The BPC Blog: | Digital Banking

Latest Posts

What is next for Asia Pacific payments market in 2026. BPC predictions.

Asia Pacific continues to set the pace for digital payments. Wallets, QR, instant payments and embedded finance are no longer emerging capabilities, they are reshaping how banks,..

Are you prepared for 22 of November? Jumping on the ISO 20022 train.

As the global payments industry moves beyond the initial adoption of ISO 20022, a new phase is taking shape, one defined by continuous evolution, richer data capabilities, and the..

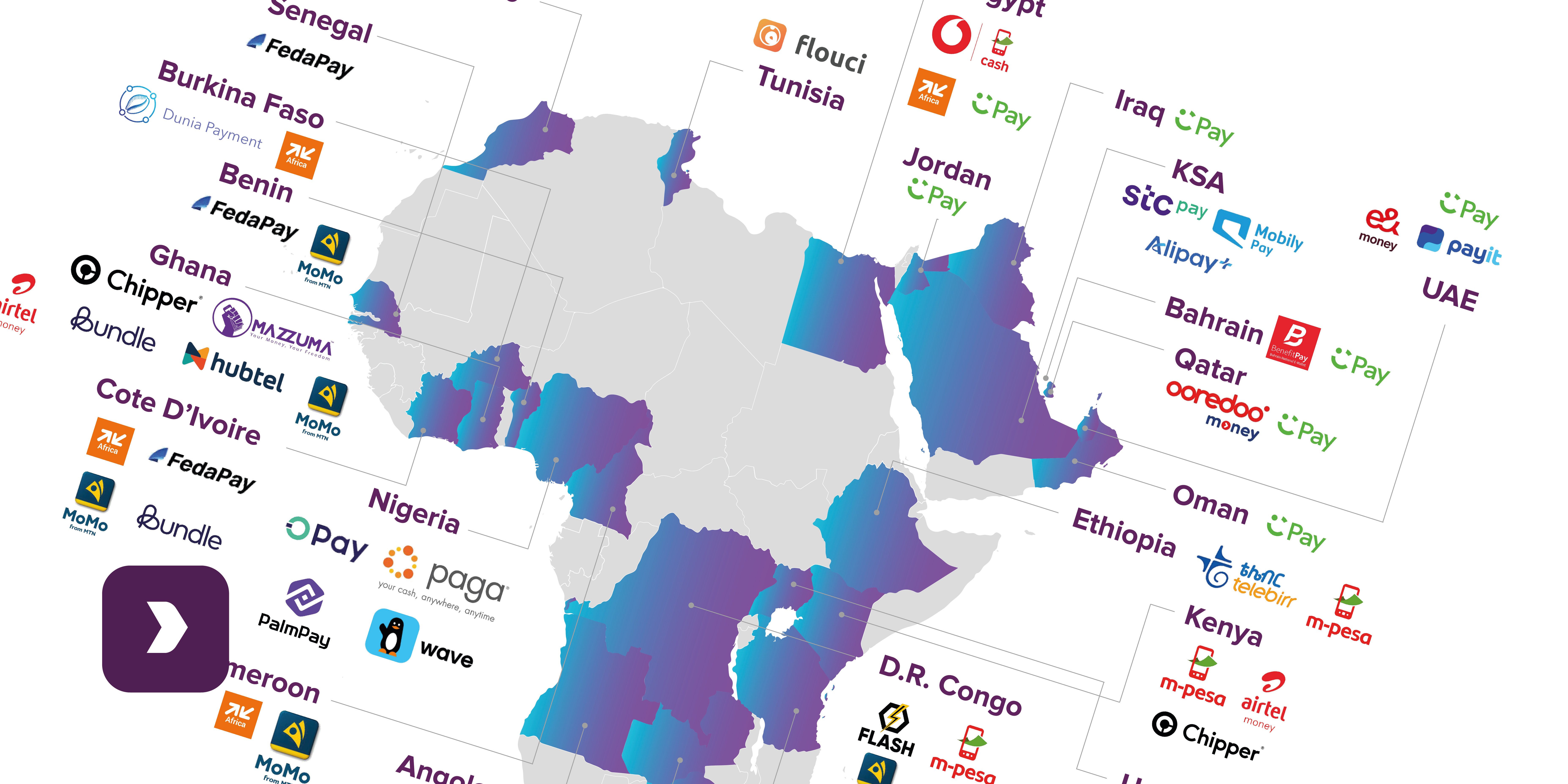

MEA’s dual wallet landscape

Across the Middle East and Africa, wallet ecosystems have evolved in line with local market realities, from telecom-led payment platforms to interoperable digital wallets. The..

Beyond Just Payments: The Diversity of APAC’s E-Wallet Market

In Asia Pacific, digital wallets are no longer viewed as experimental add-ons to cash or cards. They have become everyday tools used to pay, transfer, and save, with adoption..

Digital Functionality Can Help APAC Banks Win Over SME's

Small businesses play a vital role in Asia Pacific’s economy, accounting for the majority of enterprises and a significant share of employment. McKinsey Global Institute..

Europe’s Wallet Evolution

Europe is undergoing a decisive shift in the way people manage their financial lives. Digital wallets already represent 44 percent of e-commerce payments across the continent, a..

APAC’s Next Era of Retail Digital Banking

Retail banking in Asia Pacific is entering a new chapter. Financial institutions are no longer simply digitalising processes; they are reimagining how banking is designed and..

ISO 20022 is the Beginning of Smarter Banking

Over the last few posts, we’ve explored ISO 20022 from different angles: its urgency, the practical hurdles, and the importance of choosing the right technology partner. Now, as..

Not All Vendors Are ISO 20022-Ready, So How Do You Find the Right One?

In our second blog, we touched on the tension many institutions face, between wanting to get migration done and dealing with limited resources. Some banks choose to implement just..