Relevance is the ultimate experience

‘‘Banking’ services are being offered by a wide range of players today. Banks have a market to defend and some are transforming into their best digital selves. We know some who have embarked on this journey, from tier one, all the way to ambitious neobanks’: we work with them. Established brands that are defending and growing their presence, to niche banks focusing on financial inclusion or specific target audiences.

With our SmartVista platform we extend your banking domain into a wider set of services, connecting with partners in all corners of the world. From lending to factoring, to forex services, whatever your customers need.

Embedded experiences

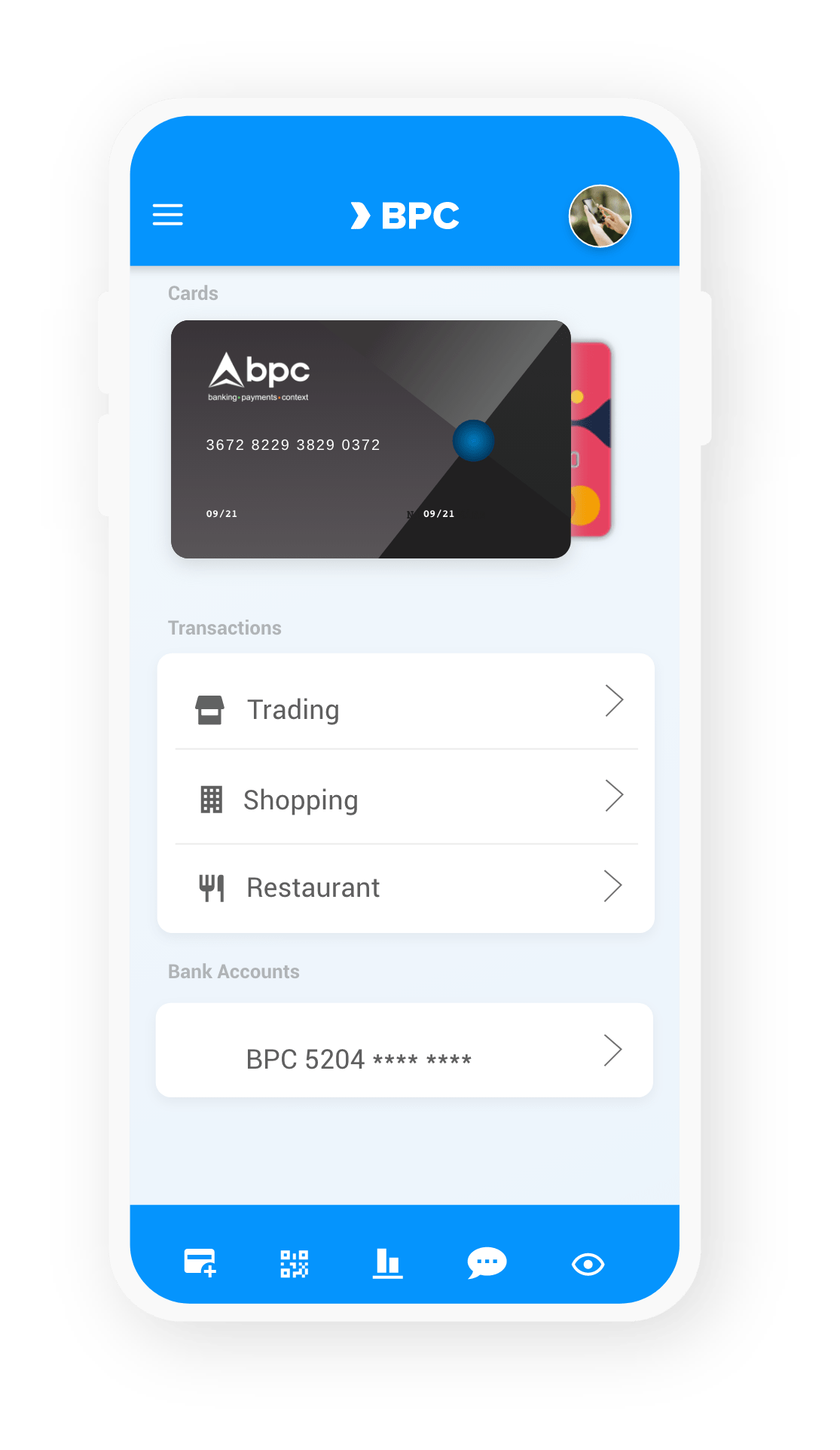

All indicators demonstrate that people and businesses move towards embedded experiences and no longer wish to ‘hop from app to app’. Banks are very well positioned to bring this functionality inside their channel through APIs and Open Banking, becoming more trusted and meaningful for their customers. Or make the other move and bring an agile banking experience inside the SuperApp of the customer’s choice. BPC’s SmartVista platform of solutions enables you both ways.

