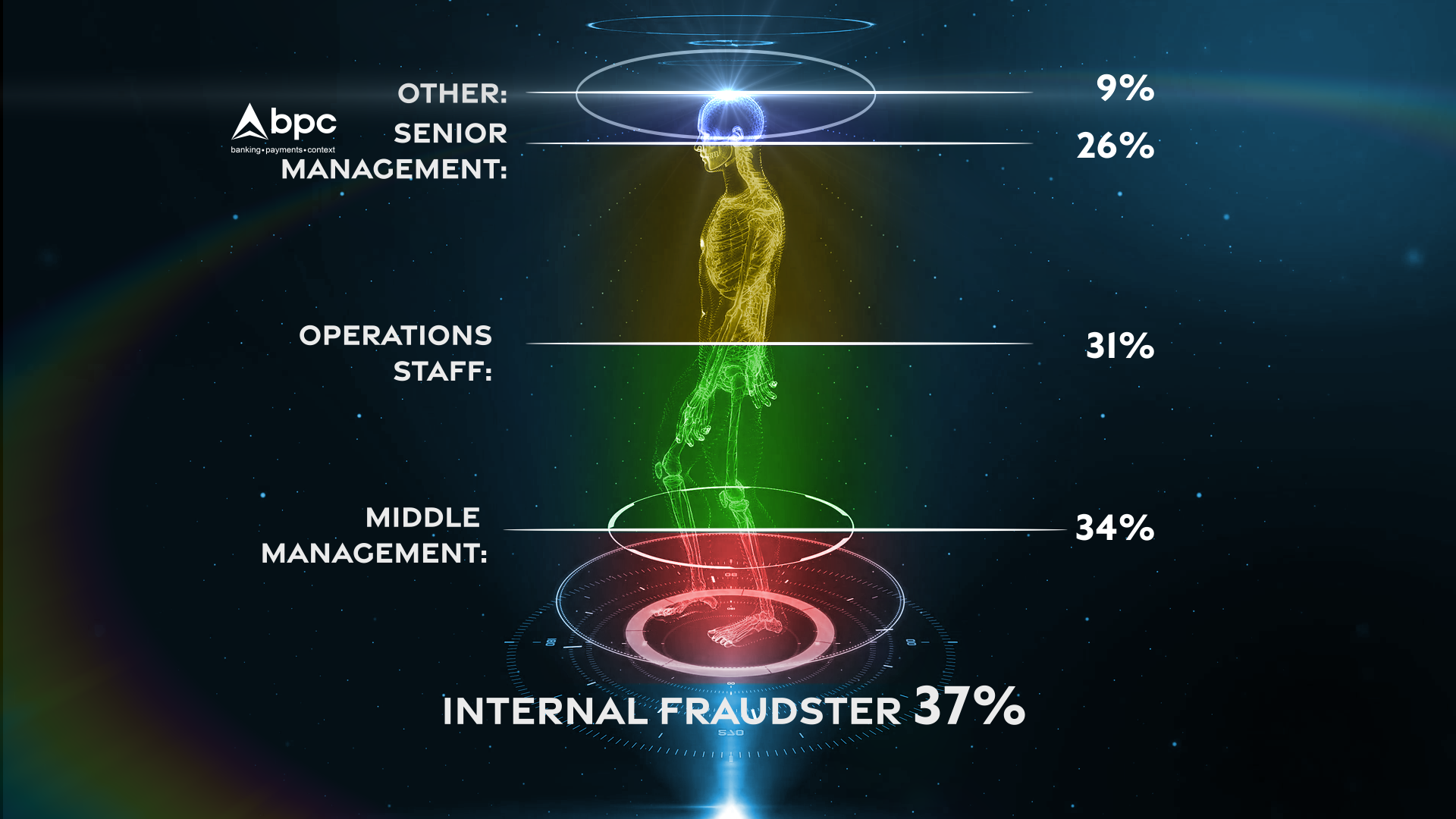

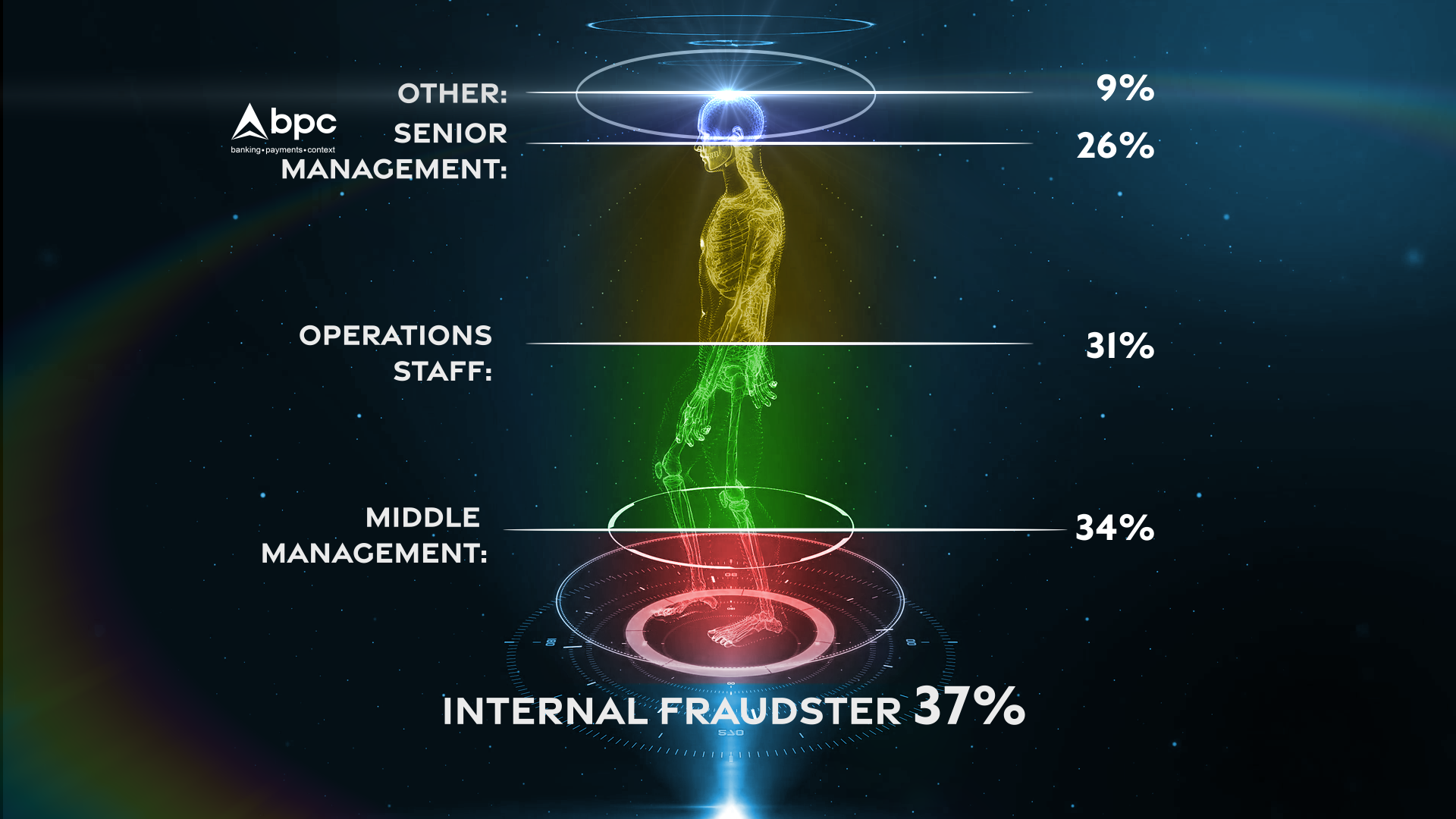

We tend to think that fraudsters are some kind of shady undefinable figures in far away countries. But internal fraudsters, or occupational fraudsters represent a major internal threat for businesses and organisations.

So as it happens, you might know the fraudster (a lot) better than you think. According to an extensive survey, conducted by the Association of Certified Fraud Examiners (ACFE):

- 65% of internal fraudsters are employed by the company

- 38% of whom have been with the company for over 6 years.

- These employees cause twice the amount of average fraud losses ($200K).

Another remarkable finding is that you can find fraudsters all through an organisation, but 20% of internal fraudsters work at an executive/C-Level. Fraudsters that act at the top of an organisation cause the highest amount of average fraud loss ($600K). These people have authority and build trust inside the company, which often enables them to override internal control.

