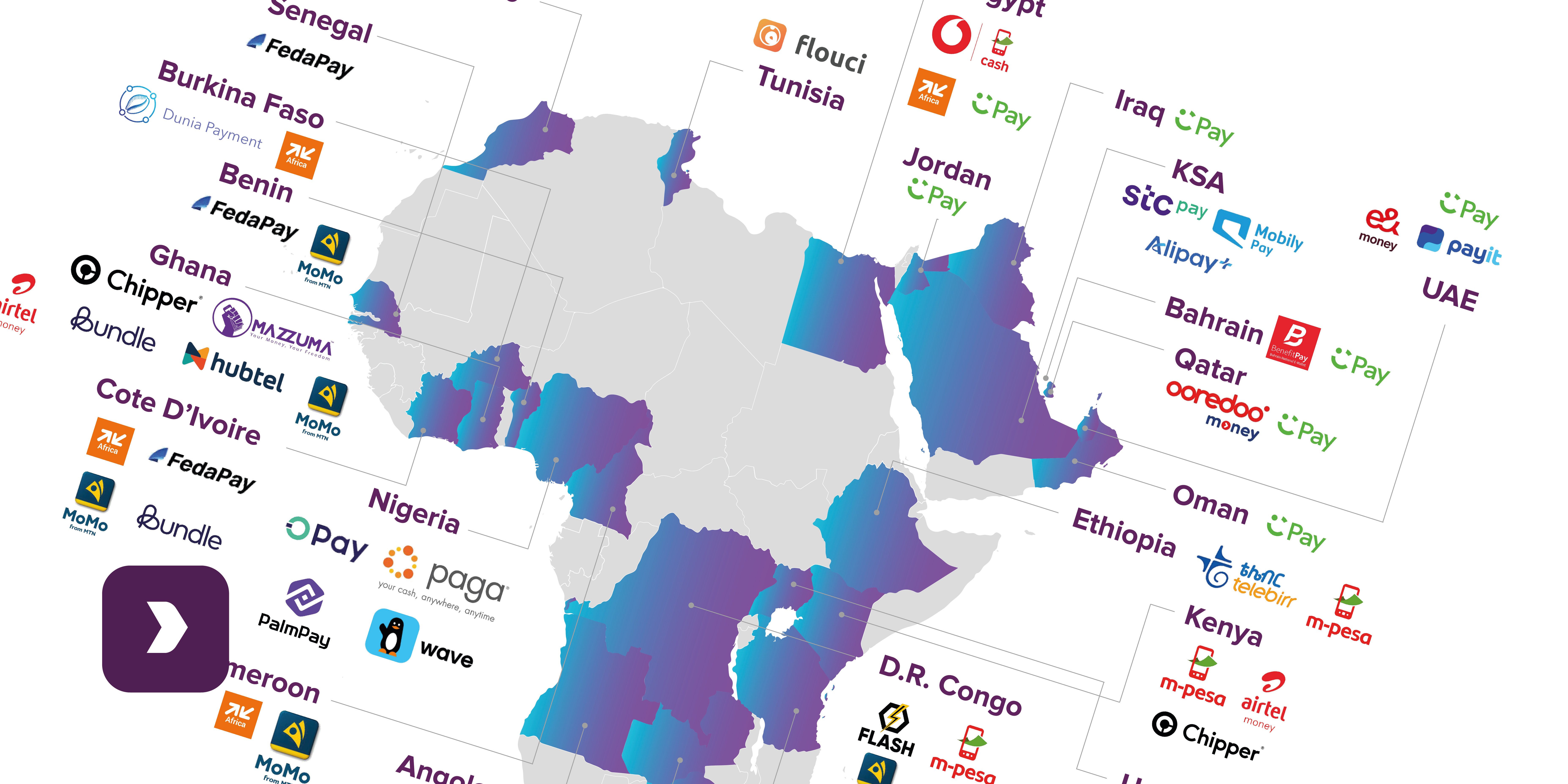

Across the Middle East and Africa, wallet ecosystems have evolved in line with local market realities, from telecom-led payment platforms to interoperable digital wallets. The region presents a diverse mix of closed-loop and open-loop models, each shaped by local regulatory frameworks, banking maturity, and consumer adoption patterns.

The MEA region’s digital wallet market is advancing rapidly. According to research from BlueWeave Consulting the MEA digital-wallet market was estimated at about USD 20.5 billion in 2023 and is forecast to grow at a compound annual growth rate (CAGR) of around 19.7 % through to 2030, reaching roughly USD 72.4 billion. Globally, the GSMA reported that mobile-money registered accounts surpassed 1.2 billion in 2020, with much of the growth coming from Africa. In subsequent years the numbers have kept rising: as of 2024, there were over 2 billion registered mobile-money accounts worldwide and more than 500 million active monthly accounts.

In the Middle East specifically, digital payments are gaining traction as real-time payments markets accelerate: the region is described as the fastest-growing real-time payments market globally, driven by younger, tech-savvy populations and strong government backing of digital infrastructure. These trends underscore that MEA is not monolithic, parts of Africa (particularly sub-Saharan) emphasise mobile money and telco-led wallets, while in the Gulf (GCC) region more bank-infrastructure, fintechs and open-loop wallet models are advancing.