Security matters most

In today’s climate of full digitisation and formidable layers of compliance and security, we put this at the core of any of our services, whether we offer payments, commerce or pure banking. And as identity becomes the true value carrier of our digital lives, we embed the identity through onboarding in our products' DNA. We ensure you comply but we also ensure your customers enjoy an experience with the least possible friction. Wherever they bank with you.

From Digital Bank to SuperApp

In 2021 we saw the download of financial and banking apps grow three times faster than the app market in its entirety. This can only mean one thing: consolidation is in the air. People clearly demonstrate here they want financial choice, and banks have the opportunity to grab this space.

Widen your reach and connect with fintechs through our SmartVista platform. Maybe you choose to go ‘M&A’, extend or merge your platforms with us. Launch your own ‘bank in a pocket’ or join the SuperApps and connect your bank to a range of eCommerce and government services. The market is ready, you have the trust. We offer the technology to make it happen.

Banking on the move

Banks around the world know one thing for sure: we must go where the customer goes. Online and in real life. Incumbents and neobanks alike. Offering retail, commercial solutions but also genZ wallets, financial inclusion and diaspora banking for people on the move. Around the world. Check out the solutions that enable you to do the same.

Banking: our products

Card Management

Buy Now Pay Later

The Buy Now Pay Later service to consumers opens revenue streams for merchants by reaching new customer segments and extending existing ones.. The global Buy Now Pay Later industry was estimated at $90.69 billion in 2020, and is anticipated to hit $3.98 trillion by 2030.

