eCommerce

The Next Level of Safe Convenience

All you need is trust

Your clients need to know that their payments are handled efficiently and accurately. Their trust is what you need.

Everyone involved in the transaction, from the customer to the issuer, needs to feel assured that payments will go through smoothly, swiftly and safely

With or without third parties

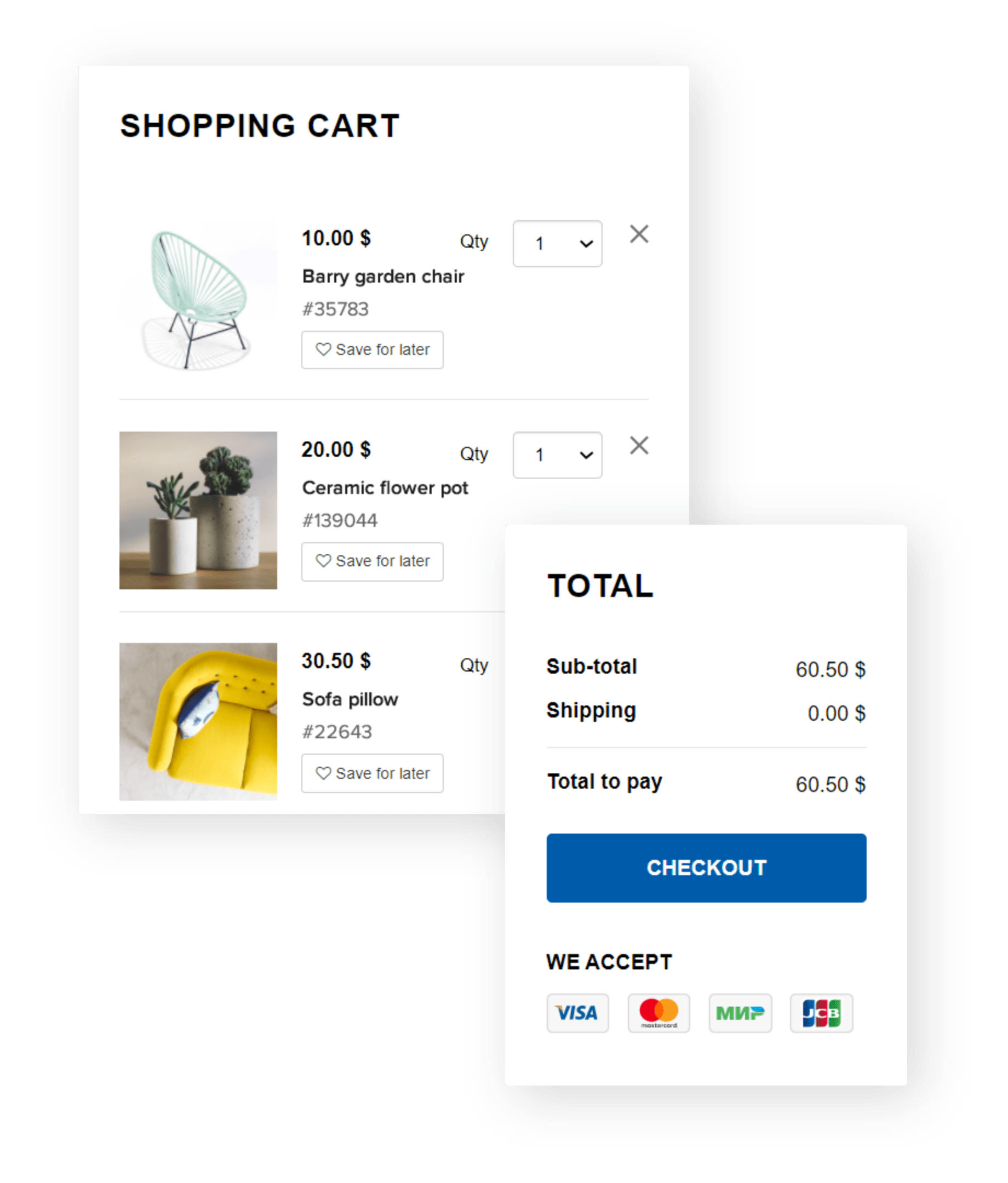

Use it as a complete solution, removing any dependence on third parties, or choose individual components to enhance an existing internet payment platform, with merchant third party services.