Closed-loop wallets are most common in markets where mobile operators or retailers dominate access to financial services. These wallets operate within defined ecosystems, offering users an entry point into digital payments without requiring a bank account. By combining payments with loyalty, airtime, and lifestyle services, they build engagement and retention, particularly among unbanked or underbanked populations.

According to the newly published “Your Essential Guide on How to Build Closed and Open-Loop Wallet Ecosystems”, there are many existent successful closed-loop wallets, and here are few examples:

- MTN MoMo (Pan-Africa) – Operated by MTN Group, one of Africa’s largest telecom providers, MoMo serves over 70 million active users across 16 markets including Ghana, Uganda, and Côte d’Ivoire. It allows P2P transfers, airtime purchases, bill payments, and merchant transactions within its own ecosystem. The service’s deep integration with mobile connectivity makes it a cornerstone of financial inclusion in sub-Saharan Africa.

- STC Pay (Saudi Arabia) – Launched by Saudi Telecom Company, STC Pay has become one of the most recognized fintech brands in the GCC. Initially designed as a telco-linked wallet, it now offers domestic and international transfers, salary disbursement, and retail payments, all while maintaining exclusive loyalty programs for STC customers.

- eZCash (Sri Lanka, adapted in East Africa) – Although originating outside Africa, eZCash’s model, a closed ecosystem connecting telecom users, local merchants, and government services, has influenced similar frameworks in East African markets, showing how localized ecosystems can achieve financial penetration where traditional banking remains limited.

- Careem Pay (UAE) – Embedded within the Careem super-app, Careem Pay facilitates payments for rides, deliveries, and food orders. Its integration of rewards and in-app spending illustrates how regional super-apps are increasingly moving towards financial service convergence.

In contrast, open-loop wallets in the region are expanding rapidly, particularly in markets with maturing regulatory frameworks, digital ID systems, crypto acceptance and strong banking infrastructure. These wallets connect with international card networks such as Visa, Mastercard, and UnionPay, enabling users to pay across merchants, borders, and channels. They are essential for creating a seamless digital economy that bridges local ecosystems with global commerce.

Some of the leading open-loop wallets include:

- Mashreq NeoPay (UAE) – A fully digital payment solution integrated with Mastercard, NeoPay supports in-store, online, and cross-border transactions. It serves both individual and SME customers, emphasizing security and interoperability across payment channels.

- FawryPay (Egypt) – Built on Egypt’s largest electronic payment network, FawryPay links wallets directly with Visa and Mastercard acceptance infrastructure. It has become a backbone for online and in-store payments, allowing users to pay bills, transfer funds, and shop digitally, fostering greater trust in digital finance.

- M-PESA Global (Kenya) – The global extension of Kenya’s pioneering mobile money service connects M-PESA users to the international financial system. Through partnerships with Mastercard and Western Union, it enables remittances, online payments, and card-linked transactions, setting the standard for mobile-first financial innovation.

- Zain Cash (Iraq and Jordan) – Supported by the Zain telecom group, Zain Cash combines mobile money and open-loop capabilities. It links users to Mastercard-enabled cards, expanding access to international e-commerce and digital marketplaces for populations with limited banking options.

Governments and regulators across MEA are also accelerating interoperability initiatives to bridge fragmented ecosystems. Central banks in Egypt, Saudi Arabia, Nigeria, and the UAE are actively introducing frameworks that allow wallets, banks, and fintechs to interconnect. The GCC’s move towards unified QR standards, Nigeria’s instant payment switch (NIP), Somalia’s SOMQR, and Egypt’s Meeza digital scheme are examples of how public-sector coordination is driving ecosystem cohesion.

These developments are particularly significant for Sub-Saharan Africa, where large segments of the population remain outside the formal banking system, yet mobile access is almost universal. By modernising payment rails, countries across the region are building the foundations of a hybrid digital payments ecosystem, one that preserves the accessibility and trust of mobile wallets while extending the reach and interoperability of card-based infrastructure.

In the years ahead, this dual-wallet approach will define how millions across the Middle East and Africa transact, borrow, and save — bridging the gap between cash-heavy and digitally enabled economies. For banks, fintechs, and mobile operators, the next phase of growth will depend on how effectively they can connect closed and open ecosystems to deliver scale, security, and financial inclusion at once.

BPC’s “Essential Guide on How to Build Closed and Open-Loop Wallet Ecosystems” delves deeper into the frameworks, technologies, and real-world use cases shaping these models. From regulatory readiness to architecture design and monetisation strategies, the guide provides a practical roadmap for institutions seeking to modernise their digital payment ecosystems and capture the next wave of wallet innovation across MEA.

Explore the full guide “Your Essential Guide on How to Build Closed and Open-Loop Wallet Ecosystems”, to understand how your organisation can build, connect, and grow within MEA’s evolving wallet landscape.