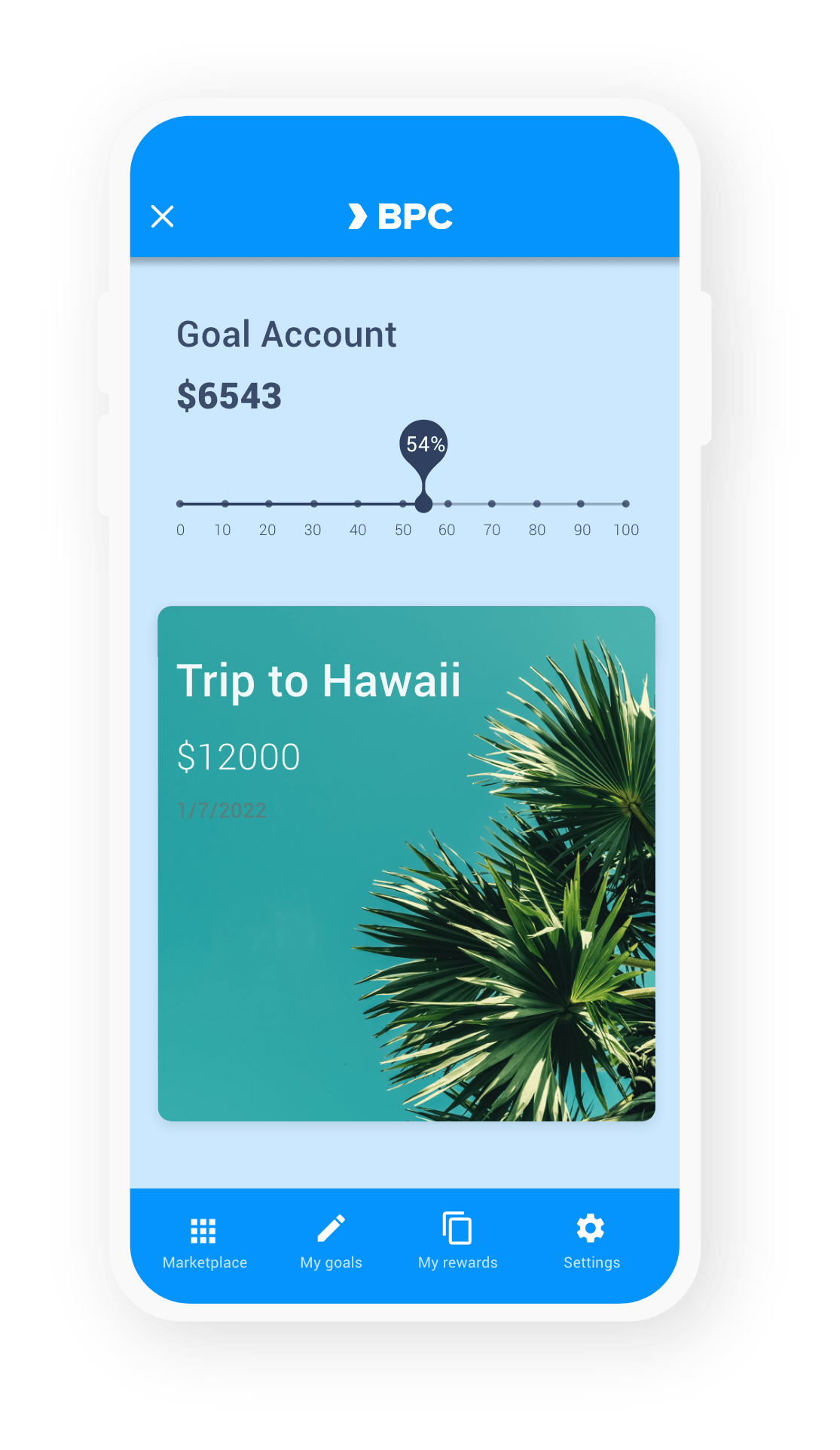

Digital Banking & Super Apps

Digital banking apps are reaching into targeted communities like SME banking to expats or students - and into a wider range of lifestyle services like mobility, government, leisure and others. Igniting any market with a secure relevant banking app to Super Apps fuelling fast developing markets and their demanding customers.

Digital Lending

Les entreprises ont besoin de se développer, mais pour réaliser leurs rêves et leurs besoins, une marge financière supplémentaire est nécessaire. Qu'il s'agisse de microcrédits ou de sommes d'argent plus conséquentes : le processus peut être numérisé, ce qui permet d'offrir un service de premier ordre aux institutions financières et à leurs clients.

API Banking

The SmartVista API Banking solution offers you full API management, including a developer portal, monitoring, request throttling and security.

Merchant Management

Meeting expectations seems more and more complicated. In the digital world as well as in real life, the bar is set high when it comes to payments. The BPC’s Merchant Management module offers a wide range of payment instruments, and it is vital to propose the right solutions and service levels to merchants.

Billing & Invoicing

Not payments but receivables are crucial to any business. Billing and invoicing are where it all starts. Speed, but also accuracy is key to stay away from time-consuming conflicts and needless corrections. With the merchant administration and portal tools, invoices can be automatically generated and payment statuses are always accessible and up-to-date.

Tap to Phone

Paying was never as convenient as now, where your devices can turn into a full-service payment channel. Through tap to phone, acquirers empower their merchants to accept all contactless payment methods: contactless EMV® cards, NFC devices such as smartphones, smartwatches, tablets and QR codes.

Risk & Fraud Management

eWallet

eWallets offers everything a classical wallet would offer and more. Digital wallets all start from the same core value proposition: offering mobile payments at large without the need for a bank account. This takes us to the next level of cash freedom anywhere: convenience and safety of a cashless future.

Loyalty

Building lasting relationships is essential in this fast-moving world where clients are easily distracted. Loyalty schemes are embraced around the world, but with huge differences, determined by culture and behaviour. Loyalty types range from bonus and point schemes to discounts and mixed packages. Creating a win-win situation is key for all.

Microfinance

With SmartVista Microfinance, you provide financial services to underserved or excluded communities. With this solution, MFI agents can make real-life connections and connect the unbanked to a digital microfinance infrastructure. Services are delivered where the clients are, even in the most rural areas.

ATM and Kiosk Management

Connecting and managing payments in the digital and the physical world can be time-consuming. Here, BPC can unburden banks and third-party processors as much as possible with SmartVista ATM Management for efficient servicing and monitoring of a diverse range of ATMs and self-service kiosks.

Agent Banking

SmartVista’s Agent Banking solution allows agents to offer a full range of transactions and services. These include cash deposits and withdrawals, money transfers, account to account payments, loan repayments, bill payments or mobile top-up. Agents, when authorised, are able to onboard new customers and perform KYC instantly.

Card Management

Buy Now Pay Later

Digital Banking & Super Apps

Digital Lending

API Banking

Merchant Management

Billing & Invoicing

Tap to Phone

Risk & Fraud Management

eWallet

Loyalty

Microfinance

ATM and Kiosk Management

Agent Banking

Case studies in Banking

At BPC we work with banks in all cultures, shapes and sizes around the build. We help them transform, we build, we digitise, we connect and extend. We enable real life transactions. Read more about it by downloading our case studies.