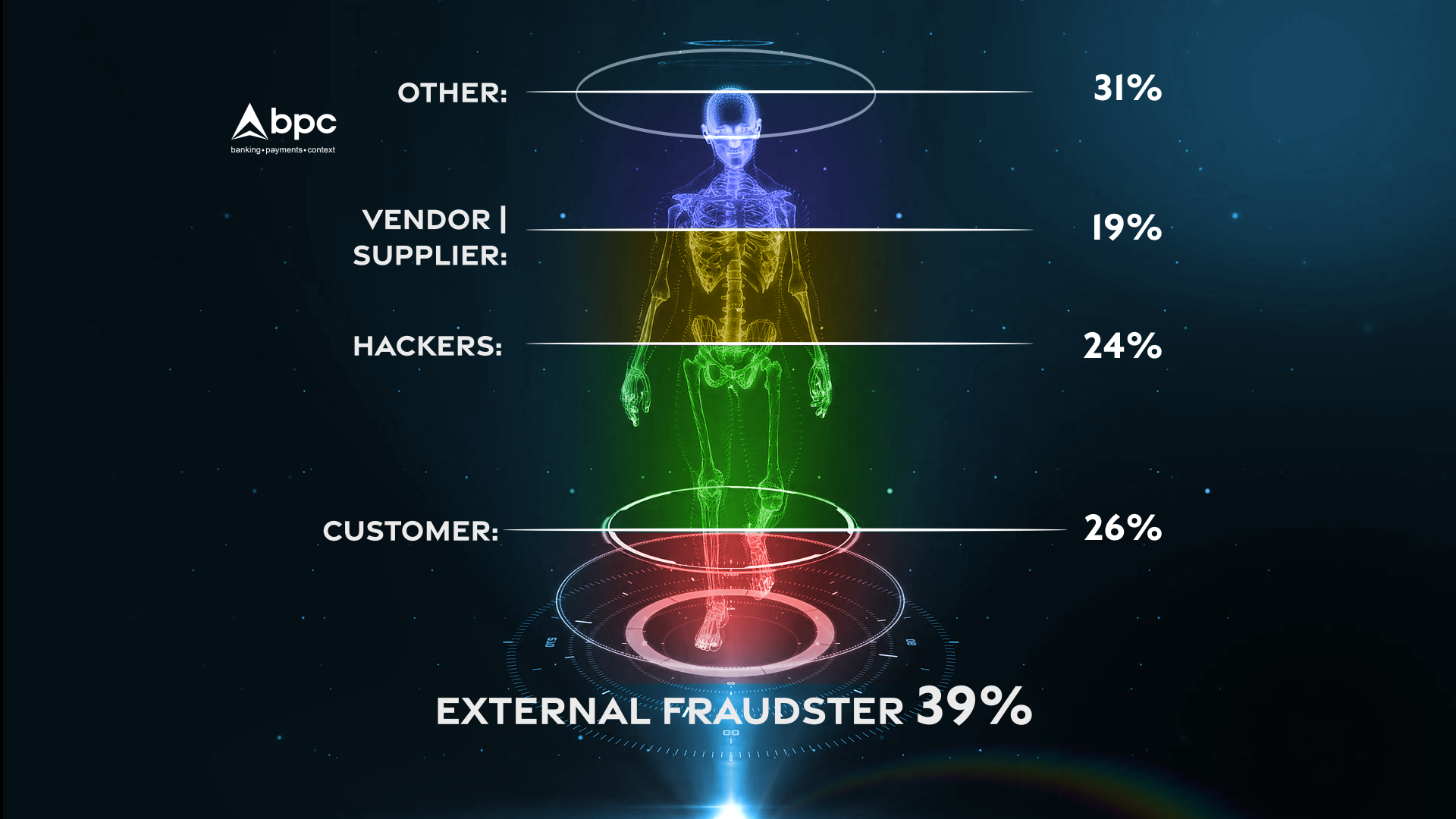

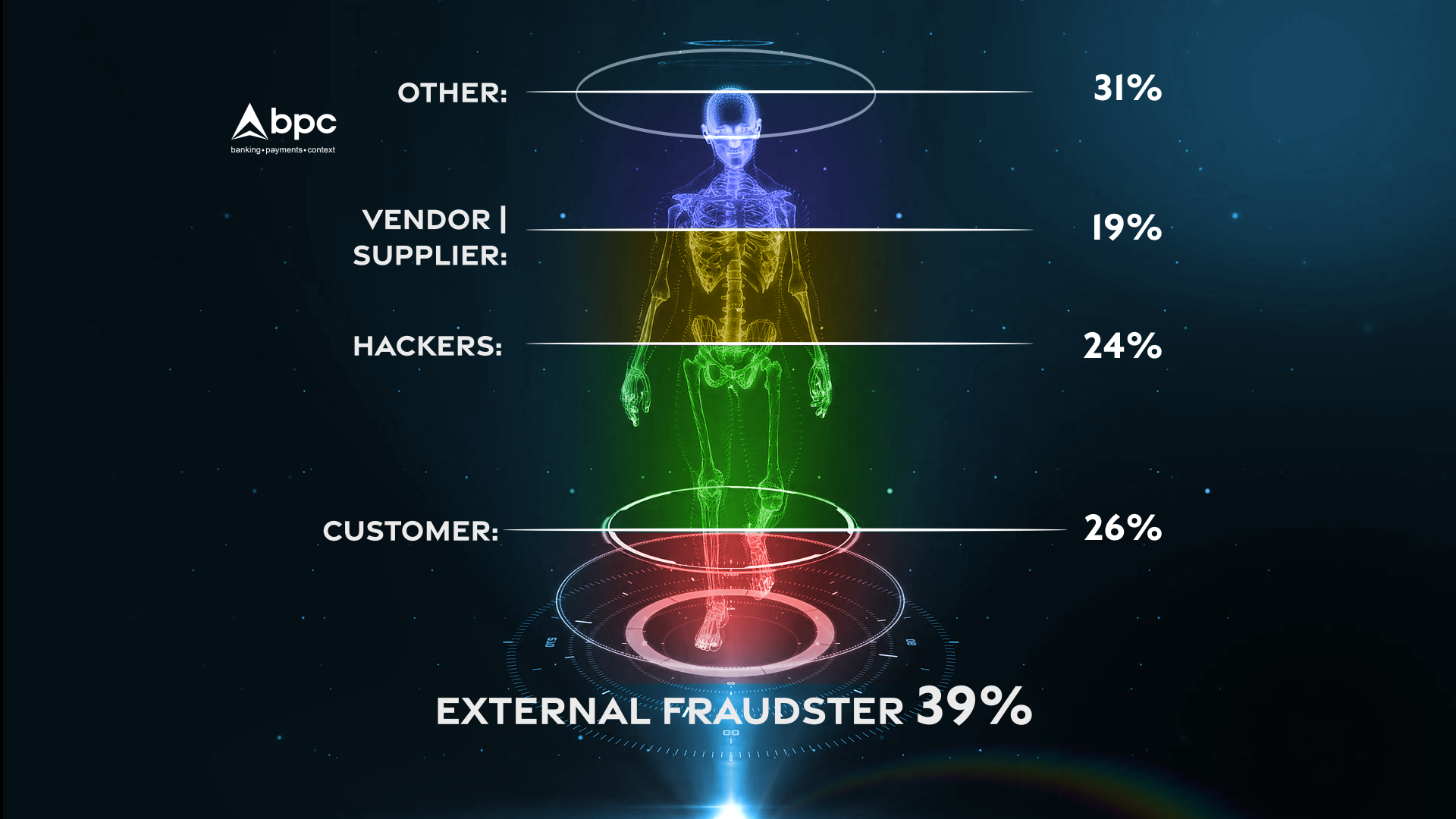

The fraudster you don’t know (yet)

Still, there are many fraudsters you don’t know. It is equally important to have an understanding of the external fraudster. Hackers, customers, vendors and suppliers can cause damage to your business in many ways:

- Fraudulent customers might submit bad checks or falsified account information for payment. Or they attempt to return stolen or knock-off products for a refund.

- Dishonest vendors might engage in bid-rigging schemes, bill the company for goods or services not provided, or demand bribes from employees.

- In addition, organizations also face threats of security breaches and thefts of intellectual property perpetrated by unknown third parties.

- Other examples of frauds committed by external third-parties include hacking, theft of proprietary information, tax fraud, bankruptcy fraud, insurance fraud, healthcare fraud, and loan fraud.

Companies try to speed up since the pandemic boosted online sales. Often this means that they face supply chain challenges as a consequence of the suddenly increased customer demand. Companies under pressure often turn to alternative suppliers and delivery companies. Due diligence procedures to prevent fraud may be skipped. This means these businesses are exposed to an increased risk of fraudulent or inexperienced suppliers. Not to mention the risk of employees colliding with third parties.

The risk of bribery has risen as well, since the pandemic increased business deals between companies and potentially corrupt government officials. Especially in countries where corruption is rampant.

Let’s get to know each other

One of the best ways to prevent fraud is to know who you are dealing with. Customer (KYC) and business (KYB) identification and authentication programs are key. Screening, identity verifications and in-depth analysis of the risks of new or existing relationships have to be done.This may seem time consuming, but can save a lot of money in the end. A great part of these processes can be automated. For example by artificial intelligence that recognizes fraudulent patterns, but the identifications and other safety measures can also be automated. Knowledge about fraud and automated fraud management systems are the tools for the online detective to keep your company and it’s business safe.