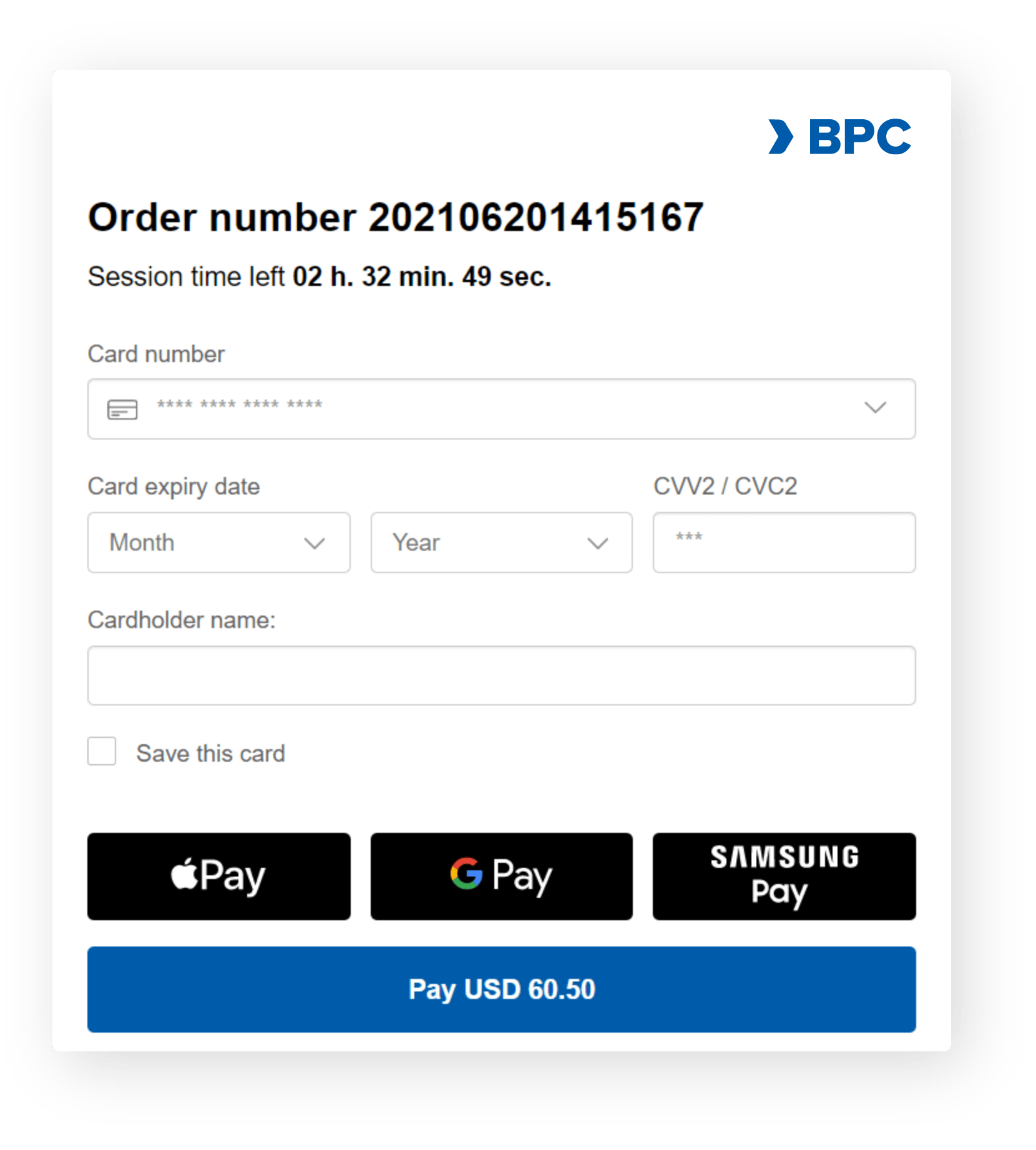

Any payment can be processed thanks to the variety of options, from standard card payments to eWallet based -payments and even crypto transactions.

No limits

The BPC e-commerce modules are easy to integrate with almost any CMS, in order to optimise the transaction flow.

No need to worry about currencies either, you select the ones you need, and the system will cover any.

Connection is key, so you can offer your ecommerce solutions on any device needed without limitations.

Holistic security

Holistic security

Ensure the privacy and security of internet payments by combining 3D Secure authentication and certification with a sophisticated anti-fraud and risk-based authentication system (RBA).

Plug and enhance

Plug and enhance

Enhance existing eCommerce systems with 3D secure and access control server (ACS) in addition to out of band authentication components. Our API Sandbox opens up an even wider connectivity play.

Growing the future

Growing the future

A wide range of payment options and types is supported — everything from e-wallets to embedded customer profiles. Easily adjustable to future payment options.

SmartVista eCommerce

Making a difference

Making a difference

- State-of-the-art gateway for internet payment processing

- Enhance existing scheme with popular merchant CMS plugins with API and Sandbox for testing purpose

- Processing any to any including Wechat, Alipay, Applepay, crypto and more

Working for you

Working for you

- Offering a full transactions eCommerce to Marketplace platform

- Scale and extend at any moment in time to any region

Working for your customers

Working for your customers

- Visual toolkit to easily design integrations

- Business logic supports the building business processes in a low code manner

- The latest payments specific protocols and connectors

Related products

Acquiring

Beyond cards and any digital and contactless payment form, BPC offers acquiring services and solutions for both the merchant (POS) and the banking services world with (customised) ATM offerings, including ATM cash management, (Soft)POS.

Risk & Fraud Management

ACS 3D secure

The SmartVista Access Control Server (SV ACS). supports the maintenance of card enrolment, authentication of card and payment requests, and cardholder notification fully compliant with PA-DSS requirements and thus is ready for PCI DSS audits.

Merchant Management

Meeting expectations seems more and more complicated. In the digital world as well as in real life, the bar is set high when it comes to payments. The BPC’s Merchant Management module offers a wide range of payment instruments, and it is vital to propose the right solutions and service levels to merchants.

Billing & Invoicing

Not payments but receivables are crucial to any business. Billing and invoicing are where it all starts. Speed, but also accuracy is key to stay away from time-consuming conflicts and needless corrections. With the merchant administration and portal tools, invoices can be automatically generated and payment statuses are always accessible and up-to-date.

Buy Now Pay Later

The Buy Now Pay Later service to consumers opens revenue streams for merchants by reaching new customer segments and extending existing ones.. The global Buy Now Pay Later industry was estimated at $90.69 billion in 2020, and is anticipated to hit $3.98 trillion by 2030.