Who is the new fraudster? The answer to this question is critical in fraud prevention. Because you must know who you are dealing with to protect your organisation.

These are the main things you need to know about the anatomy of the new fraudster:

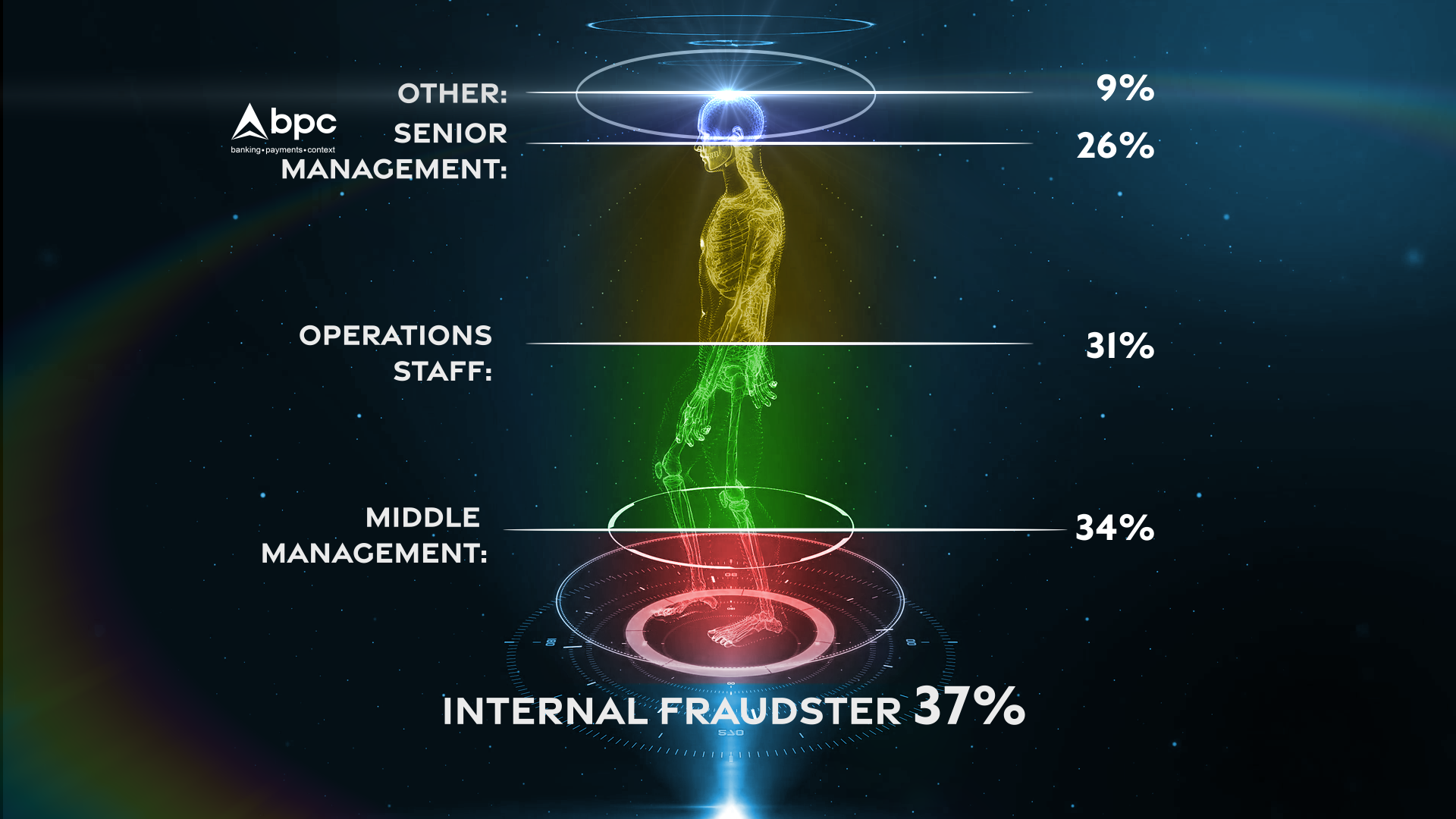

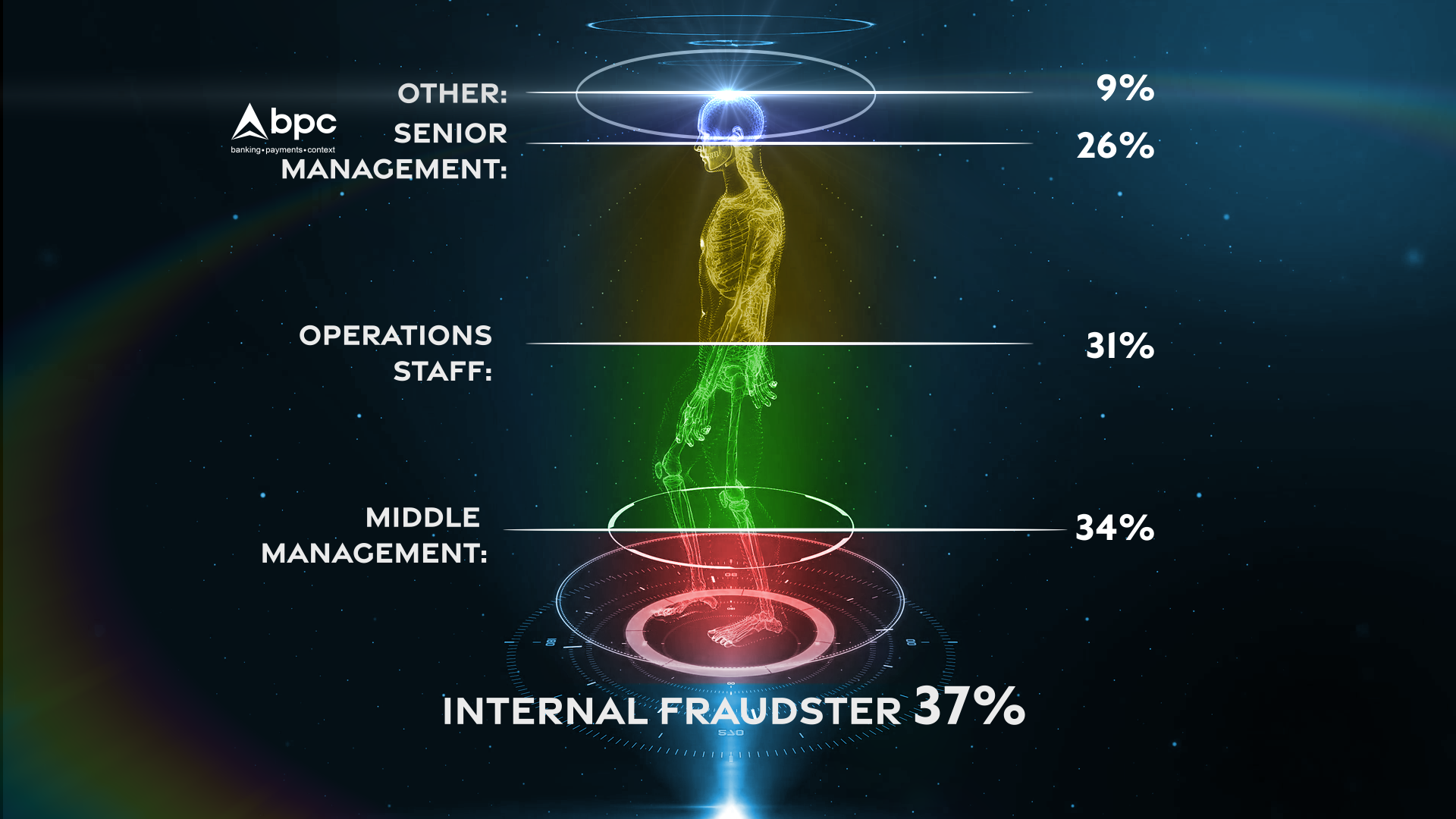

1. You might know the fraudster a lot better than you think

It is not always an anonymous hacker that tries to commit fraud. Although we sometimes would like to think otherwise, you already know some of the fraudsters preying on your business. The internal fraudster is responsible for more than a third of the fraud damages. Up to 65% of the internal fraudsters are employed by the company. Do not forget to check and screen your internal procedures to understand fraud and develop better protection against it.

2. It’s not always the new one

Of course, it is only human to trust the people we know. But at the same time, you should be aware that 38% of the internal fraudsters that the company employs have been with the company for over six years. The longer people work for a company, the better they get to know the way things work. This knowledge makes it easier for them to commit fraud. Internal fraudsters that have been employed for longer than six years cause twice the average fraud losses ($200K).

3. Easier at the top

Fraudsters are present in all ranks of the organisation. But there is one specific group of internal fraudsters that cause the highest amount of average fraud loss ($600K). These are fraudsters that work at an executive or C-level. 20% of the people that commit fraud work at this level. It is easier for them to commit often undetected fraud because they have authority and build trust inside the company. They can easily override internal control mechanisms.

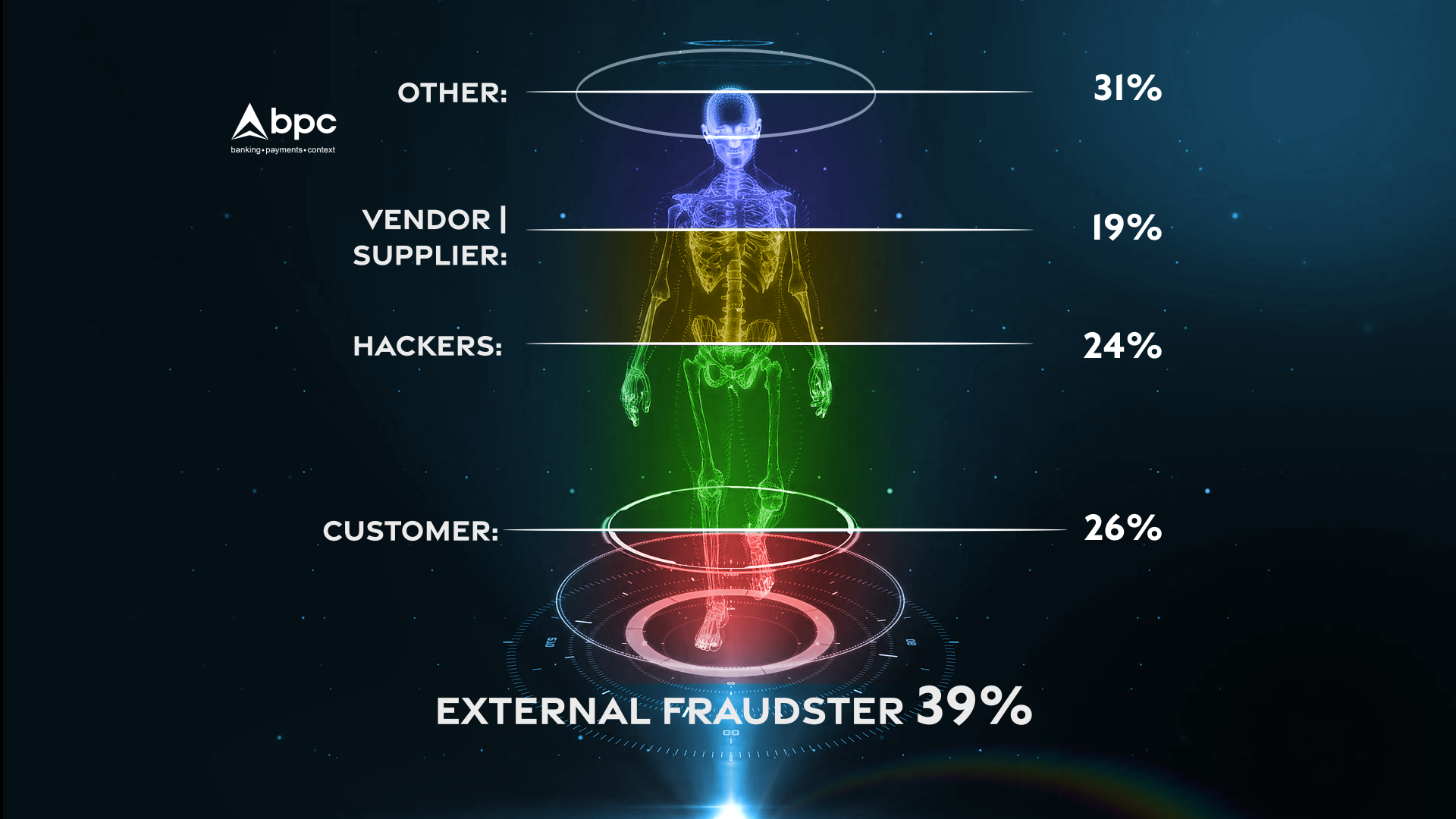

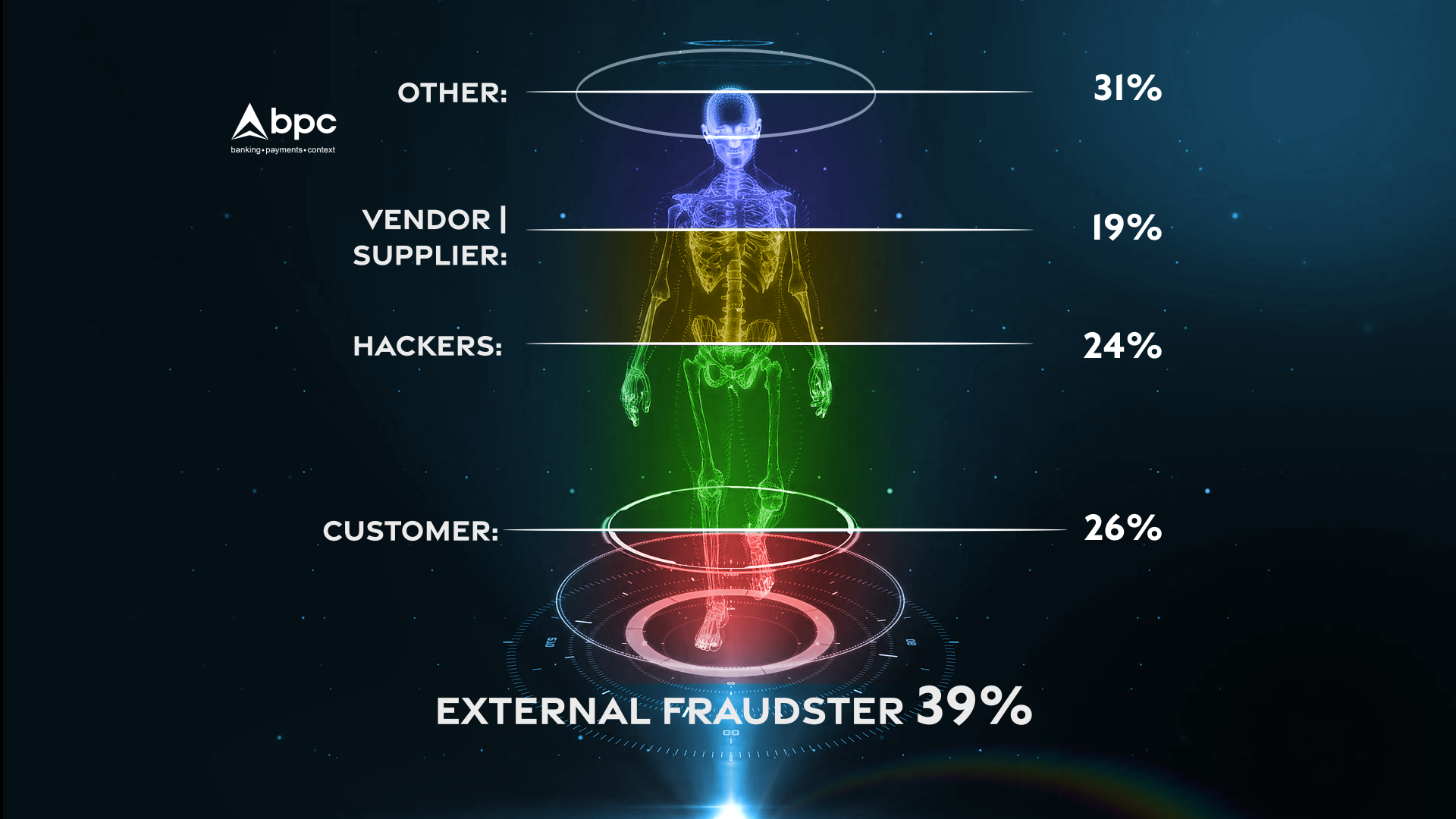

4. Don’t know them, but they know you

External fraudsters are the ones that you don’t meet daily, and the majority of them you’ll probably never meet ever at all. But they know you and the way your company works, and they take advantage of this knowledge. Hackers, customers, vendors and suppliers represent three-quarters of all external fraudsters. Make sure you understand the anatomy of these fraudsters as well.

5. Follow the money

Fraudsters follow your money. Wherever a transaction is done, external fraudsters try to get into the act. The way they do this varies a lot:

- Submit bad checks or falsified account information for payment.

- Return stolen or knock-off products for a refund.

- Bid-rigging schemes.

- Bill a company for goods or services not provided.

- Demand bribes from employees.

- Security breaches and theft of intellectual property by unknown third parties from hacking to tax fraud and loan fraud.

6. Fraudsters like it when you are in a hurry

Online sales have increased globally since the global health crisis boosted online sales. Companies feel the need to speed up to meet the increased customer demand. This means that time-consuming due diligence procedures are skipped sometimes. Fraudsters like it when you are in a hurry because the lack of prevention means they can do as they please undetected. So please be sure to use your Customer (KYC) and business (KYB) identification and authentication programs to detect the fraudster as soon as possible, before real damage is done.

In the end, knowledge about fraud and the fraudster is key to protect your organisation against these practices. To make sure your business is covered as much as possible, use an automated fraud management system. This will save you time and make sure you can speed up your business as you like, while being assured that you know that the people you deal with are trustworthy and your business is protected.